Albania and Croatia joined the pack of non-EA countries that tapped the international markets for affordable funding. They were preceded by Hungary, Romania and Serbia and they would likely be succeeded by Bulgaria and Romania (again) in months to come. Grey market on CROATIs has been a bit dim, but the most important question is never “what has happened” but instead “what will happen“. Read more in this brief article piece.

Believe it or not, publicly syndicated issuance by European sovereigns in euro and sterling have reached 269bn EUR so far this year, according to Refinitiv data – it’s already twice the size of all syndicated deals placed last year, and we’re not even half way through. The figures become more gargantuan when you switch your focus across the Atlantic – namely, the US IG issuance has already reached 1.1 trillion USD, barely below of the whole year 2019 issuance and it’s highly certain that a record high 1.33 trillion USD issuance back in 2017 will get smashed. The good news is definitely that the support from the central banks is huge and in Euro area it’s quite obvious that the central bank aims at capping the spreads on the periphery yields.

It’s quite interesting that last week we saw some 60 billion EUR worth of issuance across the board, from SSAs to HY. Croatia and Albania were among the non-EA sovereigns that placed their Eurobonds on the financial markets to raise funding for the Covid-19 mitigating measures and we could say that the timing was nothing short of perfect. In a week that was already shortened thanks to Corpus Christi holiday (Thursday, June 11th), Croatan 11Y Eurobond was placed on the same day that S&P500 reached it’s post-Covid peak (June 10th) and just a day before the global equity markets turned red.

In other words, it was a good call for the Ministry of Finance to place bonds last week, despite some of the investor base being absent on the grey market the day after the placement. Wednesday morning when the orderbook opened and IPTs started coming to our mailbox, an indication of MS+210bps looked very generous, although the investors knew that this is probably going to get tighter as the book grew. As the morning dragged on, the expectation proved to be accurate and the spread was first reduced to MS+180bps, followed by final MS+165bps (B+197.4). The orderbook ended up north of 9 billion EUR figure and the Croatian Ministry of Finance decided to follow the old Roman maxim “Carpe diem” by increasing the amount issued to 2bn EUR. To put it in the right context, this was the largest Croatian Eurobond issuance in history indicating that the excess liquidity provided by FED&ECB has its way of finding the non-EA sovereigns.

The grey market was like waking up with a bad hangover because the by Wednesday night it was already clear that the markets are pondering the risks of secondary epidemic in US and China. This erupted in a broad risk off on the following day and it was a pity that German, Austrian and Croatian investors were out of the office and therefore unable to scoop up all of the CROATI 1.50 06/17/2031 sell orders coming mostly from UK speculators. A silver lining came from the big Street banks outside of the syndicate which placed their bids @ 98.00 levels (reoffer @ 98.572), explaining why it was quite difficult for the price to stay below the 98.00 line for an extended period of time.

In our view, these Street banks are a dark horse on this trade because one cannot be sure whether they are buying this paper in order to flip it this week when German, Austrian and Croatian investors come back to the office, or are they intending to hold it for longer and wait for the demand from Croatian pension funds to show up. Speaking about the latter, July is usually characterized by large bond coupons landing on pension fund’ cash positions, explaining why there’s a CROATI buying frenzy in summer months every single year.

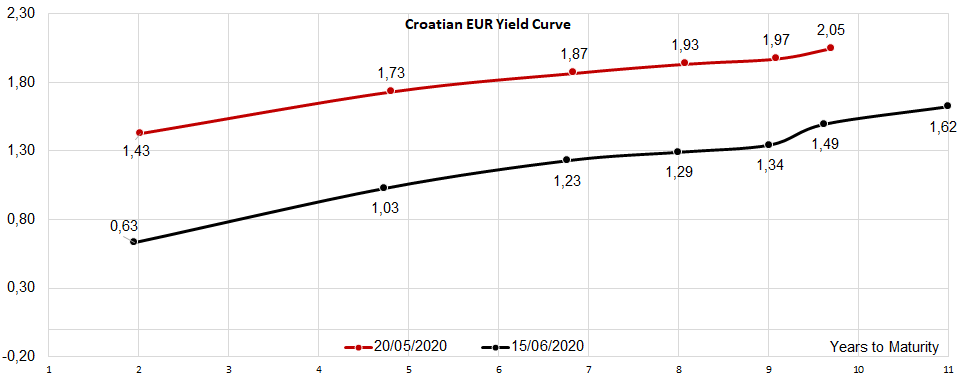

The most important question is the valuation of CROATI 1.50 06/17/2031 – is it fairly valued now (market @ 98.50-98.80, 1.62% YTM indic)? The answer usually depends upon the valuation method you use.

For instance, if you’re thinking about relative valuation versus the rest of the curve, the Bloomberg CRV function and Nelson-Siegel-Svenson fitting tell us that with 1.50% YTM (i.e. par price) the bond would be fairly valued. Nevertheless, what you should be doing is look at the similar countries and where they’re trading. Take REPHUN 1.625 04/28/2032 for instance – the paper has recently been traded in 1.54%-1.57% area, but on the other hand we’re looking at slightly longer paper than CROATI 1.50 06/17/2031. The news flow for Croatian assets has nevertheless been slightly supportive: on Thursday, the first day of grey market trading, a group of private pension funds PensionsEurope asked ECB to extend it’s bond buying program to the countries that are not in the euro-area, but with a clear commitment to full membership in the years ahead. This initiative comes from an organization that speaks for around 4 trillion EUR of assets under management, but nevertheless it is still nothing more than a “wish list” letter. Still, this favours countries such as Croatia and Bulgaria, meaning that in due time the spread on CROATIs might get tighter than on REPHUNs. If you hold this as highly unlikely then argue with this logic: Portuguese 30s are traded at 0.539% YTM, a third of REPHUN yield on the same duration in spite of Portugal having much weaker macroeconomic fundamentals than Hungary (especially in terms of public debt).

The purpose of the public invitation is to determine the existence of interested investors in the involvement in the process of restructuring and a cap hike of the company.

Đuro Đaković published an announcement on the Zagreb Stock Exchange announcing that the Management Board made a decision to publish a public call for the collection of indicative interests for participation in the cap hike of the company.

This invitation is in accordance with the Decision of the Government of the Republic of Croatia of 16 January 2020 on granting a state guarantee in favor of the Croatian Bank for Reconstruction and Development (HBOR) and / or other commercial banks in the country and / or abroad for credit indebtedness and / or financial framework for liquidity to the group.

The company’s restructuring process is carried out in accordance with the European Commission Guidelines on State aid for rescuing and restructuring non-financial undertakings in difficulty (2014/ C249/1). The purpose of the public invitation is to determine the existence of interested investors in the involvement in the process of restructuring and cap hike of the company.