US midterm elections passed with a modest surprise as Democrats most likely managed to keep the majority in the Senate with a Democratic flip in Pennsylvania. However, it seems that midterm elections were not very important for the market at the moment although there could be some consequences for the fiscal policy that will have implications for the financial markets. In this article, we are looking into more details on the elections and what to expect from today’s all-important CPI release.

It is still too early to call who controls the Senate and House after the latest US midterm elections, but it seems that Democrats could keep the Senate majority while Republicans are expected to win the House of Representatives. As was the case in the elections in 2020, the winner of the Senate could be decided only on the 6th of December when the second round of voting should take place in Georgia. In any case, it already looks like the Democrats went much better than expected in the polls while many Republican candidates that were backed by the 45th president of the US Mr. Trump disappointed in the latest race. Negative surprises on several candidates backed by Trump prompted markets to price Ron DeSantis being the main candidate for the GOP in 2024. As stated above, the results are still not clear but most likely we will see a divided Congress resulting in difficulties with any major changes in domestic policies for Mr. Biden for the next two years while we could witness another debt ceiling crisis. Looking at the equity and bond markets one could not tell that midterm elections took part this week, with most equity indices kept rising stubbornly despite a big crash in crypto markets while bonds are still not out of the woods with US Treasury yields being close to their recent highs and trading sideways. Republicans now being able to stop most of the fiscal loosening in case of any economic downturn could be seen as a modest tailwind for bond bulls.

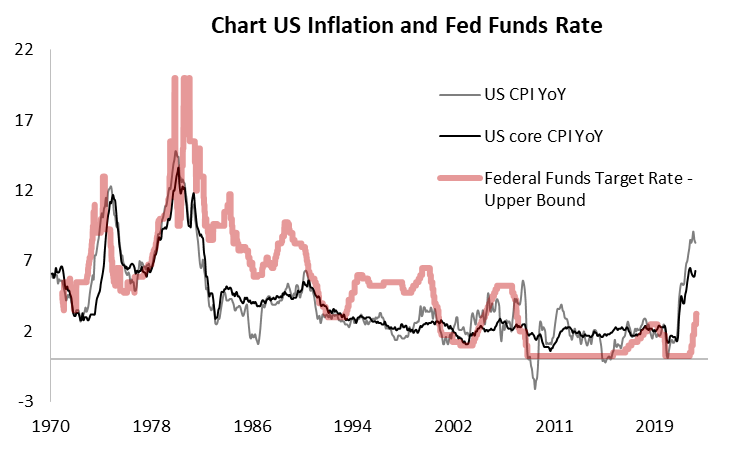

Talking about yield drivers, today we will see US CPI data for October. In YoY terms, inflation is expected to continue decelerating from 8.2% in September to 7.9% YoY while the core is expected to decrease to 6.5%, 10bps lower compared to September. As the commodity complex fell significantly from its high in June, goods inflation is expected to keep decelerating. Most of the focus will be on services inflation which seems to be driving inflation further. Last week we saw jobs report surprising markets on the upside with the economy adding more jobs and showing that average hourly earnings growth accelerated to 0.4% MoM.

September CPI release resulted in one of the weirdest intraday swings that I have seen in my short (7 years) career and in general CPI reports have been strong drivers for the market this year. With equity markets rising slowly without obvious drivers lately, we see another leg higher in case CPI comes under expectations. The picture is more blurred in case inflation overjumps expectations as the market tends to see what it wants, i.e. it could find a reason to keep rising even if CPI overjumps expectations slightly. However, I do not see this trend lasting as one has a hard time finding tailwinds for adding equity exposure besides low positioning, i.e. flow.

Source: InterCapital, Bloomberg

Producer prices of industrial products on the domestic market increased by 23.6% YoY, and 0.9% MoM in October 2022. If we were to exclude the growth in the Energy segment, the increase amounted to 11.8% YoY, and 0.7% MoM.

The Croatian Bureau of Statistics, DZS, recently published a monthly report on the developments of the industrial producer prices in Croatia, and by extension, the industrial sector. According to the report, the producer prices of industrial products continued growing in October 2022, increasing by 23.6% YoY, and 0.9% MoM. Even though we have seen somewhat of a stabilization in gas prices in the last couple of weeks, as well as the fact that starting from October 2022, the Croatian govt. capped the prices of gas, electricity, and heating for both households but also businesses, one would expect a slowdown in growth. However, this has not yet proven to be the case, and the reasons for this are multiple. First of all, the agreed price caps, for example, gas, are still multiple times higher YoY. Inflation is rampant, and this means that the spillover to other segments of the industry, besides just the energy costs, has happened.

Even so, energy still remains the main driver of growth of industrial producer prices, and if we were to exclude it, then the growth would amount to 11.8% YoY, and 0.7% MoM. One other thing that should be noted is that the industrial prices back in October 2021 were already elevated due to commodity price increases and supply chain shortages, and because of the higher base, the 23.6% overall increase YoY is even more significant.

Looking at the changes on the yearly basis, on the domestic market, producer prices in the Energy segment increased by 56.2%, followed by the increase in Non-durable consumer goods by 13.5%, in Durable consumer goods by 12.5%, in Intermediate goods by 11.5%, and finally, an increase in the prices of industrial products in the Capital goods of 6.3%. On a monthly basis, the increase in producer prices in the Energy segment amounted to 1.3%, in Non-durable consumer goods it amounted to 0.9%, in Capital goods it amounted to 0.8%, in Intermediate goods it amounted to 0.6%, and finally, in Durable consumer goods, it actually decreased by 0.6%.

Looking at the producer price changes by sectors, on a yearly basis, prices in Electricity, gas, steam and air conditioning supply increased by 63.9%, in Mining and quarrying by 44.4%, in Manufacturing by 13.9%, while in Water supply, they increased by 1.6%. Meanwhile, on a monthly basis, producer prices in Electricity, gas, steam and air conditioning supply increased by 5%, in Manufacturing by 0.3%, while in Mining and quarrying, they decreased by 10.4%.

Producer prices of industrial products (June 2016 – October 2022, YoY, %)

Source: DZS, InterCapital Research

We have witnessed growth in producer prices for over a year now, and this growth has spilled over to every industrial segment. As such, it is directly affecting the prices of products sold. What this data can tell us is that there has been some slow down and even decline in prices recorded. However, several things have to be considered. First of all, only a month has passed since the government’s implementation of its economic support measures. Second, and in this case more important, all the underlying drivers of growth in prices, for producers and consumers alike, are still present. The current situation is quite uncertain, with a lot of potential for becoming even worse. Furthermore, with winter coming, even stronger pressure will be put on the energy system and the underlying commodity supply which is used to power the said system, and as such, more strain on the prices could be expected.

Belex (Belgrade Stock Exchange) published the monthly report on the trading activity in October 2022. According to the report, the total equity turnover amounted to EUR 4.7m, an increase of almost 4x compared to September, translating into an average daily turnover of EUR 211.8k.

Looking over the companies, the most traded company on the exchange was Goša montaža, with a turnover of EUR 2.7m, which reported a flat share price during the month. Next up, we have Jugoprevoz Kruševac, with a turnover of EUR 769.8k, which reported a strong increase in the share price of 125% MoM. Following them, we have Dunav osiguranje with a turnover of EUR 391.3k, VP Dunav, with a turnover of EUR 247.6k, and Philip PP Fektić, with a turnover of EUR 213.3k.

Meanwhile, the top gainers during the month were Invest – Import with an increase of 174.3% MoM, followed by already mentioned Jugoprevoz Kruševac with an increase of 125% and Alfa plam, which increased by 30% On the other hand, NBB Nekretnine, Putevi a.d. and Rapid all lost half of its capitalization with share price decreasing by 50%.

The main index on the Belgrade Stock Exchange, BELEX15, decreased by 4% during the month and ended October at 794.31 points.