The bank expects to recognize significant provisions for credit losses and litigation liabilities that will affect the financial result of the Q4 2019.

Hrvatska Poštanska Banka (HPB) published a document on the Zagreb Stock Exchange announcing that they expect to recognize significant provisions for credit losses and litigation liabilities that will affect the financial result of the Q4 2019. According to the company’s preliminary estimates, the total amount of these provisions will be between HRK 95 and 105m for the Q4 2019. The mentioned amount of provisions mainly relates to the provisions for litigation liabilities. The residual amount of the provision relates to credit losses recognized in accordance with IFRS 9.

The company adds that despite previously mentioned losses, the result recorded in 2019 will continue to be profitable, with a significant improvement in operating income and operating profit compared to 2018, and a growing market share. Also, the bank added that the stated provisions will not have an impact on the Bank’s capitalization.

The market reacted to such news yesterday, which resulted in a share price decrease of 3.76%, with it closing at HRK 640 per share. The mentioned share price implies a P/B of 0.53.

For today, we decided to bring you a brief overview of the indebtedness and capital structure of Slovenian blue chips.

Following up on yesterday’s overview of indebtedness among CROBEX components, for today we decided to present you with a comparison of Slovenian blue chips. To be specific, we observed how indebted Slovenian companies are by comparing net debt to EBITDA (trailing 12 months) and % of debt financing. We also added how much additional debt these companies could take in order to reach 3xEBITDA.

Note that financial institutions (NLB, Triglav and Sava Re) were excluded from the mentioned overview.

Net Debt/ EBITDA (Trailing 12m)

Among observed companies Krka and Cinkarna Celje operate at a negative net debt, meaning their cash position (short term financial assets + cash and cash equivalents) exceed their financial debt. Of the other constituents, Telekom Slovenije has the highest indebtedness of 1.92xEBITDA. Next comes Petrol with a net debt/ EBITDA of 1.66. Luka Koper follows with a net debt/EBITDA of 0.21. Looking at the chart above, one can safely conclude that the all Slovenian blue chips are well within the reasonable levels of indebtedness.

We also observed how much additional debt companies could take to reach 3xEBITDA which is in the region considered as a breaking point and red flag in terms of indebtedness.

This analysis provides information on the companies’ potentials for takeovers, but also the potential for an internal growth through additional borrowing. It’s important to point out that companies with net debt above 3xEBITDA are not necessarily too indebted as not all them are equal and their industries differ (and the other way around – certain industries are not prone to hold any leverage).

Potential Additional Debt (EUR m) to Reach 3x EBITDA

Turning our attention to the capital structure, all of the observed companies are mostly equity funded. Of those, Cinkarna Celje leads the list with 99.9% equity, followed with Krka with 98.6%. On the flip side, of the observed ones, Telekom Slovenija is operating with most debt of all companies (40.3%).

Capital Structure of Slovenian Blue Chips

This week BET index reached its highest value in 12 years.

BET, the main index of the Bucharest Stock Exchange, breached the 10,000 point mark this week, ending yesterday’s trading at 10,084.1 points. Currently, the index is traded at P/E of 8.73 and EV/EBITDA of 3.83.

It is worth noting that this is the highest value of the index in 12 years. The all-time high value was recorded in July 2007, when BET amounted to 10,813 points. Last year, the BET index surged by more than 35%, which is the highest index increase among regional indices. Such a strong increase could be attributed to a double digit rise of all heavy weights as visible in the graph below.

Share Price Performance of BET Constituents in 2019 (%)

The company notes that the Q4 2019 report will be published on 6 February 2020.

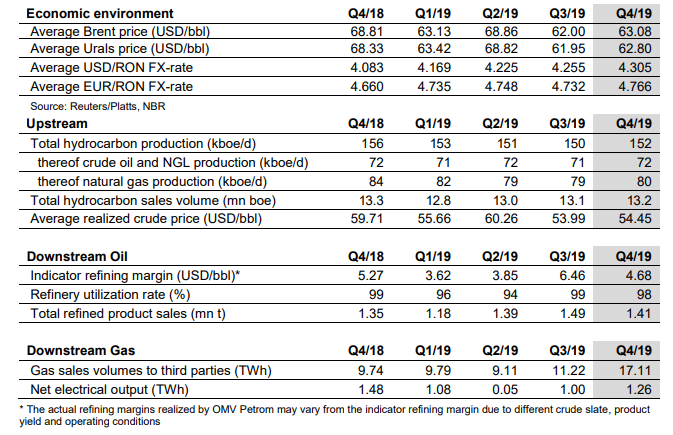

As OMV Petrom published their key performance indicators, we are bringing you their key takes. The company notes that the Q4 2019 report will be published on 6 February 2020 and that the information contained in this trading update may be subject to change and may differ from the final numbers of the quarterly report.

Source: OMV Petrom, Bucharest Stock Exchange