We all have been enjoying elevated deposit rates for quite some time and as Nelly Furtado said – why do all good things come to an end? Well, Nelly, we have an easy answer to this – it’s because the economy is slowing down and price pressures are gradually ceasing to build up. It’s time to cut. What happens next? Read in this brief research piece compiled by JOSIP RIMAC and IVAN DRAŽETIĆ.

The latest ECB GC meeting (Thursday, 07th March) went by in line with market consensus with key interest rates and QT pace remaining unchanged. On the other hand, ECB’s inflation projections went down with headline CPI forecast now at 2.3% (2024), 2.0% (2025), and 1.9% (2026). Core inflation projections have also been revised down to 2.6% (2024), 2.1% (2025) and 2.0% (2026). The only measure that hasn’t shown signs of easing is domestic price pressure which remained high due to still strong wage growth. Furthermore, President Lagarde reiterated that the ECB is determined to return inflation to its 2% target and that it’s a process that should be completed in the medium term. GC stated that they remain data-dependent to determine the appropriate level and duration of restriction, highlighting three criteria to assess the ECB’s stance:

1. Inflation outlook

2. Dynamic of underlying inflation

3. Strength of monetary policy transmission.

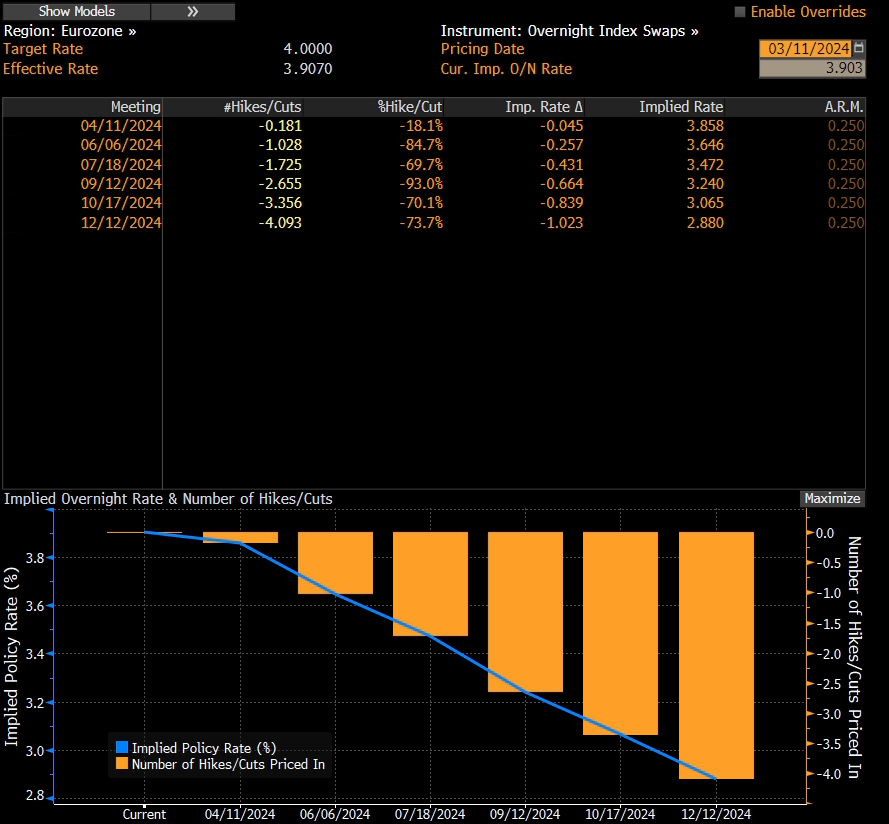

In conclusion, we believe that the first rate cut should occur in June (June 06th), as priced by the market, with July (18th July) certainly to follow and September (12th September) remaining up in the air:

This essentially means that we can finally see an end to O/N deposit rates at 3.80% for large and medium sized corporates. The story does not end here. On Friday, BLS released slightly stronger NFP data than expected (275k versus consensus 200k), however the January data was revised significantly downwards (from 353k to 259k). Moreover, the unemployment rate finally went to 3.9%. Why is this so important? It’s because according to the latest SEP (December 2023 meeting), the 2024 unemployment rate is expected at 4.1% (FOMC median). An old saying goes that when hands of the clock line up, somebody is thinking about You. Could it be that when the FOMC median estimate and real hard data align – somebody at the helm of FOMC might be thinking of You as well and might cut rates to appease You? Time will tell.

How are Croatian international bonds faring? First of all, the new one (CROATI 3.375 03/12/2034€) is trading just slightly above the reoffer (99.616 rf, 99.70/99.85 market), however, notice that this level is DBR 2.2 02/15/2034€+114bps. The paper has been placed at B+110bps, meaning that the spread has widened by +4bps. We would like to point out that S&P will be revising the Croatian credit rating this very Friday (March 15th), and currently Croatian rating sheet looks like this:

We think that it’s still a bit early to expect a credit rating upgrade this Friday, especially with elections looming. However, we would certainly look for indications about variables that S&P Global Ratings will be looking at in its deliberations. CROATI€ might be poised for more tightening ahead. Stay tuned!

Recently, the Croatian Tourism Board, HTZ, has released its latest report on Croatian tourism, for February 2024. According to the report, the total number of arrivals in February amounted to 321.3k, growing by 16% YoY, and 17% compared to 2019. At the same time, the total number of tourist nights amounted to 826k, growing by 9% YoY, and 23% compared to 2019.

The latest release by the Croatian Tourism Board, on the performance of the sector in February 2024 is showing us that there are some positive signs happening. Even though February does not play a major role in the overall tourism of the country, as that is mostly relegated to the several months surrounding the summer season, improvements in the number of arrivals and nights are still a positive development.

Accordingly, the number of tourist arrivals in February 2024 amounted to 321k, growing by 16% YoY. Of this, foreign arrivals amounted to 175k, increasing by 19% YoY, while domestic arrivals amounted to 146k, growing by 11%. Meanwhile, total tourist nights amounted to 826k, growing by 9% YoY. Of this, foreign tourist nights grew by 9%, while domestic tourist nights increased by 10% YoY. Furthermore, comparing the number to 2019, total arrivals grew by 17%, supported by a 48% increase in domestic arrivals, while foreign arrivals decreased slightly (-1%). Also, total tourist nights grew by 23% compared to 2019, with a 35% and 18% increase in domestic and foreign tourist nights, respectively.

Total tourist arrivals and tourist nights in Croatia (January 2019 – February 2024)

Source: HTZ, InterCapital Research

This would also mean that the average stay per person decreased by 5.7% YoY, to 2.57 nights, but grew by 6% compared to 2019. In terms of the tourist nights by the types of accommodation, 92% of nights were recorded in commercial, while 8% in non-commercial accommodation units. In terms of the overall numbers, 57% of nights were recorded in hotels, 21% in private accommodation, 3% in camps, and 10% in other types of accommodation.

Looking at the tourist nights by their country of origin, 38% were domestic tourists, 12% came from Slovenia, 7% from Bosnia & Herzegovina, 6% from Austria, and 5% from Germany. In terms of the best-performing counties, Istra recorded 190k tourist nights, followed by Kvarner at 142.9k, Grad Zagreb at 132.9k, Splitsko-dalmatinska at 87.8k, and Dubrovačko-neretvanska at 54.2k.

Overall, February saw an improvement in the tourist numbers, both in terms of arrivals and nights, and both on a YoY basis and compared to 2019. February represents the off-season for Croatian tourism. Furthermore, the largest share of arrivals/nights came from domestic tourists, and as the numbers are small compared to the main season, the growth in absolute terms isn’t as large. As such, further investments, and improvements to the regulatory environment and strategic direction (e.g. the Government’s tourism strategy) would be necessary to stimulate the growth of the sector outside the main season, leading to the goal of diversification.