Many seasoned EURHRK traders stared talking about their inner compass not working any more – in a weird year like this, it was quite easy to be on the wrong side of the trade. Well, at least 2020 is close to being over. What can we learn about the EURHRK trading régime in these final trading days and what 2021 might have in store for us, find out in this brief article.

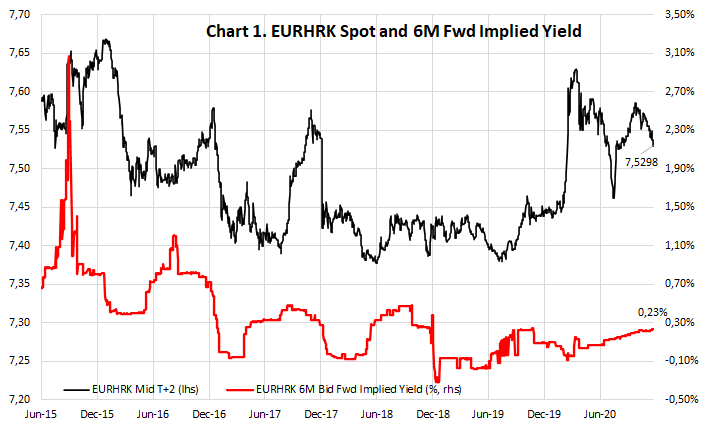

This year has definitely been annus horribilis for FX traders closely watching EURHRK – full of unexpected twists and turns and accompanied by movements atypical for a particular part of the year. As Chart 1. might suggest, the exchange rate was elevated for most part of first semester and only managed to dip below 7.55 in early July when it became clear that domestic economy will record at least a part of previous year’s tourist inflows. Too add more to our travails, we all grew too accustomed to a seasonal move of euro steadily appreciating versus kuna in the last quarter of the year, but this year we fell short of our expectations: between mid-October and beginning December 2020 EURHRK dropped by 550 pips peak to through and currently trades below mid-level of CNB’s ERM II target band (mid @ 7.5345, versus the current market mid around 7.5300). So what’s going on?

In our opinion, the single most important driver in recent days that contributed to this EURHRK dip was a large syndicated loan taken by the Croatian motorway operator in early December (a more detailed description could be downloaded here). The syndicated 12Y loan was earmarked at 120.9mm EUR and it would be used by the company to pay off old borrowings from the German development bank KfW. The syndicate is composed of three lenders: two domestic commercial banks and Croatian Bank for Reconstruction and Development (CBRD). For all three members of the syndicate this is a completely new credit facility and since we’re talking about a EUR-pegged loan, this credit arrangement would have extended their long EUR position if left unhedged. This of course warranted some EURHRK selling in order to keep their position unchanged. For the purpose of explaining the following FX implications of the syndicate, we shall break the loan down into two components: the EUR-linked component supplied by the two commercial banks (62mm EUR, each bank bearing half of it, 6M EURIBOR + 115bps floating interest rate) and a local currency component supplied by CBRD (the remaining roughly 59mm EUR, 1.8% fixed interest rate).

The 62mm EUR component of the commercial banks is a no-brainer: the two banks had to sell EURHRK to remain hedged and judging by the word on the street, this hedging trade has mostly been unwound already (it’s passé). Now we’re waiting for the other shoe to drop: it’s quite likely that in the remainder of the year the motorway operator might contribute to the EURHRK upside because the old KfW loan has to be repaid and settled in euros. At least half of the new syndicate (the CBRD component) is in local currency, meaning that this new credit facility would create EURHRK demand in the final weeks of 2020 and opening weeks of 2021. With target refinancing date set at last working day of the year (31st December 2020), it actually makes sense to be long EURHRK into year end. This is truly atypical and many EURHRK traders got too accustomed to being short into year end, collecting carry and waiting for the summer season and tourist inflows to bring the exchange rate down.

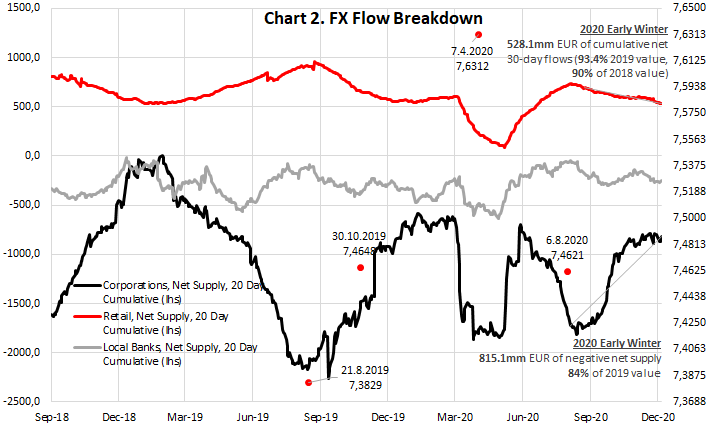

Other factors show weakness of euro inflows into year end, but the weakness is not so pronounced. As Chart 2. would suggest, on December 11th the 20-day cumulative net selling by retail clients (calculated based on CNB’s N4 table) was on 93.4% of the value recorded on the same day last year and only 90% of the value two years ago. Naturally, remittances from abroad are going to be weaker because most of the Europe is still in lockdown, however we’re not seeing a dramatic shift which would warrant higher exchange rate. There is of course the other side of that coin: remittances are obviously slightly weaker, but next year’s retail demand for euros to pay for skiing expenses would also be much slimmer. Looking at the corporate side of the market, net cumulative corporate demand has also been slightly weaker, coming at 84% of 2019 value. It’s worth remembering that this figures should only be used to roughly sketch the interplay of corporate demand and retail supply, but they could not be considered comprehensively since they only include spot transactions (no data on FX forwards is presented).

So where exactly does that leave us? Feedback from the dealing rooms points out that market depth has been much weaker this year because FX volatility observed in March/April drove many market speculators to scale down their positions. Besides that, fundamental flow coming from imports and exports has also been softer than previous years, contributing to a shallow FX market. What was once a lake is now a pond in which any large order drives the exchange rate sideways. Beginning August a 45mm EUR buying order from one Croatian corporate marked the seasonal low of EURHRK exchange rate and drove the exchange rate a couple of hundreds of pips higher. A replay of this episode might be expected in the following weeks, with different corporate in the leading act. However, most of the seasonal FX traders point out that big money would not be made on being long EURHRK because this is the carry negative trade – instead, the real juice comes from correctly predicting a peak and going short on that level. The short EURHRK is carry positive and is predicated on vaccine availability bringing things as close to normal as possible before the tourist season begins. A lot of traders are now trying to “sell the strength/short at highs” and this is the reason why we hardly see EURHRK above 7.60 in the near term. However, it might not be a bad idea to wait for a while and scale your bets because EURHRK dip would probably not be abrupt and it’s quite likely that that exchange rate would move sidewys in a narrow range until after Easter. Between New Year and Easter it’s even possible that short term drivers we aren’t even able predict could move EURHRK as close to 7.60 as possible, opening up new possibilities to scale up short EURHR trades.

Traders have been using the French word régime to describe the complex interplay of fundamental, flow-based and technical factors driving the price of a certain financial instrument. We would like to point out that the original meaning of the word régime was nutrition or diet. In the context of currency pairs, the trading régime would mean either eating carry and paying for it by realized volatility (one trader said: “Carry is what you get paid for having the wrong position“), or paying carry to someone else in order to score on volatility moving your way. Selling EURHRK in winter months has been a very nourishing régime: it was almost a safe way to score both on forward points (if entered at the right time) and volatility. Then March 2020 happened with an unprecedented short squeeze, so traders are now much careful about scaling their bets.

Could it be that in 2021 we might return to a normal EURHRK diet? Well that looks quite likely at the moment, but meanwhile we have two more weeks to go in this clearly atypical 2020 and awkward years require unconventional trading diets. It looks like being long EURHRK in the following weeks is a smart thing to do – but bear in mind that a lot of traders out there are looking to feed themselves off short EURHRK and all that good old positive carry and volatility. When January 2021 starts brace yourself for more EURHRK dips.

As all the Slovenian blue chips published their 9M 2020 results, we decided to look at what effect did the pandemic have on the profitability margins of each observed company.

It is important to note that comparing the margins across the selected companies is not necessarily the best way to do the comparison as many companies operate in different industries. Since both EBITDA and profit margin reflect to a great extent the industry in which the company operates in, we advise to compare it to the peer average or median. Nevertheless, it is still worth seeing which Slovenian companies are more profitable and therefore have “room” to potentially reduce the prices of their goods or services and remain at a high level of profitability.

9M results portray the effects of the COVID-19 virus which had unfavourable effects for most of the Slovenian Companies.

9M 2020 EBITDA margin of Selected Companies (%)

As of 9M, a pharmaceutical, telecom and port/logistics company lead the list with the highest EBITDA margins. To be specific, Krka and Telekom Slovenije recorded the highest EBITDA margin of 31.7% and 29.6%, respectively. For Krka, this translated to a significant increase in the margin of 8 p.p., as the health care sector is one of the sectors who was among the least impacted by the pandemic on revenue generating abilities. Observing the 9M period, Krka sales revenue amounted to EUR 1.2bn in revenue, representing a 6.4% YoY increase. Prescription pharmaceuticals were the leading product group, accounting for 91% of total regional sales, a 9% YoY sales increase. The largest individual market remained Germany where sales soared 32% YoY primarily due to good sales of advanced antihypertensives.

Meanwhile, Telekom Slovenije’s EBITDA margin increased by only 0.4 p.p. YoY as their decline in revenue of 2.1% was compensated by the decrease of operating expenses by 2.95% YoY. Of that, the largest item was cost of services which stood at EUR 157.1m (-7% YoY). Such a decrease could be attributed to the to the reduced volume of international traffic and roaming as and lower costs of multimedia content.

The highest drop YoY in EBITDA margin was witnessed by Luka Koper (-7.4 p.p.) due to decrease in revenue (-10.9% YoY). The fall in revenue of EUR 19m can mostly be attributed to a decreased amount of maritime throughput by 2.9m tons equaling to a decline of 16.3% YoY and is mainly attributed to the Covid-19 outbreak. The combined effect of shrunk revenues as well as an increase of labour costs in the amount of EUR 2.7m resulted in the significant drop of EBITDA.

Change in EBITDA & Profit margin (9M 2020 vs 9M 2019) (p.p.)

Turning our attention to profit margins, Krka once again leads the list with 18%, while its margin increased by 2.4 p.p. YoY. Telekom Slovenije and Cinkarna Celje follow with a profit margin of 13% and 10%, respectively.

Only one company, Telekom Slovenije, recorded a negative profit margin (net loss) of -0.1%. Of the companies which recorded a net profit, Luka Koper observed the highest drop in profit margin of -5.8 p.p. YoY.

9M 2020 Profit margin of Selected Companies (%)

In the first 11 months of 2020, GWPs declined by 0.6% YoY. GWPs in non-life insurances grew 4.8% YoY, while life insurance decreased by 14.2% YoY.

Croatian Insurance Bureau published the GWP development in November 2020. Since the beginning of the year, GWP’s observed a slight decline of 0.6% YoY (or HRK 63.2m), indicating that Croatia’s insurance sector was only grazed by the pandemic (in terms of written premiums).

The total amount of GWPs collected reached HRK 9.797bn (includes insurers located in Croatia and insurers operating in Croatia but based in another EU country). The aforementioned decrease came solely on the back of the life segment which observed a strong decline of 14.2% YoY (or HRK -403.1m) to HRK 2.44bn. Such a decrease could arguably be attributed to the maturing of policies which were underwritten coupled with lower savings through life insurance and early termination of these policies. Meanwhile, non-life segment which traditionally accounts for the biggest portion of total GWPs (75%), is still up by 4.8% YoY (or HRK 339.9m).

Croatia’s largest insurer, Croatia Osiguranje accounted for 26% of the market, being flat YoY.

Top & Bottom Performing Insurance Segments (Jan – November 2020 vs Jan – November 2019) (HRK m)

When observing GWPs by structure since the beginning of the year insurance against civil liability in respect of the use of motor vehicles (which accounts for 24.93% of GWPs) recorded a high increase of 12.31% YoY (or HRK 262.3m). Strong growth of this type of insurance can be explained by both, increase in number of policies issued (2.4%) and increase in average policy value (9.7% YoY). The average premium for insurance against motor vehicle liability for damages caused to third parties in 11M 2020 has amounted to HRK 1,072.64 ( vs. HRK 977.75 in 11M 2019). In 11 months of 2020, 2,231,982 policies were concluded, i.e. 51,700 policies more than in the same period in 2019.

The second biggest category in Non-life insurance is vehicle insurance (casco policy) which accounts for 12.55% of total GWPs, and it has recorded an increase of 3.38%. Health insurance observed also a solid YTD performance of +4.53%. Credit insurance observed a sharp decrease of 32.2% (or HRK 112.8m). This does not come as a surprise given the expected lower loan issuance activity in Croatia as a result of Covid-19 outbreak.

By looking at the latest announcement from the Tax Administration of the Republic of Croatia, being tracked for Covid-19 pandemic purposes, in the period from 24 Feb till 22 Dec 2020 the value of taxable invoices decreased by 16.4% YoY.

A higher frequency data is compiled by Croatian Tax Administration, a department of the Ministry of Finance, who stated that the value of taxable invoices dropped by 16.4% YoY (or HRK 27.1bn) in the period from 24 February till 22 December. Meanwhile total taxable invoices in the mentioned period amounted to HRK 138.2bn.

Drop in taxable invoices in wholesale and retail trade in the same period was only at 8.2% (or HRK 8.76bn) while drop in accommodation and food services reached 46.5% (or HRK 11.64bn).

The value of taxable invoices in the 2nd week of December 2020, observed a double digit decrease for the second time this month. To be specific in the 3rd week of November taxable invoices decreased by 11% YoY to HRK 3.14bn. Drop in taxable invoices in the wholesale and retail trade was relatively low at -1.4% YoY, while drop in accommodation and food services was at -76.9% YoY. This does not surprise us given the newly imposed restrictions in Croatia and throughout Europe with efforts to tackle the spread of the virus.

If we were to compare it on a WoW basis, there is some positive news after all, as the value of invoices has increased by 3.2% or HRK 95.9m.