For today, we decided to present you with an updated asset structure analysis of Croatian Mandatory Pension funds.

Pension funds could be described as the key player on the Croatian capital market, as their current domestic equity holdings account for more than 40% of the free float market cap of ZSE. Therefore, it is particularly interesting to see how they have been affected by the ongoing Covid-19 situation. As the global financial markets, as well as the Croatian capital market, observed a partial rebound in April and the following months, it is worth seeing how Croatian mandatory pension funds performed during that period.

NAV of pension funds has witnessed a steady increase for each consecutive month since April, and as of end July stood at HRK 113.19bn (+0.2% MoM or HRK 272.2m). This also represents an increase of 0.5% YTD. As a reminder, in March (the worst performing month for almost all asset classes) the pension funds recorded a decrease of 3.3% MoM or HRK 3.76bn. It is also worth adding that in July contribution payments amounted to HRK 749.1m, which is quite above the average contribution usually paid. The increase could mainly be attributed to later payments regarding the grants to preserve jobs given during the lockdown (March & April).

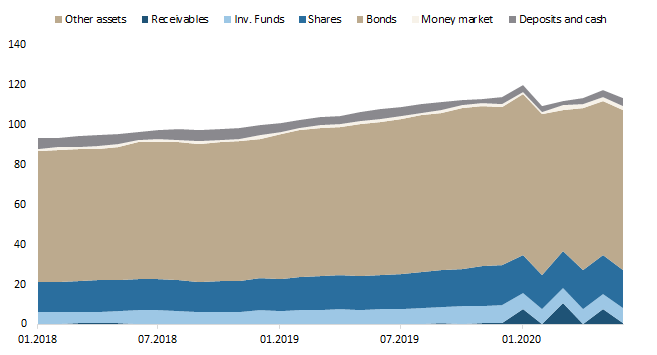

Asset Structure of Croatian Mandatory Pension Funds (July 2020)

Looking at the asset composition of pension funds, it seems that asset managers have not changed significantly their composition, which can be seen in the graph above. Bonds account for the vast majority of total assets (70.6%) which as of July amounted to HRK 80.33bn. Shares come next, with 16.9% or HRK 19.24bn. Unlike Croatian UCITS funds whose majority of equity holdings are foreign, mandatory pension funds have 58.3% (or HRK 11.22bn) of their equity holdings allocated in domestic shares. Note that since the beginning of the year, pension funds have witnessed a decrease of 3.1% in shares.

Total Assets of Croatian Mandatory Pension Funds (2018 – July 2020) (HRK bn)

Source: Croatian Financial Services Supervisory Agency, InterCapital Research

In Q2, data traffic grew by 46%, while in H1 revenue in the electronic communications market decreased by 5.4% YoY.

As Croatian Regulatory Authority for Network Industries (HAKOM) published their H1 2020 data traffic report, we are bringing you its key takes. In Q2 of 2020, data traffic as well as the number of minutes in the mobile telephone network grew on a YoY basis. To be specific, in April, data traffic reached record consumption compared to all previous measurements, a total of 191 PB (+58% YoY). On a quarterly basis, data traffic compared to the same period in 2019 grew by 46%. Such a high increase in data traffic should not come as a surprise given the surge in businesses, education institutions and others working from home as a measure to contain the spread of Covid-19.

In the H1 of 2020, total revenue in the electronic communications market decreased by 5.4% YoY. The decrease in total revenues could mostly be attributed to lower revenues from fixed and mobile telephone services of 14.2%, which was partially offset by the growth of revenues in the broadband Internet access market (+2.8%) and the growth in pay-TV market (+2.6%).

Although total fixed network investment grew 7.7%, the growth was mostly generated by an increase in investment in intangible assets, while investment in tangible assets decreased. Therefore, the regulator adds that in the coming period, greater investments in broadband access infrastructure are necessary in order to maintain the positive growth trend of high-speed broadband connections. On the other hand, in the mobile network, investments in network equipment grew by 7.2% YoY.

Looking at broadband connections in the fixed network, the number of connections via fiber optic access technology continues to record the highest growth, and about 10% of users have broadband Internet access via FTTH / FTTB connections. Roughly 40% of users in the fixed network gain access to the Internet at speeds greater than 30 Mbit / s, or over 11% at speeds greater than 100 Mbit / s. The number of users of 4D packages exceeded the number of 3D packages for the first time, and it can be expected that in the next year the largest number of users will use 4D packages. Slightly more than 56% of households use pay-TV services.

The high rating is a reflection of the stable and profitable operations of the Group, its strong capitalization, sound reinsurance protection and its leading position in the domestic and regional insurance markets.

Following its regular annual revision on 11 September 2020, S&P Global Ratings reaffirmed the “A” Long-Term Credit Rating and Financial Strength Rating with a stable medium-term outlook of Triglav Group. The high rating is a reflection of the stable and profitable operations of the Group, its strong capitalization, sound reinsurance protection and its leading position in the domestic and regional insurance markets. The “A” credit rating exclusively reflects the Group’s stand-alone credit risk profile.

In its report, S&P assessed the business risk profile of Triglav Group as strong and its financial risk profile as very strong. By maintaining its client-centric approach, the Group ensures stable and profitable operations in both activities, insurance and asset management, even during the current economically challenging times. The leading position in the Slovenian market enables it to implement economies of scale, which it complements with its diversified product range and sales network, as well as a strong brand. Triglav Group’s risk profile remains solid, benefiting from its conservative investment policy and a stable and effective reinsurance protection; its investment portfolio is of high quality and well-diversified, with most assets invested across the eurozone. According to S&P, this combined with underwriting discipline is a key factor for Triglav Group’s stable earnings and capital position.

The medium-term outlook reflects S&P’s expectations that the Group will continue to effectively implement its business strategy at least over the next two years, focusing on growth and further diversifying its operations. The agency expects that despite the pandemic and its impacts Triglav Group will sustain strong, stable earnings and strong capitalization at least in the “AA” range over the next two to three years.