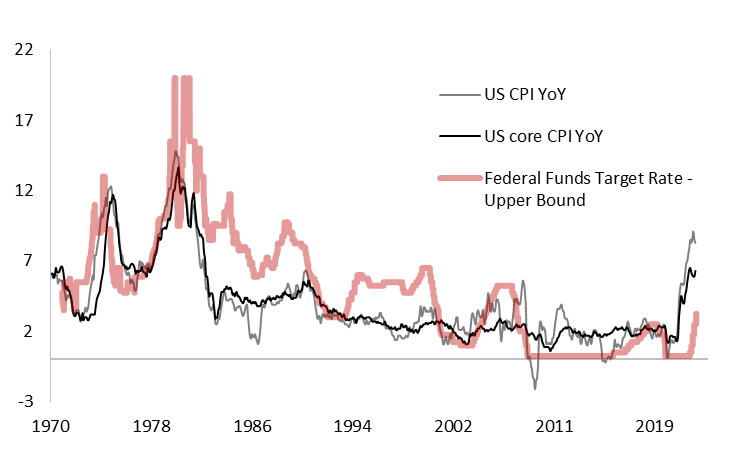

This week we have seen continued sell-off in bonds across the globe although there was not much news on the macroeconomic front until today when US September’s CPI is to be released. The market expects CPI growth to decelerate to 8.1% from 8.3% in August while the core reaches the peak seen in March. In this brief article, we are looking at the possible drivers that would mark the peak of global yields.

If you are looking at the CPI and PPI releases this year, you would notice that almost every month the US data exceeded consensus expectations and the result was a quick drop in bond prices. The same thing happened yesterday after the US Bureau of Labor Statistics released data on September’s PPI data which showed that PPI Index for final demand increased by 0.4% MoM vs 0.2% expected which was the strongest growth since May when it increased by 0.5% MoM. In YoY terms, PPI increased by 8.5% which represents a modest deceleration from August when it increased by 8.7%. In any case, bond prices fell immediately on the data showing that the market still widely expects (hopes) that inflation will come lower, and the story repeats every month.

Today we are waiting for the CPI release, and the market expects the rate to fall to 8.1% YoY vs 8.3% in August due to lower gasoline prices, but the service sector is still expected to push core rates even higher to 6.5% compared to 6.3% last month. 6.5% level was seen in March 2022 but since then core rates have been constantly slowing until August, so it is to be seen whether August was just noise or another turn that confirms that inflation is here to stay until the Fed really breaks something.

Talking about breaks, the UK is still fighting with its kind of financial crisis after several UK pension funds had problems with liquidity and gilt market liquidity evaporated. Although the BoE stepped in to save pension funds and announced a temporary asset-buying program, this week the central bank had to include inflation-linked bonds in the program as well. However, on Tuesday BoE’s governor, Bailey said that pension funds have only three days to get this done before the program ends (October 14th) which put additional pressure on financial markets, pushing yields up even more. Furthermore, in the morning after Bailey’s speech, there were some speculations that BoE told banks in private that the program could be extended in case there is a need for the tool to stabilize the markets. So, if you were thinking that UK’s situation is a complex one and a bit confusing, you got a confirmation right there. Anyhow, gilts’ yields topped the levels reached right before the BOE’s intervention meaning that investors still refuse to long UK’s bonds before we have some confirmation that the program will become more permanent or that tax cuts will be reversed.

Gilts reached the peak levels seen two weeks ago and the same story goes with US treasuries and EUR yields. Currently, it looks like there is no story that could break the inflation – the central bank tightening mantra that resulted in the biggest and fastest sell-off of bonds in history. Although yields across the world are close to their 10-year lows investors are refraining from buying them as volatility is just too high. However, we do not see volatility settling down soon, as many subjects are underinvested meaning that on any sign that inflation is decelerating there will be a lot of demand and no supply, resulting in a jump of bund by 1000 pips. This results in looser financial conditions that result in tighter policies from central banks. And repeat.

US Inflation and Fed Funds Rate

Source: Bloomberg, InterCapital

At the end of August 2022, the total deposits of Croatian financial institutions equaled HRK 406.1bn, breaching the HRK 400bn mark for the 1st time in their history. This would mean that they grew by 13.1% YoY, and 2.2% MoM.

The Croatian National Bank (HNB) has published its latest monthly report on the consolidated financial positions of the monetary financial institutions, for the month of August 2022. Within the report, we can see that by the end of August, the total deposits in Croatia amounted to HRK 406.1bn, which is an increase of 13.1% YoY, and 2.2% MoM. This would mean that even though the growth is continuing, on a monthly basis, the increase did somewhat decelerate from July’s and June’s 3.5% and 3.3% MoM increase, respectively. However, this growth is still above way higher than the average since 2010, during which the deposit growth amounted to a measly 0.4%.

The main factors that are still influencing deposit growth are the following: First of all, the tourism season. August is usually the month with the highest number of arrivals/tourist nights in any given year in Croatia. Taking into account that around 50% of all tourism-related real estate is rented by the private individual and not larger tourism companies when the tourists do pay the rent, a lot of that money is deposited in those renters’ accounts, thus leading to higher deposit rates. Secondly, the switch to Euro is also having its influence, as having a lot of paper money at hand means that money will have to be exchanged for euros sooner or later, and this is usually done by depositing the money in the individual’s bank account.

Furthermore, given the current macroeconomic situation, with a lot of inflationary pressures, especially in terms of energy and of course, consumer goods prices, having higher deposits is a must in case the situation escalates further and new and unexpected costs arise. Finally, Croatians usually hold a lot of money in the form of deposits, with the main investment type in the country being real estate which requires a lot more financing in terms of loans, and thus, higher deposits are required to both pay those loans, but also, indirectly to even allow banks to issue new loans (remember, loans and deposits are 2 sides of the same coin in the balance sheet of a given bank).

Looking at the deposits by the components, on a yearly basis, demand deposits increased by 15.2% in August 2022, and amounted to HRK 169.9bn. Meanwhile, saving deposits increased by 11.7% and amounted to HRK 236.1bn. On a monthly basis, demand deposits increased by only 0.2%, while saving deposits increased by 3.8%.

Dividing the saving deposits even further, deposits in the domestic currency (HRK) decreased by 15.2% YoY, and 0.6% MoM, amounting to HRK 27.4bn. This marks the highest decrease on a yearly basis and continues the trend for the last couple of months when the deposits in HRK have been declining by more than 10%. The reason is the aforementioned switch to Euro, which is set for January 2023. This would also mean that deposits in HRK currently stand at 11.6% of the total saving deposits, which is a decrease of 3.7 p.p. YoY, and 0.5 p.p. MoM. Meanwhile, foreign currency deposits, which account for the remaining 87.9%, amounted to HRK 208.7bn in August 2022. This would mean that on a yearly basis, they grew by 16.5%, while on a monthly basis, they increased by 4.4%. Also, this marks the first time that the foreign saving deposits breached HRK 200bn.

Croatian deposits breakdown (November 2012 – August 2022, HRKbn)

Finally, taking a look at the household deposits, they increased by 10.5% YoY, and 1.5% MoM, amounting to HRK 263.4bn by the end of August 2022. This would mean that 64.9% of all deposits held were household deposits, representing a decrease of 1.53 p.p. YoY, and 0.49 p.p. MoM.