Here you can find the dates for the upcoming events of the regional companies.

| wdt_ID | Date | Ticker | Announcement | Country |

|---|---|---|---|---|

| 6 | 23.12.2022 | SALR | Salus estimated business plan for 2023 | Slovenia |

Due to the nature of these events, they are subject to change (might be postponed or canceled).

NLB confirmed the 2nd dividend payment for 2022, in the amount of EUR 2.5 DPS. At the share price before the proposal, this would amount to a DY of 4.6%. The ex-date is set for 16 December 2022.

At its GSM meeting held yesterday, 13 December 2022, the shareholders approved the distribution of the 2021 profit. According to the announcement, out of the distributable profit of EUR 408.3m, EUR 50m, or EUR 2.5 DPS shall be paid out as dividends, implying a payout ratio of 12.25%. The remaining EUR 358.3m share be transferred into the retained earnings. The ex-date is set for 16 December 2022, while the payment date is set for 20 December 2022.

Combined with the previous dividend this year, NLB will pay out a total of EUR 100m, or EUR 5 DPS in 2022, implying a payout ratio of 24.5%. Combined, this would mean that in 2022, the DY of NLB amounted to 8.4%. Below, you can see the historical dividends and dividends per share of NLB.

NLB Dividend Per Share (EUR) and Dividend Yield (2019-2022, %)

Source: NLB, InterCapital Research

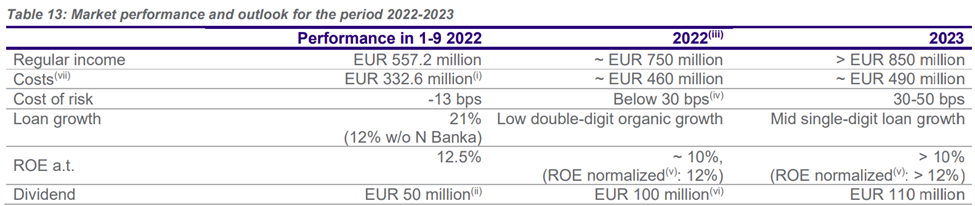

In their 9M 2022 results, NLB also commented on their outlook for the years to come, including the dividend payments.

Source: NLB

As seen in the Company’s outlook, they expect another dividend payment of EUR 100m in 2022 and EUR 110m in 2023. In fact, the Company commented that they are aiming to pay out a total of EUR 500m in dividends between 2022 and 2025.

NLB share price (2022, YTD, EUR)

Source: Bloomberg, InterCapital Research

NLB received its first ESG rating from Sustainalytics. The company reported a score of 17.7 and was assessed to be at low risk of experiencing material financial impacts from ESG factors due to its medium exposure and strong management of material ESG issues.

NLB received its first ESG rating and was given a score of 17.7 by Sustainalytics. The company was assessed to be at low risk of experiencing material financial impacts from ESG factors due to its medium exposure and strong management of material ESG issues. As Sustainalytics said, „The company is noted for its strong corporate governance performance, which is reducing its overall risk. Furthermore, the company has not experienced significant controversies.”

In addition, NLB’s ESG Risk Rating places the company among the best 15% banks assessed by Sustainalytics. In the report, it is noted that NLB is the first bank with head headquarters and exclusive strategic interest in Southeast Europe which has obtained this rating, as well as the first among the companies, listed on the Ljubljana Stock Exchange.

Further, NLB emphasized a few efforts in the field of sustainability encompass the environmental, social and management aspects. Some of the NLB’s actions were, according to the Company: It has established the NLB Group Sustainability framework; the directions and goals of sustainable business, sustainable financing and contribution to society. Further, NLB is also the first bank from Slovenia to commit to the UN Principles for Responsible Banking, and in the spring of this year joined the United Nations Net Zero Banking Alliance, which aims to harmonize credit and investment portfolios with reaching zero net emissions by 2050 or earlier. You can read more about it here.