We are constantly looking at a few asset classes – equity, of course, along with real estate as Croats hold the majority of their wealth in real estate. Today, we decided to look at another alternative asset class – luxury watches, from an investment perspective.

Watches, as an asset class, could be considered as an alternative investment. Today, we decided to look at this asset class from a market perspective and observe its market movement during these times of high uncertainties. Also, we will compare the historical movement of the representative index for this asset class with equity.

Demand shrinks

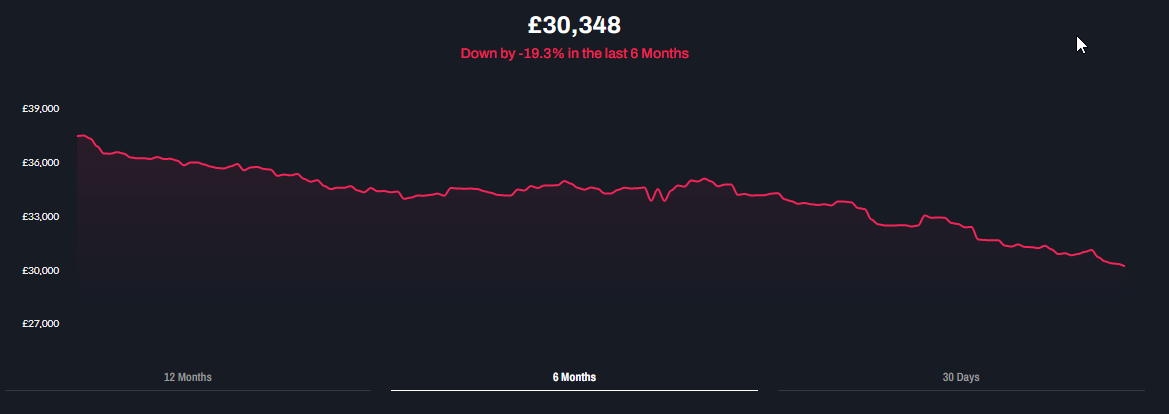

We decided to look at the SUBDIAL50 index, as a representative of this market. The index tracks the top 50 most traded second-hand luxury watches on the pre-owned market. Those top 50 most traded models on the pre-owned market together account for over 20% of total money spent globally on this market, while the weighting in the index is based on relative sales values. For a general sense, watches included in this index are Nautilus from Patek Phillipe, Royal Oaks from Audemars Piguet and the remaining majority is composed of Rolex models.

Source: Subdial, InterCapital Research

This market is slightly different compared to other asset classes, characterized by a relatively fixed and stable supply. Consequently, one could conclude that changes in prices is primarily driven by a shift in demand. In the past 6 months, the index decreased by 19%. According to Bloomberg, prices „has fallen to levels not seen since before an unprecedented boom in 2021 and early 2022“.

During these times of uncertainty, it should not surprise that demand for this kind of asset shrinks, resulting in a lower price of the assets themselves. The decline shows that the top Swiss brands were unable to maintain those ATH prices. If we were to look at this information from an investment point of view, this should not surprise us. Watches, as an asset class, noted a decline in prices just like equity did, along with bonds.

However, if we were to look at the performance of equity representatives, noted performance in the previous 6 months is relatively better with NASDAQ, S&P500and MSCI World Index reporting a decrease of „only“ 9.1%, 5.3% and 5.1%, respectively. However, it should not surprise that the decline in the watch market is larger compared to the equity, due to mentioned unprecedented boom in 2021 and early 2022. Also, we note that the 6M decline period should be overall representative for comparison as global uncertainties took time to spill over other markets – like the retail watch market.

Finally, we want to emphasize a quote from the man that needs no introduction, Warren Buffett. “I would rather own all the farmland in the US than all the gold in the world.”. He appealed to the readers that one must own productive assets that actually produce something, like equity, rather than non-producing assets represented by shiny gold. He further explains that the holder of gold has received no income return on his capital and has instead, on contrary, incurred some annual expense for storage.

Performance of equity indices compared to SUBDIAL50 Index (%)

Source: Subdial, Bloomberg, InterCapital Research

We are tremendously proud to announce that InterCapital has been awarded the Member of the Year award by the Zagreb Stock Exchange for the 11th year in a row.

The award came as a result of our leading equity market share of 35.5%, continuous research activities, and the contribution of our market-making mandates.

InterCapital is a market maker for many of the blue chips listed on the Zagreb Stock Exchange. Currently, we provide services for 9 Croatian issuers: AD Plastik, Adris Grupa (both regular and preferred stocks), Arena Hospitality Group, Atlantic Grupa, Hrvatski Telekom, Končar, Podravka, Valamar, and Span. The aim of the market-making service is to improve liquidity as well as to lower the spread, all with the goal of improving the trading efficiency for retail and institutional investors alike.

Furthermore, this achievement comes on the back of our ongoing investment into a fully independent research team and a securities promotion platform, all with the goal of providing our clients with an in-depth, comprehensive, and forward-looking analysis of the best quality investment ideas in the region. Currently, our research team has one of the broadest coverages in Croatia, currently covering 14 Croatian issuers: AD Plastik, Adris Grupa, Arena Hospitality Group, Atlantic Grupa, Croatia osiguranje, Ericsson NT, Hrvatski Telekom, Maistra, Končar, Podravka, Valamar Riviera, Span, Atlantska Plovidba, Zagrebačka banka.

We would like to express our gratitude to the Zagreb Stock Exchange for the great honor of being the Member of the Year for every consecutive year since the inception of the Award in 2012. We fully believe that this award strongly supports the validity of our strategy, i.e., to constantly promote the Croatian capital market, through the dedication of all of our employees.

Finally, this recognition could not have been achieved without our clients and partners, whom we would like to take the opportunity to thank for all their continued support and trust. We are very proud to be the leading broker in both Croatia and Slovenia, and we are very much looking forward to the growth opportunities that lie ahead of us, in all the years to come.

Recently, we also received the Member of the Year award from the Ljubljana Stock Exchange, and if you would like to read more about that, click here.