With the turbulence and uncertainty that can be seen in the world in 2022, and especially in Europe, we decided to bring you a brief overview of how the regional and global indices reacted to these challenges by looking at their performance.

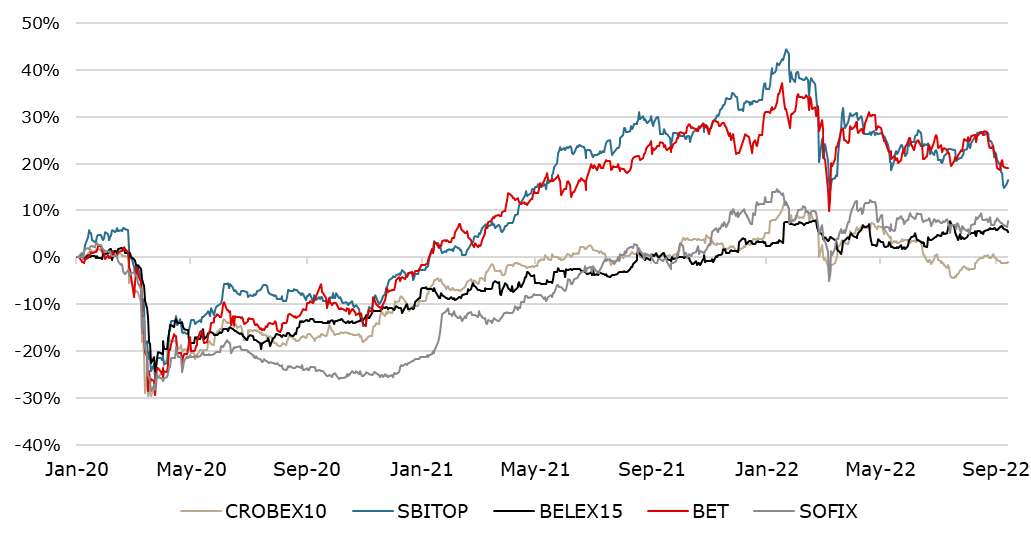

Starting off with the region (which includes indices from Croatia, Slovenia, Serbia, Bulgaria, and Romania), only 1 index, i.e. the main index on the Belgrade Stock Exchange, BELEX15, recorded an increase, growing by 3% YTD. Every other index in this group recorded decreases since the beginning of the year, with SBITOP decreasing by 14%, followed by BET with 9%, CROBEX10 with 6%, and SOFIX, which decreased by 3%.

Performance of select regional indices (%, YTD)

However, looking at a longer time frame, say, the pre-pandemic period, i.e., the beginning of 2020, only CROBEX10 declined, and by 1%. Other indices all recorded growth, with BET and SBITOP leading the way, at 19%, and 17%, respectively. SOFIX and BELEX15 also recorded increases, of 8% and 6%, respectively.

Performance of select regional indices (%, beginning of 2020 – today)

Source: Bloomberg, InterCapital Research

Moving on to European indices, we looked at the main indices of Germany, France, the UK, Austria, Hungary, and Poland. Out of these, again, only 1 index didn’t record a decrease, remaining at 0%, that being FTSE 100. On the other hand, WIG declined by 28%, ATX by 22%, BUX by 18%, DAX by 17%, and finally, CAC 40, which declined by 13%.

Performance of select European indices (%, YTD)

Compared to the beginning of 2020, CAC 40 is the only index to record an increase, growing by 4.5% while WIG and BUX are the only indices with declines over 10%, at 13.4% and 10.2%, respectively.

Performance of select European indices (%, beginning of 2020 – today)

Source: Bloomberg, InterCapital Research

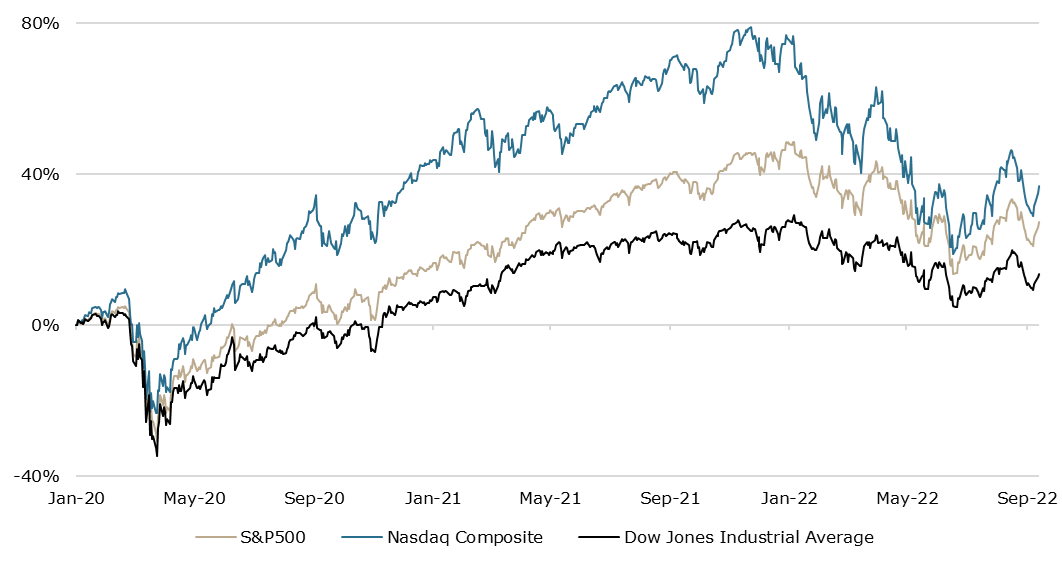

Moving on to the largest indices in the US, since the beginning of 2022, Nasdaq Composite declined by 26%, S&P500 by 17%, while Dow Jones Industrial Average by 14%.

Performance of select US indices (%, YTD)

Finally, comparing them to the beginning of 2020, all 3 indices recorded growth, with Nasdaq Composite increasing by 30%, S&P500 by 22%, while Dow Jones increased by 9%.

Performance of select US indices (%, beginning of 2020 – today)

Source: Bloomberg, InterCapital Research

There are several things that can be taken away from this data. Firstly, in regards to regional indices, the declines were not as severe as the larger pan-European or US indices, with the exception of the SBITOP index. The countries in which these indices are located are affected by high inflation rates, with levels above the European average, meaning that the effect on equity is more severe, and more actions are required by the central banks, especially when it comes to the countries which are not the part of the Eurozone (such as Romania, Bulgaria, Serbia, and currently, Croatia). Low liquidity on some of the stock exchanges in the region is also affecting the volatility of prices, which in this case, can be seen as a “positive”.

Moving on to the pan-European indices, what we can see is that there is a certain correlation between the conflict in Ukraine and the countries’ select stances on the conflict. For example, WIG, the main index on the Warsaw Stock Exchange, declined a lot more than say, the French or the German indices, and Poland’s proximity to the conflict, its stance in terms of sanctions on Russia, as well as the impact on its economy (through higher costs and inflation) is also affecting companies, investor sentiment, and by extension, market performance. ATX, the main index on the Vienna Stock Exchange, is also indirectly affected by the macroeconomic situation, as Austria is one of the largest importers of Russian gas, and as such, could be severely affected by the potential cutoff, which again, is evident in the investor sentiment. When it comes to Hungary, even though it placed better in terms of energy security, also is part of the EU and the political uncertainty related to its government and its response to the crisis is also hurting investor sentiment. Finally, German and French indices, DAX and CAC 40, both declined but at a lower rate. However, strong uncertainty regarding the energy future, possible recession fears, high inflation, and the announced ECB rate hikes will put pressure on equity in general.

Finally, taking a look at the US indices, it should be noted that the Fed started raising interest rates a lot sooner than most central banks, and especially ECB, to combat the high inflation rates. Even though the US is not as affected by the energy crisis as the EU, Fed’s insistence on combating inflation even with a threat of recession sent the stocks in the country on a negative path. This is especially true if we consider that the largest components of these indices are mainly growth (or rather, technology) companies, which are again a lot more sensitive to negative sentiment and interest rate hikes, and as such, are affected more severely when those things do happen. However, the gains that the US indices made before the start of the pandemic have not yet been eroded, despite the sentiment.

From January to July 2022, total GWPs in Slovenia grew by 4.9% YoY. Non-life insurance increased by 6.38%, while Life insurance increased by 0.92% YoY.

The Slovenian Insurance Association has published the latest monthly report on the changes recorded by the Slovenian insurance sector, for July 2022. In the first 7M 2022, total GWPs cumulatively increased by 4.9% (or EUR 79.2m) YoY and amounted to EUR 1.71bn. On a monthly basis, total GWPs increased by EUR 229.5m, which represents a 6% higher value YoY. Compared to last month, however, the total GWPs amount is 4% lower, meaning that despite the continual growth, the GWPs did start slowing down.

Looking at the growth by segments, both Non-life and Life GWPs increased in the first 7M of 2022. Non-life insurance GWPs increased by 6.4% (or EUR 75m) and amounted to EUR 1.25bn. This would mean that Non-life GWPs accounted for 73% of the total GWPs. Looking at the data for July 2022 by itself, however, Non-life insurance decreased by EUR 12.5m (or 7%) MoM, while it increased by EUR 10.8m (or 7%) YoY. On the other hand, Life insurance GWPs increased by 0.92% YoY (or EUR 3.65m) in the first 7M 2022 and amounted to EUR 461.2m, while in July 2022 alone, it increased by 5% (or EUR 3.1m) MoM, and 3% (or EUR 1.65m) YoY.

Breaking down the Non-life insurance segment by components, in the first 7M 2022, in absolute terms, the largest increase was recorded by Land motor vehicles insurance, which increased by EUR 18.6m (or 8.6%) YoY, followed by Other damage to property insurance, which increased by EUR 14.8m (or 12.4%), and Motor vehicle liability insurance, which increased by EUR 10.1m (or 5.9%). On the other hand, the largest absolute decrease was recorded by Fire and natural forces insurance, which decreased by EUR 708.9k (or 0.75%) YoY.

On the flip side, in the Life insurance segment, in the 7M 2022, Unit-linked life insurance increased the most, by EUR 13.3m (or 8%) YoY, while Marriage assurance, birth assurance decreased by EUR 1.87m (or 1%). For July 2022, the story is quite similar, with Unit-linked life insurance increasing by EUR 2.8m (or 12%) YoY, and EUR 2.35m (or 10%) MoM, while Marriage assurance, birth assurance decreased only slightly MoM, but increased by 2% (or EUR 521.4k) YoY.

All of this data can show us that despite the continued growth of the Slovenian insurance sector, Non-life increase is the main driver of the growth, while Life insurance while increasing, is increasing at a slower pace. The decreases on the monthly basis can show us, however, that the growth is slowing down, especially compared to the same period in 2021.

Changes recorded by the Slovenian insurance sector by the end of July 2022 (YoY, EUR)