With the continuation of inflation concerns, there has been quite a lot of interest in potentially including commodities in diversified portfolios. Commodities have, in the past decade, underperformed for the vast majority of the longest bull run of US equities. Nevertheless, if someone told you that a certain commodity surged by more than 1000% in the last 5 years, chances are you might have not guessed that that particular commodity is EU carbon permits. Despite such a surge, these permits are still relatively uncharted territory for many investors. In today’s blog, we are bringing you up to date with the growing popularity of EU carbon permits.

Green house gas (GHG) emissions have for decades been one of the biggest ecological issues of the world, and they have received quite a lot of spotlight in the recent times in the finance industry with the growing popularity of ESG investing.

In order to reduce or eliminate GHG emissions, the European Commission (EC) presented at the end of 2019 the European Green Deal, according to which the EU plans the elimination of net greenhouse gas emissions by 2050. In addition, relatively recently, Chinese President Xi Jinping announced that China also aims to eliminate net emissions by 2060. Such ambitious plans require a transition to renewable energy sources, which certainly cannot happen overnight. Therefore, in order to gradually reduce GHG emissions, states and regulators have long set the so-called “cap and trade” system with emission units.

What is “cap and trade”?

In a typical cap and trade program, a limit (“cap”) is set by a regulator, such as a government entity or supranational organization, on the total amount of specific GHG (such as CO2) that regulated entities (such as manufacturers or energy producers), may emit. The regulator then issues or sells emission allowances to the regulated entities when they emit less GHG than permitted by the cap.

The regulated entities may then buy and/or sell (“trade”) the emission allowances on the open market. The regulator may gradually reduce the cap on emission allowances, thereby potentially increasing the value of such allowances and forcing the regulated entities to reduce their GHG emissions. The cap thus supports the value of the allowances and is intended to incentivize the regulated entities to reduce their GHG emissions.

Cap and trade in the EU

Cap and trade in the EU is done through the EU Emissions Trading System (EU ETS). It caps the total volume of GHG emissions from installations and aircraft operators responsible for around 50% of EU GHG emissions.

InterCapital is also a pioneer in this segment on the Croatian market and has, since 2013, been providing brokerage services for corporate clients who trade these allowances. Back in 2009, Croatia joined the cap and trade system, committing a number of companies that emit significant amounts of CO2 into the atmosphere to purchase the aforementioned permits.

Participants who fail to comply with their obligation to surrender allowances under the EU ETS are fined with EUR 100 per tCO2. Intuitively, the level of this fine definitely has an important impact on the price of the allowances, since as long as the fine is higher than buying the allowance, it makes sense to buy the allowance.

How does the cap on GHG work and how are allowances allocated?

A single EU wide cap is set out in the ETS directive in terms of percentage reductions. This is translated into a cap expressed in tonnes of CO2 equivalent for each trading phase, calculated and established at EU level, by the EC, before the start of the trading period. The cap in phase 3 of the system ensures that the sectors covered contribute to meeting the EU’s 2020 GHG emissions reduction target, to reach 20% overall reduction of EU greenhouse gases compared to 1990 levels.

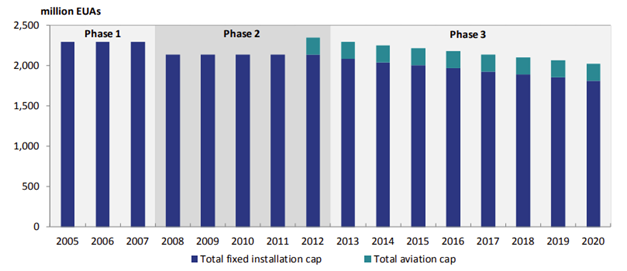

source: European Commission

The way the fixed installation cap (visible in the graph above) has changed as of phase 3 so that the total cap decreases each year to 2020 and beyond. The cap has been decreasing each year by a linear factor of 1.74% compared to 2010. As of phase 4 (2021 – 2030), in order increase the pace of emissions cuts, the overall number of emission allowances will decline at an annual rate of 2.2% from 2021 onwards. The Union-wide cap for 2021 from stationary installations is fixed at 1,571,583,007 allowances, while the annual reduction corresponds to 43,003,515 allowances.

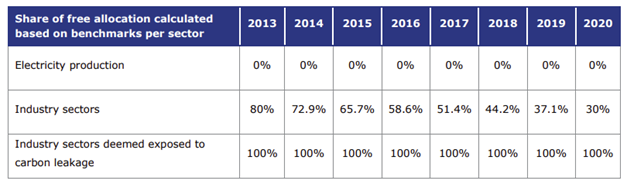

Turning our attention to the allocation of allowances, this is done either by free allocation, where installations receive allowances for free or via auctioning of allowances. In phases 1 and 2 of the EU ETS most allowances were given out to participants for free, while the idea of the EC is to eventually revoke free allocation and remain only with the auction. From 2021, around 57% of the Union-wide cap is auctioned and the rest is provided for free. To be specific, as of phase 4, the system of free allocation will be prolonged for another decade and has been revised to focus on sectors at the highest risk of relocating their production outside of the EU. These sectors will receive 100% of their allocation for free. For less exposed sectors, free allocation is foreseen to be phased out after 2026 from a maximum of 30% to 0 at the end of phase 4 (2030).

source: European Commission

Why just not impose a carbon tax instead of cap and trade?

According to the EC, a tax does not guarantee that the GHG emissions reduction target will be achieved and in a multi-national system, as an agreement would be required across all countries on the right price for carbon. It is also very difficult to determine the “right price” to obtain the cut in emissions required without under- or overcharging companies. Trading allows companies in the system to determine what the least-cost option is for them to meet a fixed cap. The carbon price is then set by the market through trading and based on a wide range of factors. For those who wish to speculate on price changes of the allowances, such reasoning of the EC can instill a certain level of confidence that the cap and trade system would not be fully be replaced by a carbon tax system, which would potentially lead to a significant or almost full depreciation of the value of the mentioned allowances.

The benefits of cap and trade

The above stated system works on the idea that in the future the amount of allowances that can be issued will be reduced, which implies that the same emission units could gradually become more expensive. Therefore, companies might find it more efficient to turn to renewable energy sources instead of buying the mentioned allowances.

As interestingly, such a system opens up another large space – the speculation on the movement of the price of these emission units.

How can one trade with emission units and why?

Investors who do not necessarily participate directly in the “cap and trade” system itself may still be exposed to price movements of the allowances.

One would do so for three main reasons:

- Because one might believe that the price of allowances will rise in the future

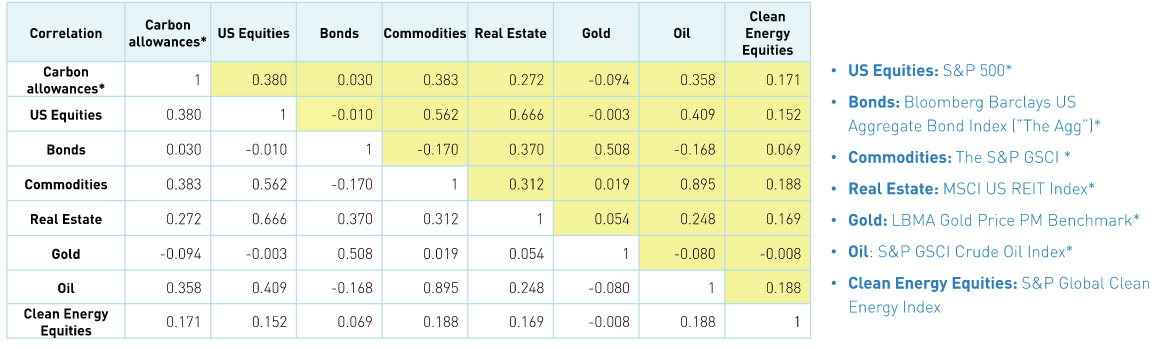

- The movement of emission prices is very weakly correlated with the movement of other financial assets, so they can serve in portfolio diversification (as visible from the table below)*

*Source: KraneShares; top 3 carbon allowance markets (weighted by volume) correlation’ to other asset classes from 31 July 2014 to 30 June 2021

- Used as a hedge, for investors who are concerned about the increase in cost of carbon emissions on their portfolios.

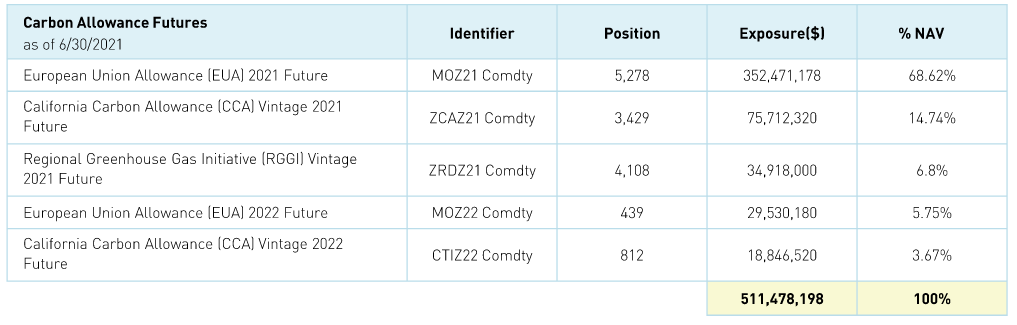

One of the ways to be exposed to the price movement of these allowances is to buy the allowance itself (spot), however they are not as easily traded (available) as publicly traded shares are. Therefore, for retail investors, it might be easier to expose themselves to the price movement of these allowances through the KranShares Global Carbon ETF (ticker: KRBN) which is listed on the NYSE. The ETF itself tracks the IHS Markit’s Global Carbon Index, which is designed to track a portfolio of liquid carbon credit futures with “physical delivery” of emissions allowances issued under “cap and trade” programs (not solely under ETS). To put things into a perspective, as of end 2020, the three largest global carbon futures markets, tracked by the Index, had a market size of USD261bn.

Holdings and Exposures of the KRBN ETF

Source: KraneShares

The KRBN ETF has only been in existence for a year and has so far attracted considerable interest from investors given that the fund’s NAV reached USD 0.5bn. As the price of the allowances has risen sharply in the last year, the ETF has so far achieved a very high return of c.80%.

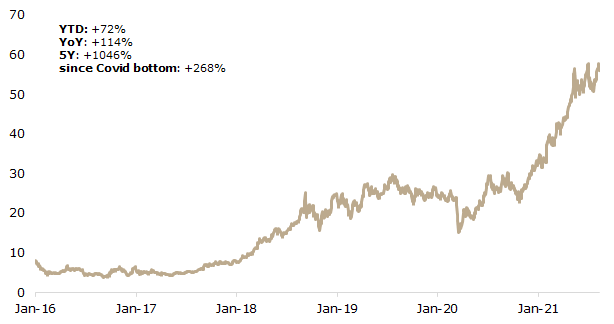

Price of GHG Allowances under ETS (EUR)

Source: Bloomberg, InterCapital Research

Risks associated

Although such an investment (exposure to allowances prices) may seem quite logical at first glance, given the ambitious plans to gradually reduce GHG emissions, the risks associated with such an investment should certainly be mentioned.

1) Cap and trade risk

There is no assurance that cap and trade programs will continue to exist. Cap and trade may not prove to be an effective method of reduction in GHG emissions. As a result, or due to other factors, cap and trade programs may be terminated or may not be renewed upon their expiration. Additionally, the cost of emissions credits is determined by the cost of actually reducing emissions levels. If the price of credits becomes too high, it will be more economical for companies to develop or invest in green technologies, thereby suppressing the demand for credits.

2) Regulatory risk

Regulatory risk related to changes in regulation and enforcement of cap and trade programs could also adversely affect market behavior. In other words, there is a risk of changing policy options, ie the view of the importance of reducing emissions, which could have a negative impact on the price of emission units.

Additionally, if fines or other penalties for non-compliance are not enforced, incentives to purchase GHG credits will deteriorate, which could result in a decline in the price of emissions credits.

3) Decarbonization could be end up not being a priority

In addition to the above stated, decarbonization can potentially end up not being the priority even of political parties which advocate for it, which can happen in moments of crisis. So, for example, the market reacted negatively at the beginning of the Covid crisis – that is, the price of emission units fell by 38% (since the beginning of 2020). Nevertheless, the price has recovered significantly since then, as can be seen in the graph above.

4) (Over)supply of allowances by the Market Stability Reserve

Although Market Stability Reserve (MSR) aims to provide a long-term solution to the current market imbalance as a result of the growing surplus of allowances that has accumulated since 2009, one has to take into consideration that control of supply works in two ways. The MSR is designed as an objective and rule-based mechanism, with automatic adjustment of auction volumes under pre-defined conditions. So for example, allowances up to 100m are injected into the market through an increase in auctioning volume by taking allowances out of the reserve if the allowance surplus on the market drops below 400m allowances. Besides that, if the allowance surplus on the market does not drop below 400m, but if for more than six consecutive months the price of allowances is three times higher than the average price during the preceding two years, 5 allowances up to 100m are also injected in the market through an increase in auctioning volume by taking allowances out of the reserve. Therefore, if we see high price increases of the allowances, MSR might tamper with the supply, putting a downward to the price of the allowances, especially in short to medium term.

As of July, Fondul’s NAV reached RON 10.95bn (+8.3% YoY).

According to the latest NAV report (30 July 2021), Fondul reported a total NAV of RON 10.95bn (EUR 2.23bn), which translates into a NAV per share of RON 1.8533 (EUR 0.775).

When comparing it to the same period last year, their total NAV recorded an increase of 8.3%, while NAV per share is up by 19.0% YoY.

Fondul Proprietatea’s portfolio structure remains largely oriented towards the power utilities generation sector (55.15% of NAV) and oil and gas sector (14.99% of NAV), which is why the two largest holdings, Hidroelectrica and OMV Petrom account for 70.14% of the total NAV.

In terms of the Fund’s portfolio structure, unlisted equities make up the majority, accounting for 77.62%, which represents an increase of 7.37 p.p. YoY. Listed equities follow with 17.48% (-4.98 p.p. YoY), while net cash and receivables account for 4.90% of the structure (-2.39 p.p. YoY).

The discount to NAV per share currently stands at 3.31%.

For today, we decided to present you with a DuPont analysis of Croatian companies, a useful technique used to decompose the different drivers of ROE.

The DuPont analysis is a useful technique used to decompose the different drivers of ROE. This model allows stock analysts and investors to examine the profitability of a company using information from both the income statement as well as the balance sheet. This gives the analyst a thorough view of a company’s financial health and operating efficiency. Note that for this analysis we used H1 2021 results (trailing 12m).

ROE of Croatian Blue Chips (TTM results)

Speaking in broad terms the equation allows analysts to dissect a company, and to efficiently determine where the company is weak and where it is strong. This allows analysts to quickly know what areas of business to look at (inventory management, debt structure, margins) for more answers. However, the measure is still broad and is not a substitute for detailed analysis.

DuPont tells us that ROE is affected by three things:

- Operating efficiency, which is measured by profit margin

- Asset use efficiency, which is measured by total asset turnover

- Financial leverage, which is measured by the equity multiplier

For this we excluded three Tourist companies (ARNT, RIVP and MAIS) as they noted a TTM net loss. 3 out of 11 observed companies, recorded a double-digit ROE, with Dalekovod leading the list (47.7%). However, this could mostly be attributed to a very high equity multiplier of 13.54 as the company has been accumulating losses over the years. We also note that a high portion (57%) of the company’s equity comes from revaluation reserves. Recently the company published an invitation for the subscription of new shares with a maximum amount of HRK 412.5m. To read more about it, click here.

Ericsson Nikola Tesla noted also a very high ROE of 47.5%. The Group reported a profit margin of 7.7% and a somewhat elevated equity multiplier of 3.74x. We also add that the company has reported a asset turnover of 1.65, which is the highest among the observed companies.

Among food companies, Podravka noted a ROE of 8.2%, Atlantic Grupa noted a ROE of 6.4%, while Kraš reported a ROE of 5.8%. Their profit marigns ranged from 3.2% to 6.5%. The breakdown of profit margins of observed companies can be seen in the graph below.

Adris reported the lowest ROE of the selected companies, indicating that their insurance and food segment showed enough resilience to offset the affected tourism sector.

Profit margin breakdown (TTM)