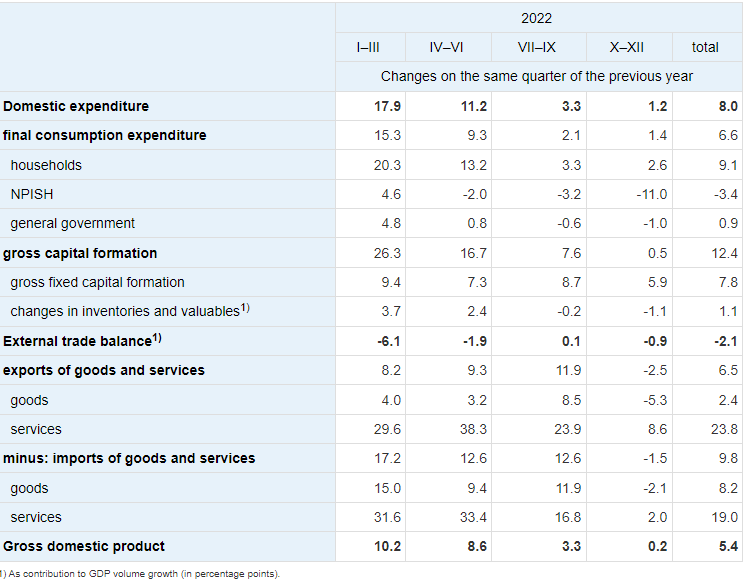

The Slovenian Statistical Office published its GDP figures for 2022, showing that in real terms, it increased slightly by 5.4% YoY. At the same time, in Q4 2022, the GDP grew by 0.2% YoY.

In 2022, GDP increased by 5.4% in real terms. Meanwhile, in Q4 2022, the GDP grew by 0.2% YoY. Overall, in the first half of 2022 the majority of GDP components were increasing faster than in the second half of the year. Due to higher growth of imports than exports and worse terms of trade in all four quarters of 2022, the external trade balance was lower than in 2021.

In Q4 2022, domestic consumption increased by 1.2%, household consumption expenditure grew by 2.6% (contributing the most to the overall GDP growth). Gross fixed capital formation increased by 5.9%. Also, the changes in inventories had a negative impact on GDP growth. In the last quarter, both exports and imports went down, which was the first decrease since the 4th quarter of 2020. In total, exports went down by 2.5%, while imports were down 1.5% in Q4. The contribution of the external trade balance to GDP growth was negative (-0.9 p.p.). This trend of negative contributing net exports is likely to continue in 2023, as exports continue to recover due to improvements in the economic situation among Slovenia’s main trading partners. As imports will also be supported by consumer confidence and household spending, we expect the trade balance to be neutral to GDP in 2023 and to start contributing positively from 2024.

On the yearly basis, the consumption expenditure and gross capital formation contributed to GDP growth positively. Further, as imports reported higher growth than exports, the worse terms of trade occurred in all four quarters in 2022 with lower external trade compared to FY 2021, amounting to EUR 961m in 2022 (2021 was EUR 3,310m).

GDP by expenditures, constant prices, growth rates (%)

If we were to look at value-added activities, at constant prices, construction, and professional, scientific, technical, administrative and support services activities contributed the most to the total value added. For these activities, the was the first decrease in the last two years.

By the end of January 2023, BET increased by 4.1% MoM, and on the YoY basis, it declined by 9.9%, ending January at 12,139 points.

The first month of 2023 started the year with a series of significant rallies for the BET index as a whole. The biggest surge was recorded by the index that includes the energy companies – BET-NG, which noted an increase of 6% in January. Further, a new all-time high regarding the number of investors was achieved, standing at 133,000 investors. Also, the BVB noted it has launched the “Investor Relations and Liquidity Support Programme” and have recently added a section dedicated to the individual investor. The mentioned program should improve capital market visibility and stock exchange liquidity.

Romania has also taken steps to join the Organization for Economic Cooperation and Development (OECD), which will bring added value to all Romanian companies that could have access to capital from international investors through better corporate governance.

Total equity turnover amounted to RON 584.5m (EUR 127.9m) in January 2023. This represents a sharp decline on a MoM basis. However, we note the previous month was significantly influenced by the ABB of OMV Petrom, during which over 1.78bn shares of the Company were sold by Fondul Proprietatea.

Performance of BET constituents in January 2023 (MoM, %)

Source: Bloomberg, InterCapital Research

Looking at the BET index and its constituents, on an MoM basis, almost all of the companies recorded share price increases with a good few of them reporting a double-digit increase. Further, two bet constituents ending the month in red recorded only a slight decline in price. Of the largest gainers, BVB itself leads the list with a 13.3% MoM share price increase during January. BVB is closely followed by Aquila and Medlife with both of them increasing by 13% MoM. Teraplast follows with 12.2% and Alro with 11.5%. the last company to note a double-digit increase is Conpet with a 10% increase in share price. The only two constituents to note a negative development in share price are Fondul Proprietatea and Banca Transilvania with a slight decline amounting to 0.5% and 0.4%, respectively.

Performance of BET constituents Jan 2022 – Jan 2023 (YoY, %)

Source: Bloomberg, InterCapital Research

On a YoY basis, taking into the account latest share prices available, the largest increase was recorded by the already mentioned BVB, at 55.6%, followed by Transgaz at 22.1%, and Transport Trade Services at 9.1%. Further, two other constituents to note a positive share price development are Romgaz and OMV Petrom with a 5.4% and 3.7% increase, respectively. The remaining constituents all recorded price decreases, meaning that 15 out of 20 companies declined on a YoY basis. Of these, the largest declines were recorded by TeraPlast, at 48.8%, followed by Purcari at 44.4%, BRD at 32.9%, Aquila, at 24.6%, MedLife, at 22.7% and Digi, at 22.4%.

Overall, it could be said that the first month of 2023 was a month of recovery, slightly erasing 2022 losses, which should not come as a surprise considering just the amount of outside pressures Romanian companies were facing.

Here you can find the dates for the upcoming events of the regional companies.

| wdt_ID | Date | Ticker | Announcement | Country |

|---|---|---|---|---|

| 14 | 26.2.2023 | SNN | Nuclearelectrica General Assembly Meeting | Romania |

| 15 | 27.2.2023 | TTS | Transport Trade Services 2022 dividend proposal | Romania |

| 16 | 27.2.2023 | TTS | Transport Trade Services Preliminary Results for 2022 | Romania |

| 17 | 27.2.2023 | TEL | Transelectrica Preliminary Results for 2022 | Romania |

| 18 | 27.2.2023 | AQ | Aquila Preliminary Results for 2022 | Romania |

| 19 | 27.2.2023 | ALR | ALRO Preliminary Results for 2022 | Romania |

| 20 | 27.2.2023 | COTE | Conpet Preliminary Results for 2022 | Romania |

| 21 | 27.2.2023 | ATPL | Atlantska Plovidba Supervisory Board Meeting | Croatia |

| 22 | 27.2.2023 | ARNT | Arena Hospitality Group Supervisory Board Meeting | Croatia |

| 23 | 28.2.2023 | TGN | Transgaz Preliminary Results for 2022 | Romania |

| 24 | 28.2.2023 | DIGI | Digi Preliminary Results for 2022, Conference Call | Romania |

| 25 | 28.2.2023 | AQ | Aquila Preliminary Results for 2022 Conference Call | Romania |

| 26 | 28.2.2023 | ATGR | Atlantic Grupa Q4 2022 results, unaudited Financial Report for 2022 | Croatia |

| 27 | 28.2.2023 | ONE | One United Properties Preliminary 2022 Results | Romania |

| 28 | 28.2.2023 | WINE | Purcari Preliminary Results for 2022 | Romania |

| 29 | 28.2.2023 | SNG | Romgaz Preliminary Results for 2022 | Romania |

| 30 | 28.2.2023 | FP | Fondul Proprietatea Preliminary Results for 2022, Conference Call | Romania |

| 31 | 28.2.2023 | KOEI | Končar Q4 2022 Results, Unaudited Financial Report for 2022 | Croatia |

| 32 | 28.2.2023 | RIVP | Valamar Riviera Q4 2022 Results, 2022 Audited Annual Report | Croatia |

| 33 | 28.2.2023 | PODR | Podravka Unaudited Financial Statements for 2022 | Croatia |

| 34 | 28.2.2023 | ATPL | Atlantska Plovidba Management Board Meeting, Unaudited 2022 Annual Report | Croatia |

| 35 | 28.2.2023 | ARNT | Arena Hospitality Group Q4 2022 Results | Croatia |

| 36 | 28.2.2023 | ARNT | Arena Hospitality Group 2022 Annual Report | Croatia |

| 37 | 28.2.2023. | SPAN | SPAN Q4 2022 Results | Croatia |

Due to the nature of these events, they are subject to change (might be postponed or canceled).