Yesterday’s FOMC left us with one sentence resonating: we are getting back to a point where both mandates (inflation and unemployment) are important. This sentence signals that rate moderation seems to be ahead in inflation continues to slide down. What do we make of the current environment and what can we expect from today’s ECB? Read in this brief research piece.

Post-pandemic years have been quite unusual in terms of the interplay of macroeconomic forces and macroeconomic variables such as inflation proved to be impossible to forecast. Think of it this way: in 2020 we had an unprecedented set of fiscal and monetary support across the globe (MMT at its finest) that failed to have a material effect on inflation up until last year. Investment funds that went short duration in 2020/2021 we’re out of business by end-2021 (Michael Hasenstab from Franklin Templeton is a case in point). Then in 2022 when CPI/PCE went loose, central banks were left behind the curve and had to react immediately and confidently. Yet, the fastest rate hike cycle on record still failed to bring about a recession that many feared was unavoidable. Yes, we have seen a manufacturing recession in Europe and China and yes, SVB and CS collapsed, but these banks were swiftly acquired by rivals or bigger banks and the stability of the financial system remained intact. History doesn’t repeat itself, sometimes it doesn’t even rhyme. This time it really was different.

With this in mind, we refer to yesterday’s FOMC that kept the FED fund rate corridor unchanged at 5.25%-5.50% in a clear break from the last DOTS report that penciled in one more rate hike by the end of the year. The believers in that phantom rate hike were conjuring around interpretations that JOLTS are gradually dropping and core inflation remains stickey at +4.0% YoY. Nevertheless, these observations got only an honorable mention from Chairman Powell when he said: „Participants didn’t write down additional hikes. Participants also didn’t want to take the possibility of further rate hikes off the table.“ Once Powell delivered his comments on the state of the economy, it became clear that additional hikes were possible, but not probable. The fight against inflation s likely over, at least in the United States.

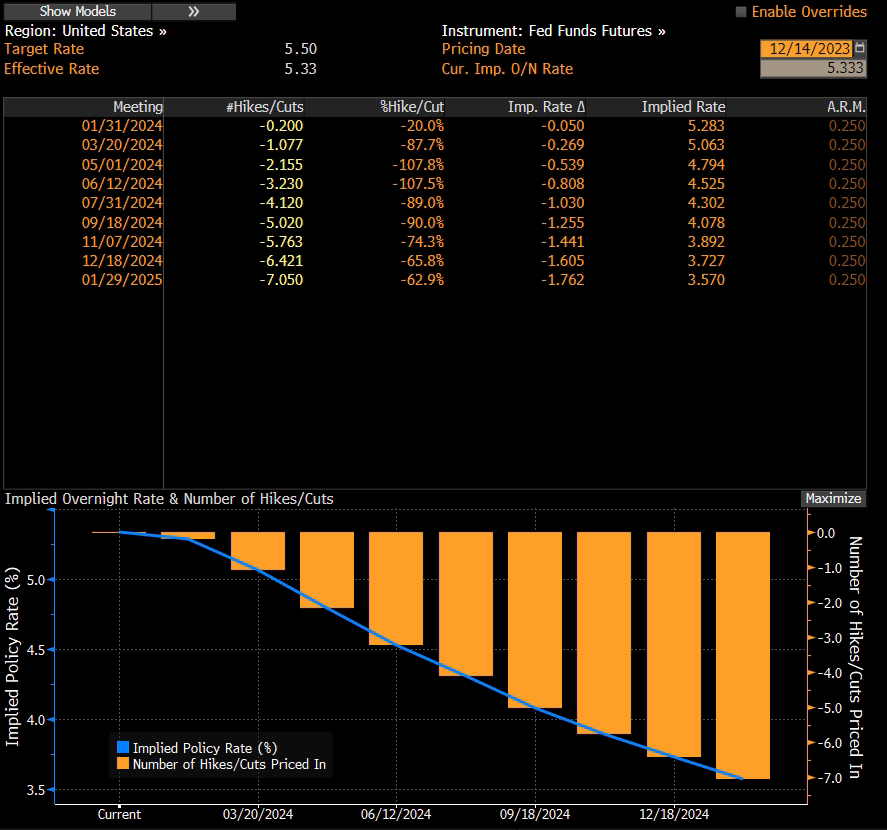

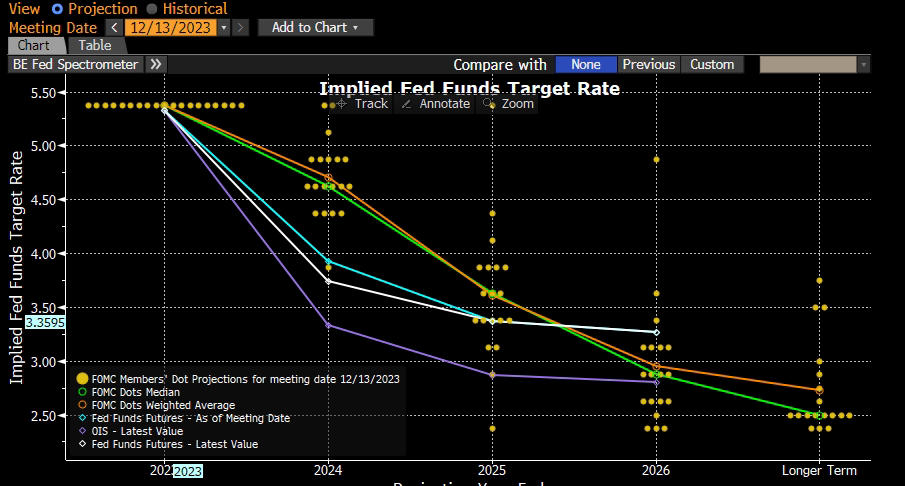

So where are we now? According to the WIRP US function (chart above), OIS swaps are expecting the first rate cut by March 2024 (second day of spring, March 20th looks like a decent date) and a total of six rate cuts by the end of 2024. The median dot is at 4.7% by year-end 2024 (implying three cuts), however by now the credibility of DOTS report (chart below) is really put into question and you can lose serious money by relying on the dots report alone. Nevertheless, most clients asked us this morning is the current bond rally running into thin air? Well, it might lose momentum after today’s ECB, but a sell-off must be catalyzed by either a change in narrative, or hawkish hard data, either one looking unrealistic at this point.

More importantly, what do we expect from today’s ECB? Nothing in terms of monetary policy rates, a possible reduction in 2024 GDP growth and inflation, but more importantly we would be listening for any indication about a change in PEPP reinvestments. It’s almost impossible for ECB to immediately pull the rug on PEPP reinvestments, but we do expect that today the GC might signal that it’s actively exploring options to reduce PEPP reinvestments from 2Q2024. This is still insufficient to bring about periphery spread widening, but the ball will start rolling.

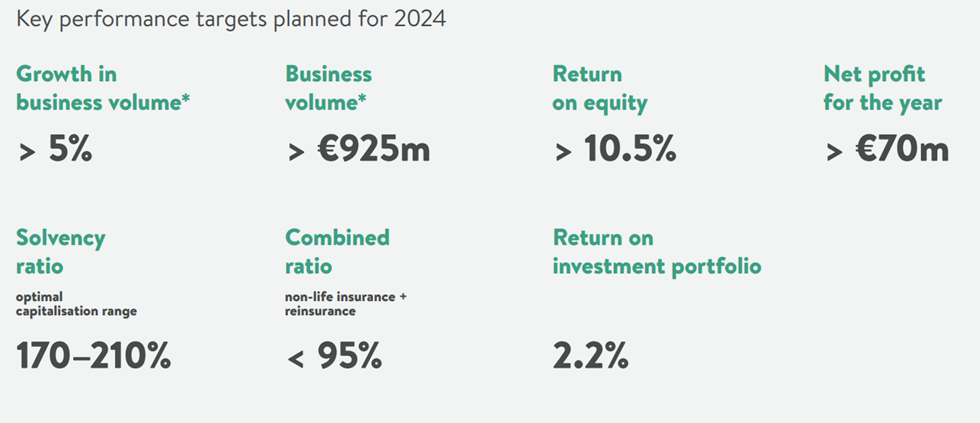

For 2024 the Group plans to generate more than EUR 925m in business volume and a net profit above EUR 70m, which translates into a planned ROE of at least 10.5%.

Earlier today, Sava Insurance Group published its 2024 business plan. The management board believes that the business plan is ambitious both in terms of the development activities planned and the set targets. Further, the Group will continue to work towards the financial targets set in the 2023 – 2027 strategic plan.

The Group’s business volume is planned to exceed EUR 925m in 2024, growing at a rate of approximately 5% in the Group’s strategic markets and approaching one billion euros in business volume. Growth should mainly be driven by non-life business with premiums growing at least 6% in the EU market and up to 8% in non-EU markets. Double-digit growth of 10% is expected in the non-EU life business, while premium levels in the EU market will continue to be affected by the maturing of old policies. Finally, based on estimated fund inflow and projected returns, the Group is targeting revenue growth of at least 5% in asset management and pensions.

Sava will mainly focus on delivering its key three business strategy focus areas. The Group will further automate and digitalize customer interactions and develop digital and self-care solutions to improve and optimize the customer experience. It will continue to streamline its underwriting and customer service processes, as well as its internal business processes. In the area of sustainability, the Group will implement its sustainability policy for the strategy period.

Sava Re 2024 Business Plan

Source: Sava Insurance Group

Finally, if claims experience development in line with expectations for the last quarter, the Group plans to maintain a combined ratio of less than 95% for non-life & reinsurance segments, which is in accordance with the Group’s strategic targets. Through active management of the investment portfolio, the Group aims to increase the investment return to 2.2% and to maintain quality of investment portfolio as we have seen in the past.

Business volume growth planned for 2024

Source: LJSE, InterCapital Research

Here you can find the dates for the upcoming events of the regional companies

| wdt_ID | Date | Ticker | Announcement | Country |

|---|---|---|---|---|

| 4 | 15.12.2023 | PETG | Petrol 2024 Business plan and key targets | Slovenia |

| 5 | 15.12.2023 | ATPL | Atlantska Plovidba 2024 Events Calendar | Croatia |

Due to the nature of these events, they are subject to change (might be postponed or canceled).