In October 2021, US CPI stood at 6.2% YoY while in monthly terms it was at 0.9%, surprising markets on the upside and showing that prices in US rise at the fastest pace since 1990. Although inflation was way above expectations, longer yields went up moderately but accelerated after terrible 30Y auction.

Yesterday’s data published by Bureau of Labor Statistics showed that US CPI increased by 0.9% MoM and 6.2% YoY in October 2021, compared to BBG forecasts of 0.6% and 5.9% respectively. Furthermore, both MoM and YoY pace increased compared to September when CPI increased by 0.4% and 5.4%. Core inflation also increased more than expected as it stood at 0.6% MoM and 4.6% YoY terms. Looking at the details from the press release, it could be seen that increase was broad based, with energy and new and used cars being the largest driver while prices of food do not show any signs of deceleration, growing by 0.9% MoM for the second consecutive month. Going on, rent prices also posted significant gains of 0.4% MoM meaning that cyclical inflation pressures are starting to incorporate in all parts of the economy. This also means that inflation is most likely to be more persistent than was expected by all central bankers in the developed world. Before US CPI data was released, Chinese CPI also surprised investors on the upside as it stood at 1.5% YoY compared to 0.7% last month while PPI was at 13.5%, highest level in the last 26 years.

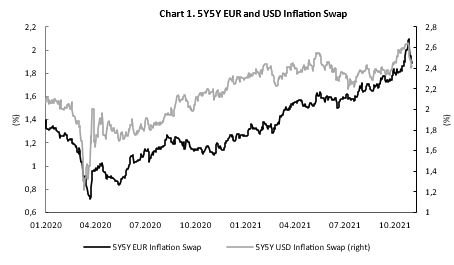

On its latest monetary policy meeting, Mr Jerome Powell still insisted that inflationary pressures are expected to be mostly transitory with drivers of the pressure being mostly connected to dislocations caused by the pandemic. Although one could agree that inflation pressures are driven by pandemic, it is becoming more and more questionable whether strong inflation forces could decrease significantly in the next several quarters. Nevertheless, inflation expectations in US did not move much yesterday, with 5y5y inflation swap being at 2.55%, more than 3 percentage points below compared to October’s CPI.

Talking about expectations, markets did react on the inflation surprise but moves were not dramatical as one would expect showing how investors got used on deeply negative real rates and expect inflation to settle down rather sooner than later. Namely, US 2Y yield went up by 5bps, from 45 to 50bps, while Libor futures dropped by some 10bps. Longer part of the curve increased more modestly, with US 10Y increasing by few basis points, barely surpassing 1.50% level, resulting in further flattening of the yield curve. Equity markets were little changed but equity markets stopped reacting on inflation surprises many months ago. However, that all changed after US 30y auction with more than 5bps NIP, highest since 2011. US 10y yield accelerated North and ended the day more than 10bps above, at 1.56%, while equity markets sold off.

So, what to take from yesterday’s move on markets? We think that investors expect a mix of the following: (1) inflation will fall quickly next year and Fed will lift rates slowly starting September; (2) Fed will decide to lift rates at much faster pace meaning that it will decelerate economic growth in such a manner that it will have to choose between higher inflation and growth and will choose growth and cut rates; (3) central banks will not be able to decrease their balances in the distant future and QEs will only increase; (4) there are too many financial subjects with mandate to buy bonds. However, one must wonder what would happen in case oil price continues increasing or wages start increasing faster and inflation rates stay above 5.0% for few quarters more. However, not many portfolios would want to see that scenario.

Source: Bloomberg, InterCapital

Today we bring you the analysis of the days receivables metric of CROBEX10 constituents, based on the 9M 2021 results.

Days Receivables, also called Days Sales Outstanding (DSO), is a metric used to show the average number of days that it takes a company to collect payment for any sale. This metric is determined on a monthly, quarterly, or annual basis.

To show an example of this metric in practice, we decided to compare the Croatian companies that compose the CROBEX10 through this metric. It should be noted that due to the differences in the industries these companies operate in, this shouldn’t be taken as apples to apple comparison.

Out of the observed companies, Atlantska Plovidba has the lowest days receivables, currently standing at an average of 6 to 7 days to make payment on a sale. Following them are other tourism companies like Valamar Riviera with an average of 13 to 14 days, and Arena Hospitality Group with 24 to 25 days. Adris Grupa stands at 64 days, however, when we look at Maistra (their tourism segment), they themselves have an average of 16 to 17 days.

Food companies, Atlantic Grupa and Podravka stand at 75 and 79 days, respectively. The last two companies on our list are Končar and HT, with 88 and 114 days, respectively. Considering the industries in which these companies operate in the average days receivables of these companies is reasonably higher.

In general, the observed Croatian companies are well within their limits in this metric when we take into account the industry they are in, as we can see that on average all of the companies are in a similar range inside the industry they operate in.

Days Receivables of CROBEX10 Companies

In the period from 24 Feb till 8 Nov 2021 the value of taxable invoices increased by 26% YoY amounting to HRK 154.8bn. The value of last week’s taxable invoices is up 11% YoY, but compared to the week before it was down 15%.

By looking at the latest announcement from the Tax Administration of the Republic of Croatia, in the period from 24 Feb till 8 Nov 2021 the value of taxable invoices increased by 26% YoY amounting HRK 154.8bn. This growth in taxable invoices should be encouraging, even though it is still 17% below spending in comparable period in 2019 (25 Feb – 10 Nov 2019).Taxable invoices in wholesale and retail trade in the period from 24 Feb till 8 Nov 2021 grew by HRK 14.8bn (17% YoY), and it is 4% above value of spending level in this segment in the same period in 2019.

The value of taxable invoices in all segments in the 1st week of November 2021 witnessed double-digit growth of 11% YoY. Compared to the same period in 2019 growth was also 11%, beating pre-pandemic spending. In the last week (1 Nov – 7 Nov) the spending in wholesale and retail trade picked up 11% YoY. Meanwhile, it is important to note that the value of taxable invoices in wholesale and retail trade increased 4% (HRK 6.64bn), when compared to the same period in 2019. This means that spending in Croatia, in a given period breached pre-pandemic spending, representing positive consumer expectations. In the last week in November taxable invoices in accommodation and food services decreased by 2% compared to the same week in the last year 2020.

The value of taxable invoices in all segments in the 1st week of November 2021, compared to the week before (25 Oct – 31 Oct 2021), was down 15% , while in wholesale and retail trade it was down 13%. When looking at the value of taxable invoices in accommodation and food services, it decreased by 25% compared to the week before (25 Oct – 31 Oct 2021). It can be connected with the increase in number of daily new confirmed cases of infections with coronavirus and changes in restriction of movement and public gatherings that came to force on 6 Nov 2021. The new set of measures will be in force until 30 Nov 2021. Namely, on 26 Oct Croatia had 622 daily new confirmed COVID-19 cases (per 1M), while on 1 Nov it had 891 confirmed cases in 1 million of citizens. On the day when new measures came into force on 6 Nov, Croatia had 1,055 new confirmed cases per 1 million of citizen and it was 4th country with the highest incidence number, coming after Slovenia (1,338), Estonia (1,300) and Georgia (1,180).