After most of the major central banks around the globe made their move to defend their economies by cutting interest rates, today we are looking at Frankfurt and ECBs actions. Of course, monetary policy is not going to be enough to counter the escalation, but we expect strong fiscal package also that would decrease negative impact from the new virus.

In the last two weeks it became obvious that corona virus will have significant impact on world economy and as several countries in Europe are already in quarantine while many of them are looking for stronger measures to stop the spread of the new virus that accelerated in both Europe and USA. It is a bit calming that situation in China is stabilizing while seems like number of new cases in Italy decreased on March 9th after three weeks of rising. As many European countries and US are lagging in terms of new cases (in relative terms compared to Italy), we expect number of new cases to accelerate further for a week or two and then could see an inflection point in case most of them extended their measures such as closing of schools and limit bigger events.

After G7 countries’ finance ministers and central bankers decided to take measures to reassure markets last week, FED was the first one to react slashing its reference rates by 50bps in one cut on last Tuesday while the same was done this week by BoE. That move wasn’t nearly enough to calm the markets so at the moment finance ministers are competing which package will be bigger. For instance, Italian Prime Minister Gisueppe Conte announced they will spend around EUR 25bn on stimulus to defend its economy from crisis which at the moment looks inevitable. Package includes help for temporary workers, compensation for firms, moratorium on some loans and so on. Talking about fiscal package, yesterday we have seen UK’s Rishi Sunak announcing giant fiscal stimulus to help their SMEs and National Health Service, saying “Whatever it takes, whatever it costs, we stand behind our NHS”. On the other side of the Atlantic, President Trump and his lawmakers began talks on relief package which could include cut of payroll taxes that could make up to USD 700bn-900bn which is more than 2008 bailout package. However, package doesn’t seem to be close as there are many details to discuss and political points to win as we are heading closer to the elections.

Attention now turns to the main event today, ECB’s monetary policy meeting. Market expects at least 10bps cut while many other options are also on the table. First, more negative reference rate, i.e. -60bps would even more hurt banks so ECB could be prone to uplift its tiering limit to even more than 6 times mandatory reserves. Going on, asset purchases could be lifted from current EUR 20bn a month to 30bn or even more but then they will have to lift capital keys and limits of 33% of each issue. Moratorium on some loans or change of TLROs are also in their toolkit. So, it seems that there are still some tools left, it just depends on whether Mrs Lagarde is prepared to go ahead of the curve and if she thinks the same measures will help against completely different type of crisis compared to the one in 2008 and in 2013.

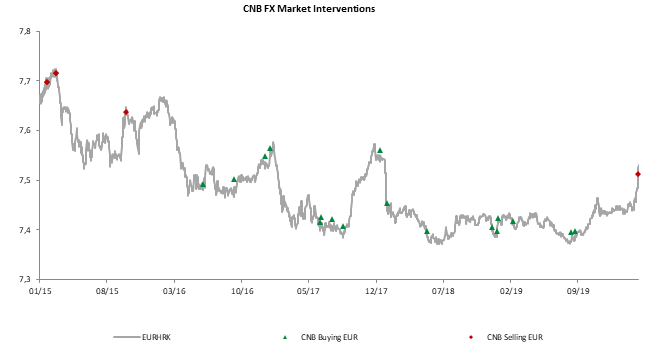

Talking about central banks actions, we should just mention that this week we have seen Croatian central bank coming to FX markets to intervene as EURHRK went North sharply. In the last few weeks, HRK started to depreciate most likely due to several factors. Namely, global uncertainties, local FX bonds auction, larger corporate buying of single currency and lower income from the tourism sector. CNB decided that 7.56 level was enough and sold EUR 387m at average price of 7.512738 but only day after HRK started to depreciate again and this morning, we see offers at 7.5800. which is level last time seen in December 2017 and December 2016.

Source: Bloomberg, CNB, InterCapital

The Supreme Court ruled that the conversion agreement has legal effects and is valid in the case where the provisions of the basic variable rate loan agreement and the foreign currency clause are null and void.

The Supreme Court of the Republic of Croatia ruled that the conversion agreement concluded on the basis of the Law on Amendments to the Consumer Credit Act has legal effects and is valid in the case where the provisions of the basic variable rate loan agreement and the foreign currency clauses are null and void.

The Supreme Court has taken a legal view of a matter that is decisive for a large number of lawsuits filed in a vast majority of cases before first instance courts, or is expected to be filed, on a motion filed by the Pazin Municipal Court.

The decision is based on the conclusion that previous judgments of the Croatian courts have established that the provisions of the regarding variable interest rate and foreign currency clause in the CHF of the original agreement are unfair, null and void but they have not been established the original agreement to be null and void in their entirety.

Furthermore, it was concluded that in order to prevent and eliminate the unfair business practices of credit institutions, as well as due to the deepening of the debt crisis, a special regulation was adopted (Law amending the Consumer Credit Law), which was harmonized with the Constitution and confirmed in a procedure before the Constitutional Court, according to which credit institutions were obliged to act in accordance with the that Law amending the Consumer Credit Law, while the borrowers were given the disposition of whether to enter into a new agreement or to maintain the applicable contractual terms. By concluding agreements between credit institutions and borrowers, in accordance with that act, as a separate regulation, a new legal basis has emerged, on which there is no place to apply the general rules of law of obligations on contract novation.

At the current share price dividend yield is 4.9%. Ex-date is 6 May 2020

HT published an announcement on the Zagreb Stock Exchange stating that the Management Board and the Supervisory Board proposed the distribution of net profit from 2019.

In the proposal HRK 646.13m would be used to pay out dividend to the shareholders, which translates into a dividend of HRK 8 per share. Such a dividend is HRK 2 per share lower compared to the dividend paid out in 2019 and represents a payout ratio of 90.2%

Note that the ex-date is 6 May 2020, while the dividend is subject to approval at the GSM which will be held on 29 April 2020.

The Management Board also stated that they currently expect the payment of the dividend of a minimum amount of HRK 6 per share for the year 2020 (which was also stated for the year 2019).

In the graph below, we are bringing you historical overview of the company’s dividends.

Dividend per Share (HRK) & Dividend Yield (%) (2008 – 2020)

*compared to the share price a day before the dividend proposal

In the yesterday’s trading session, CROBEX slid below 1,600 points and once again ended the day in red, with a decrease of 4.45%. Due to regular revision, Arena Hospitality Group and Končar shares will be excluded from the composition of both CROBEX and CROBEXtr indices that is valid from 23 March. Kraš and Atlantska Plovidba shares will be added to the calculation of the CROBEX10.

In the yesterday’s trading session, CROBEX slid below 1,600 points and once again ended the day in red, with a decrease of 4.45%. It ended the day at 1,591.42 points. Of the current constitutes, 14 recorded a share price decrease, while 1 observed an increase. Arena Hospitality Group observed the highest decrease of 12.08%, closing the day at HRK 262 per share. Such a price puts the share at a P/E of 9.2 and EV/EBITDA of 7.8. Of the index heavy weights, HT recorded a decrease of 3%, while Podravka recorded a decrease of 3%. Valamar Riviera was the share with the highest turnover in the day (EUR 1.1m), while its share price decreased 7.7% to HRK 24 per share. Hospitality companies are hit the hardest by the sell-off due to current Corona virus threat, while Valamar Riviera has already announced dividend that at current share price amounts to 5%. Valamar Riviera has also announced, on Monday in its convocations to General Assembly, that it is requesting rights for Management Board to increase share capital for up to EUR 111 m in the next five years. It is also worth noting that ZSE once again observed a very high turnover of HRK 39.6m (EUR 5.2m).

At the meeting held yesterday, the Index Committee has concluded a regular revision of the Zagreb Stock Exchange indices with changes applied to the following indices:

CROBEX and CROBEXtr

Arena Hospitality Group (ARNT) and Končar (KOEI) shares will be excluded from the composition of both CROBEX and CROBEXtr indices and following shares will be incorporated in the structure of both CROBEX and CROBEXtr indices:

- Auto Hrvatska (AUHR)

- HPB (HPB)

- Institut IGH (IGH)

- KRAŠ (KRAS)

- PBZ (PBZ)

- Saponia (SAPN)

- Tankerska Next Generation (TPNG)

- VIRO (VIRO)

After the revision of the index, CROBEX will have 21 constituents.

The table below you can find the new index weights.

| wdt_ID | Company | Weight (%) |

|---|---|---|

| 1 | ADPL | 5,36 |

| 2 | ADRS2 | 9,47 |

| 3 | ATGR | 10,00 |

| 4 | ATPL | 3,02 |

| 5 | AUHR | 3,41 |

| 6 | DDJH | 0,17 |

| 7 | DLKV | 0,50 |

| 8 | ERNT | 9,95 |

| 9 | HPB | 3,87 |

| 10 | HT | 10,76 |

CROBEX 10

Kraš shares (KRAS) and Atlantska Plovidba shares (ATPL) will be added to the calculation of the CROBEX10.

Meanwhile, CROBEXprime and ADRIAprime were left unaltered. The revision is based on the trading data from 1st September 2019 to 29th February 2020. The calculation of indices with a new composition will start as of March 23rd 2020.

In 2019, the Group recorded an increase in sales of 5%, a decrease in EBITDA of 24% and a net profit decrease of 29%.

In 2019, Cinkarna Celje recorded one of the best sales results in the company’s history which amounted to EUR 172.6m (+5.3% YoY). Note that this result also came in above the 2019 plan which projected sales in the amount of EUR 167.7m (+2.9%). The reason for this is improvements in market conditions in the titanium dioxide industry, where demand for product is picking up and no further pressure on price is evidenced. Adding to the result was the abandonment of the unprofitable rolled titanium sheets and building materials program, which in turn significantly improved the structure of the business programs and the internal performance of the entire system.

Operating revenues in FY 2019, amounted to EUR 177.7m, which on the other hand represents a decrease of 2.4%. The reason, why operating revenues are lower than sales is that the company observed a negative change in the value of inventories of products and work in progress of EUR -3.77m.

Turning our attention to operating expenses, they observed an increase of 5.4%, amounting to EUR 140.8m. The increase could be attributed to the rise in COGS by EUR 5.5m (+6.2%) which was higher than growth of sales (+5.3%). On the other hand, labor costs observed an increase of only 2.6%, amounting to EUR 30.8m.

Going further down the P&L, EBITDA amounted to EUR 36.9m, which represents a decrease by EUR 11.7m (-24.1%). Such a high decrease could be attributed to the above-mentioned decrease in operating revenues and increase in operating expenses.

As a result of the above-mentioned, net profit in FY 2019 decreased 29.1% YoY reaching EUR 21.7m while in the same time it is still double the target which amounted to EUR 11.1m.

Cinkarna Celje Performance (FY 2019 vs FY 2018)

CAPEX wise Cinkarna Celje spent EUR 12m in 2019. Most of the funds were spent on modernization, stabilization and improvement of the quality of our products, environmental protection projects and occupational safety and health. Part of the funds was also aimed at updating and ensuring the legal compliance of the devices and infrastructure.

In 2019 the company paid out EUR 22.8m in dividends, which translates to pay-out ratio of 75%. Last year dividend has amounted to EUR 28.3 per share and the dividend yield was 14.1%. As profit was in 2019 29% lower, that much lower dividend could be expected which would amount to app. EUR 20 per share. That would be in case we would apply the same pay-out ratio while the company would spend EUR 16.1m for dividends. The dividend yield at the current share price would amount to almost 13%.

The company has also published its 2020 business plan. You can read more about it here.

The benchmark interest rate was cut by 50bps to help lessen the disruption caused by the Coronavirus outbreak.

Yesterday the National Bank of Serbia announced a cut of its interest rate to 1.75%, which is a reduction of 50bps. Such a decision was brought a day ahead of a scheduled meeting, to help lessen the disruption caused by the Covid-19 outbreak.

The National Bank of Serbia stated that the domestic economic and financial system is stable and strong enough to cope with the potential negative consequences of the spread of the Coronavirus. They further state that the domestic factors that will contribute to the growth of the domestic economy over the past years are learning that it will have a strong incentive effect on economic activity in Serbia, which will be greatly outweighed by the potential negative effect from the international environment.

According to estimates by the government, the International Monetary Fund and the central bank, Serbia’s economic growth is seen at 4.2% in 2019 and around 4% in 2020.