It has been over two weeks since the Russian invasion of Ukraine began, and a lot of developments happened during this time. Because of this, we decided to bring you a brief overview of how these developments impacted the markets so far.

First of all, we would like to note that we took different time frames to demonstrate how different events impacted the changes in the markets. These time frames are the following: Year-to-date to give more of a broad overview; the change since the separation of Donetsk and Luhansk separatist republics (21 February 2022 – to date); the change from the beginning of the Russian invasion of Ukraine to the end of the 1st week of the invasion (24 February 2022 – 3 February 2022); and finally, the change from the beginning of the Russian invasion to date.

Looking first at the equity markets, we decided to look at some of the largest global, European, as well as regional indices to see how they performed. Starting first with the change in the 1st week of the invasion, the largest change was recorded by the main Austrian index (ATX), and the main Hungarian index, which both declined by 13% during the week. Following them, we have BET and CROBEX10, which declined by -9% and -7%, respectively. On the flip side, the only indices that increased during the week were S&P500 and Nasdaq Composite, which makes sense as the US is located a lot further away from the conflict, as well as the suite of announced US sanctions & support for Ukraine in the 1st week, which gave some breathing room to these indices.

Taking a bit wider look (since the declaration of Separatist Republics), ATX still maintains the largest decrease, with -17%, followed by BUX with -14.6%, and SBITOP with -14.8%. Meanwhile, DAX and CAC40 declined by -9.4% and -9.66%, respectively. At the same time, none of the observed indices experienced positive returns in this period.

Now changing our view to how these indices were affected since the beginning of the invasion to date, the situation has improved somewhat for the indices, with ATX regaining some of its value and landing at -12%, followed by BUX with -10%, while SBITOP and BET declined by -10% and -9%, respectively.

Finally, one should look at the entire picture, and in order to do so, we decided to see how these indices performed since the start of the year. On a YTD basis, Nasdaq Composite declined the most, with -17.9%, followed by ATX with -17.7%, BUX with -15.4%, DAX and SBITOP, with -14.2% and 14%, respectively. Out of the remaining observed indices, all of them except FTSE 100 declined by more than -5%, with it being the only one to decline by less, at -3.1%. The discrepancy between the YTD and since the start of the invasion time periods can be attributed to the main topics at the beginning of the year before the Russian invasion: Inflation, rate hikes, and the end of the quantitative easing.

Performance of select indices (YTD, %)

Performance of all observed indices since the beginning of the invasion (%)

We also took a look at the commodity market in the same periods. Starting with the largest one, on a YTD basis, we first took a Bloomberg commodity index, which is composed of gas, oil, and its derivates. On a YTD basis, this index increased by 26%. Since the beginning of the invasion, it has increased by 9%. If we looked at oil and gas by themselves, on a YTD basis, oil prices increased by 40%, while gas increased by 89%. Since the beginning of the invasion, they increased by 14% and 58%, respectively. Next up, we looked at wheat prices, as Ukraine and Russia are some of the largest exporters of this commodity. Since the beginning of the year, it increased by 42%, while since the start of the invasion, its price grew by 24%.

Oil, Gas, Wheat price change YTD (%)

The exchange rates for the USD/RUB and EUR/RUB also show a similar story. Since the beginning of the year, rouble to the dollar depreciated by 59%, while since the start of the invasion, it depreciated by 46%. The rouble to euro exchange rate shows the same story, since the beginning of the year, the rouble depreciated by almost 60%, while since the beginning of the invasion, it lost 48% of its value to the euro.

USD/RUB and EUR/RUB exchange rates, YTD (%)

Lastly, we looked at how the Russian invasion impacted the region. What can be seen is that companies that have the largest exposure to Russia/Ukraine were also affected the most. Out of the Slovenian companies, this relates to Krka, which lost app. 31% of its share value since the beginning of the year, with -21% since the beginning of the invasion. On the Croatian side, this relates to AD Plastik, which is by far the largest decliner in the region, losing -43.8% of its value since the beginning of the year, and -40% since the beginning of the Russian invasion.

Performance of CROBEX10 constituents, YTD (%)

The total impact of the invasion is still uncertain, and new developments are happening daily. One thing that can be seen, however, is just how sensitive the markets are to news relating to war, conflict, sanctions, and especially escalation of any of these things. At the same time, it can also be said that the markets are also resilient and steady in their recovery. It should also be noted that besides the entire situation in Ukraine, inflation is also affecting pricing, but to what extent is hard to determine, due to the way the situation in Ukraine overshadows everything else in its magnitude.

Direct exposure of Croatian blue-chip companies to Russia is not that extent and it is limited to AD Plastik, Podravka, and Ericsson NT. It will influence their operations, but it will not disrupt the business and financial stability of these companies.

Revenues in the Russian market, which represent 27% of the total AD Plastik revenues in 2021, reported an increase due to the semiconductor crisis affecting that market with less intensity. In the upcoming period, Group’s sales revenues should most certainly suffer due to Russia – Ukraine war, which will be another drag on Group’s profitability. Due to the Russian invasion of Ukraine and uncertain political and economic situation, Togliatti and Kaluga factories and companies in ownership of AD Plastik are expected to continue functioning. But they will negatively impact the results of AD Plastik group because of a drop in sales and FX loss due to the devaluation of the Russian currency. Therefore, we expect a drop in sales of Ad Plastik in 2022 and the pressure on the share could continue in the next period so the short-term outlook is not so bright.

Podravka’s exposure to Russia through Belupo’s is app. at 7% of total sales, while a reduction of these sales will also bring a drop in profitability. Due to inflationary pressures and lower gross margin, we have expected a drop in the net income of Podravka even before the Russian invasion. Coupled with a decrease in Pharma margins and FX loss from a long position in Russian rouble the level of bottom-line decrease will depend on the period needed for resolving of Russia – Ukraine war.

Ericsson NT has in Belarus its own local company with 25 employees, while the most important activities include extensions of LTE networks for local operators and informatization of the central health system. Revenues from these activities in 2021 had a share of about 4% in total sales results of the Ericsson NT and have significantly contributed to operating cash flow.

Performance of SBITOP constituents, YTD (%)

When it comes to Slovenian blue-chip the highest exposure to Russia and Ukraine is in Krka which has app. 21% of sales realized in Russia and app. 6% in Ukraine. In currency position structure in 2020 43% was related to Russian rouble exposure as partial hedging against rouble-related risk is done. Less than 50% of the risk exposure to rouble was hedged through forward contracts. Also, in 2020 Krka realized a growth of 17% of sales in local currency and 5% growth in EUR terms. The 2020 fluctuation in the Russian rouble was unfavourable for Krka, as the value of the rouble expressed in the euro dropped by 23.5%. Due to the drop in the rouble value, Krka generated exchange rate losses, which were partly offset through net revenue from the rouble hedging instruments meaning that through effective hedging it was possible to achieve better results. When looking at the Russian Government’s reaction to the withdrawal of business from the Russian market for big global firms, it is likely that nationalization would follow so total loss of equity for Krka in Russia Federation of app. EUR 50m is possible. But this is only the case in our downside scenario. We expect that Krka would try to avoid it by continuing production and that it will continue to consolidate Russian entities. Our main scenario for resolution of Russia-Ukraine war envisages containment of war by Ukraine conceding to Russian terms, which will result in continued sanctions of Russia in the mid to long-term. Therefore, we expect that Russian sales in Krka will continue but that they will drop considerably. Also, we are considering a drop in the currency that can by the year-end be more than 100%. With less transparency on sales and a decrease in depth for Rouble hedging instruments in the market, Krka sales in 2022 could decrease if the crisis prolongs. The fall in the rouble value was in the past the main reason for the Group’s total negative net financial result, which will exacerbate in the following quarter results. At the end of 2020, Krka had EUR 161m current trade receivables due from Russian subsidiaries which will be even higher at the end of 2021. We do not expect a write-off of trade receivables in the 1Q of 2022, but for the whole year, Krka’s bottom line would likely see hits due to sales decrease, devaluation of rouble, and write-offs of trade receivables, on the level higher than sales decrease.

This week, we will present you with detailed series – decomposition of Return on Equity (ROE) of selected Croatian companies, using 5-Step DuPont Analysis. DuPont analysis breaks down the underlying components of the ROE in order to analyze the contribution of each component. ROE is a measure of the profitability of a company in relation to equity. The higher ROE company achieves, the more efficient company is in generating profits, using its equity to do so.

ROE – Croatian Blue Chips [FY 2021]

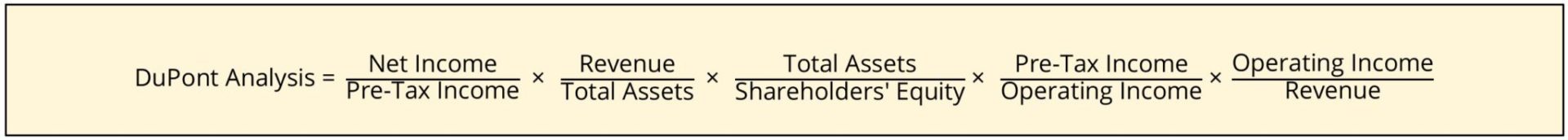

5-Step DuPont Analysis

When decomposed in the 5-step formula, ROE looks like this. If the same variable from numerator and denominators is „cut out“, the aftermath would just be net profit divided by equity – which is in fact, nothing but ROE. Also, it should be noted that each component is the most useful when compared to companies within the same industry, as each industry has its own specific characteristics.

In other words, the company’s profitability ratio (ROE) is decomposed in five other ratios.

Operating margin gives us information on the company’s ability to generate profit from its operations and revenues. It calculates how much operating profit can a company make on a dollar of sales, after paying all costs of production (COGS, wages..), but before paying interest or tax. Overall, the operating margin represents the company’s operating efficiency.

Financial leverage divides a company’s total assets with a company’s equity, giving us information on how leveraged the company is with debt. Financial leverage can be useful as it emphasizes the financial stability of a company. Financial leverage equal to 1 would indicate that the company has no debt – that company financed its total assets with equity. The higher the financial leverage goes, the more leveraged company

Asset turnover compares a company’s assets to its sales. This ratio helps us to determine how efficiently a company uses its assets to generate revenue. This ratio is crucial as every company has to utilize its assets. The higher the ratio is, the more efficient company uses its assets to generate revenues. This means the company uses its equity and debt to produce higher revenues, compared to the company having a lower asset turnover ratio.

The last two components within DuPont are tax and interest burden. These components highlight how much do tax and interest weigh down a company’s net profitability. The tax burden gives us the proportion of profits retained after tax. This indicates how much does tax impacts on company’s bottom line. Interest burden tells us the extent to how much the interest expense of the company impacts its net profit.

Today, we will look at the Operating margin of a few Croatian Blue Chips, as a first DuPont component. Operating margin gives us insight into the company’s operating efficiency and ability to generate profit to equity from operating activities. The higher operating margin is a result of the company’s ability to generate more operating profit on each dollar of sales and it is a direct result of the company’s cost management efficiency.

Operating margin (%) – Croatian Blue Chips [FY 2021]

Tomorrow we will look into the second DuPont component of Croatian companies, Financial leverage, and compare them with peer companies operating within the same industry.

BET index reaches 20 constituents for the first time after including Aquila – the largest company on the consumer goods distribution. Changes will become effective on March 21st.

BET index reaches 20 constituents for the first time after including Aquila – the largest company on the consumer goods distribution in Romania. Aquila has 2,462 employees and generated EUR 390m of sales in FY 2021.

The Index Committee took the decision on March 9th and the changes will become effective on March 21st. The weight of the index constituents were determined based on the number of shares and closing prices at the end of the trading session of March 11th, with respect to free-float factors, representation factors and liquidity factors. The new structure will become effective starting with March 21st. You can read the full article here.

BET index weight structure