FED’s monetary policy committee appears to be set up for one more rate cut at the end of this month. Nevertheless, the minutes from the latest meeting revealed a lively debate behind closed doors about the need to target average inflation rates, instead of nominal ones. This would allow the US central bank to weather periods of slightly higher inflation without the imminent need to pull the plug on expansive monetary policy. The newly exposed monetary fexibility is one more star in the constellation of possibly higher inflation rates in the future, but we need to see actions, instead of just words.

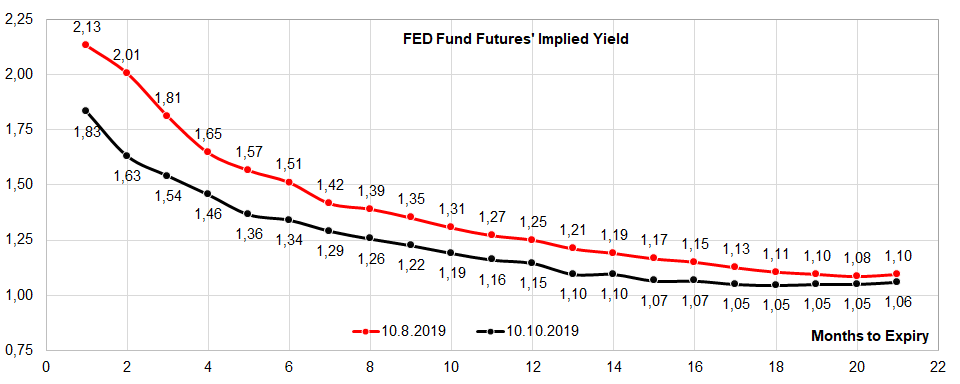

The minutes from FOMC meeting held on September 17th-18th reveal that committee members harbor a wide range of views on the appropriate timing of the rate cuts, as well as communication about the future direction of interest rates. Two things are certain: future monetary policy decisions are “not on a preset course”; and FED’s decision-making process is data dependent, meaning that with the recent ISM flop financial markets are completely right to expect a third rate cut this year on the October 29th-30th meeting (as depicted on the chart below). A handful of participants that favored keeping rates intact said that the FED should react to data, instead of risks. Additionally, the hawks on the committee argued that too much of a stimulus now would leave “monetary policy with less scope to boost aggregate demand in the event that such shocks materialized”.

This part of the minutes was mostly anticipated, but the really interesting paragraph comes once you get to the inflation portion of the report. The persistently low inflation and, more importantly, inflation expectations anchored well below 2.00% (5Y5Y inflation swap @ 1.90%, the lowest since Trump got elected) are changing FED’s attitude towards inflation targeting. According to the minutes, most participants are now open to the idea that the best way to get to 2.00% goalpost is to target the average inflation rate over time. This would give FED more headroom to implement monetary stimulus since committee members would not be worried about short term inflation overshooting the target. Nevertheless, committee members are just starting to debate average inflation targeting and we should watch closely for the future FOMC minutes to see how the policy making process goes.

A similar approach to inflation is also considered by the ECB’s Governing Council and it’s worth mentioning that looking at Europe, it seems that core European countries are preparing for a more meaningful fiscal push. For instance, in the middle of September news began to circulate about Dutch government planing to enact a 50bio EUR infrastructure investment, corresponding to approximately 6.4% of the Dutch 2018 nominal GDP; it’s also worth mentioning that Netherlands is particularly exposed to trade wars and Brexit due to the structure of it’s GDP. Additionally, in the beginning of October heads of three German economics institutes (DIW, Halle Institute for Economic Research and BDI) called for additional fiscal stimulus in the midst of manufacturing recession. To put things into context, the setup for higher inflation expectations is gradually building up, however so far it’s only been talking the talk; bond yields might start to rise once we get to walking the walk part.

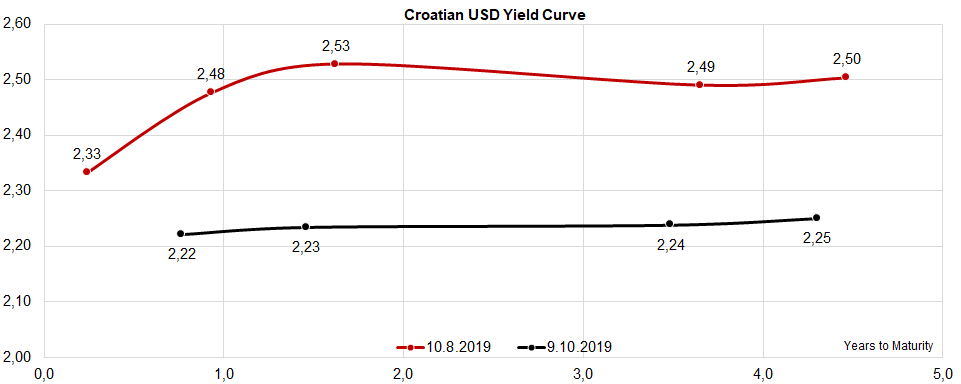

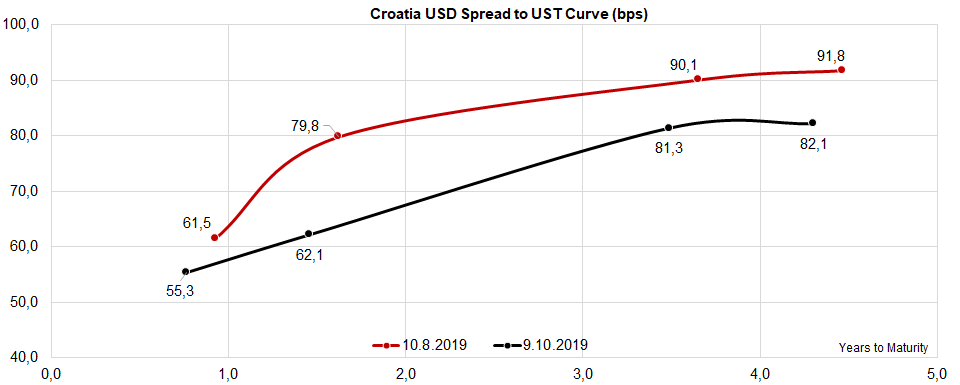

Speaking about Croatian USD Eurobonds, the yield curve is as flat as it gets (it’s worth mentioning that CROATIA 2019 USD has been removed from most of the curves due to maturity getting near). Back in July Croatian banks held about 118mio USD of CROATIA 2019 USD (according to the central bank data) and it’s quite likely that once the paper becomes due, the proceeds might be reinvested along the remaining four USD-denominated Eurobonds. Since the beginning of the year, Croatian banks were net buyers of CROATIA 2021 USD (increasing their holdings by about 40mio USD) and CROATIA 2023 USD (buying a net of about 20mio USD). It’s quite likely that holders of the shortest Croatian Eurobond might once again target these two bonds, nevertheless tight supply will continue making it difficult to buy larger chunks of Croatian dollar debt instruments.

In the first nine months of 2019, the Group recorded net sales of EUR 170m (+3% YoY) and throughput of 17.7m (+0.4% YoY).

Luka Koper published a document on the Ljubljana Stock Exchange regarding their throughput and revenues in the first nine months of 2019. According to the report, the company recorded EUR 170m of net sales, representing a 3% increase YoY. Meanwhile, the port throughput in the same period observed a slight increase of 0.4% YoY, amounting to 17.7m tons (+78 thousand tons YoY).

The largest increase was registered in the liquid-cargo commodity group (+19% YoY). Car throughput showed a slight increase compared to the results registered in the first half of 2019, however, is still 9% lower compared to the same period in 2018. The lower throughput could be attributed mostly to the global slowdown of sales of new cars. The company notes that Car exports to Turkey are still 40% below last year’s figure whereas the importing of cars manufactured in Turkey increased. Car exports to the Far East increased as well over the last months, which contributed to reducing the gap between this year’s and last year’s throughput.

The situation in the car industry generally influences the throughput in other groups of commodities. The Group further states that European car manufacturers adapted their production lines in response to a reduction in sales, and related sheet-metal imports decreased as a result. The manufacture of steel products in Europe also decreased, which has been reflected in lower exports of these types of products. This trend has also exerted a negative impact on the throughput of raw material applied in the steel industry, which is reflected in the general cargo (-14% YoY) and dry bulk (-5% YoY) segment.

This fall in the production of cars also partly influences the container segment (which recorded a 2% YoY increase) considering that the car-manufacturing units situated in Central European countries are supplied via Koper.

When observing the containers segment, the Group states that they are confronted at the moment with cheaper ocean freight rates across Northern European ports. Despite this fact, they do not expect major fluctuations. Koper is solidly in the top position among the container terminals in the Northern Adriatic, despite increasing competition among nearby ports.

The cargo throughput by segment can be observed in the table below:

| wdt_ID | Cargo throughput (tons) | Jan – Sept 2019 | Jan – Sept 2018 | change (%) |

|---|---|---|---|---|

| 1 | General cargo | 942.061,0 | 1.100.661,0 | -14,4 |

| 2 | Containers | 7.246.442,0 | 7.132.763,0 | 1,6 |

| 3 | Cars | 791.711,0 | 867.385,0 | -8,7 |

| 4 | Liquid cargoes | 3.218.298,0 | 2.698.955,0 | 19,2 |

| 5 | Dry bulk cargoes | 5.540.419,0 | 5.861.028,0 | -5,5 |

| 6 | Total | 17.738.931,0 | 17.660.793,0 | 0,4 |

With the newly added well, the gas production from the Totea field, could provide heating for over 500,000 households.

As OMV Petrom published their key performance indicators, we are bringing you their key takes. The company notes that the Q3 2019 report will be published on 30 October 2019 and that the information contained in this trading update may be subject to change and may differ from the final numbers of the quarterly report.

| wdt_ID | Economic environment | Q3/18 | Q4/18 | Q1/19 | Q2/19 | Q3/19 | YoY change (%) |

|---|---|---|---|---|---|---|---|

| 1 | Average Brent price (USD/bbl) | 75,16 | 68,81 | 63,13 | 68,86 | 62,00 | -17,51 |

| 2 | Average Urals price (USD/bbl) | 74,16 | 68,33 | 63,42 | 68,82 | 61,95 | -16,46 |

| 3 | Average USD/RON FX-rate | 4,00 | 4,08 | 4,17 | 4,23 | 4,26 | 6,51 |

| 4 | Average EUR/RON FX-rate | 4,65 | 4,66 | 4,74 | 4,75 | 4,73 | 1,83 |

| wdt_ID | Upstream | Q3/18 | Q4/18 | Q1/19 | Q2/19 | Q3/19 | YoY change (%) |

|---|---|---|---|---|---|---|---|

| 1 | Total hydrocarbon production (kboe/d) | 160,00 | 156,00 | 153,00 | 151,00 | 150,00 | -6,30 |

| 2 | - thereof crude oil and NGL production (kboe/d) | 74,00 | 72,00 | 71,00 | 72,00 | 71,00 | -4,10 |

| 3 | - thereof natural gas production (kboe/d) | 87,00 | 84,00 | 82,00 | 79,00 | 79,00 | -9,20 |

| 4 | Total hydrocarbon sales volume (mn boe) | 13,70 | 13,30 | 12,80 | 13,00 | 13,10 | -4,40 |

| 5 | Average realized crude price (USD/bbl) | 66,35 | 59,71 | 55,66 | 60,26 | 53,99 | -18,60 |

| wdt_ID | Downstream Oil | Q3/18 | Q4/18 | Q1/19 | Q2/19 | Q3/19 | YoY change (%) |

|---|---|---|---|---|---|---|---|

| 1 | Indicator refining margin (USD/bbl)* | 6,62 | 5,27 | 3,62 | 3,85 | 6,46 | -2,40 |

| 2 | Refinery utilization rate (%) | 98,00 | 99,00 | 96,00 | 94,00 | 99,00 | 1,00 |

| 3 | Total refined product sales (mn t) | 1,39 | 1,35 | 1,18 | 1,39 | 1,49 | 7,20 |

*The actual refining margins realized by OMV Petrom may vary from the indicator refining margin due to different crude slate, product yield and operating conditions

| wdt_ID | Downstream Gas | Q3/18 | Q4/18 | Q1/19 | Q2/19 | Q3/19 | YoY change (%) |

|---|---|---|---|---|---|---|---|

| 1 | Gas sales volumes to third parties (TWh) | 7,54 | 9,74 | 9,79 | 9,11 | 11,22 | 48,80 |

| 2 | Net electrical output (TWh) | 1,04 | 1,48 | 1,08 | 0,05 | 1,00 | -3,80 |

New gas discovery in Oltenia region

Besides that, OMV Petrom published a document regarding the new gas discovery in Oltenia region, which is in the proximity of producing Totea field.

The company notes that the drilling of the well Totea 4461 was started in January 2018 and reached final depth in September 2018. The well was successfully tested in April 2019 up to 500,000 cubic meter of gas per day. Tie in to the Totea facilities through a new built pipeline was achieved in less than a year and the experimental production to test the potential and extent of the new accumulation has been started. Investments in the new well and facilities amount to roughly EUR 50m, in addition to the EUR 200m already spent since 2011 for the development of the gas infrastructure in the Totea area.

Development works included drilling of five deep gas wells and construction of the 4540 Totea surface production facilities. With the newly added well, the gas production from the Totea field, could provide heating for over 500,000 households.