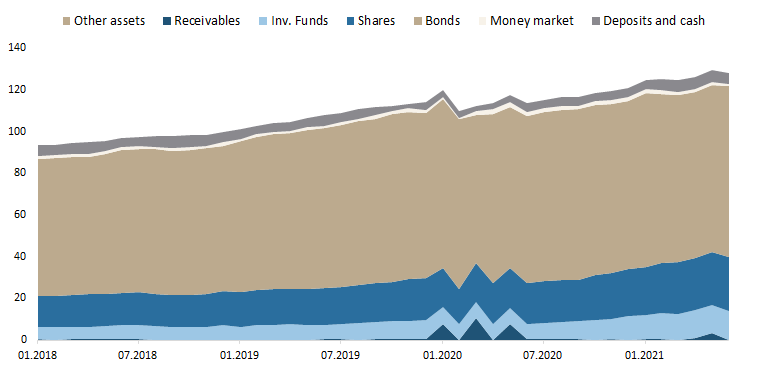

As of end July 2021, NAV of Croatian Mandatory Pension funds amounted to HRK 127.56bn.

As Pension funds could be seen as the key player on the Croatian capital market, it is worth seeing how they have performed since the beginning of 2021.

NAV of pension funds has witnessed a steady increase for the 16th consecutive month, and as of end July stood at HRK 127.56bn (+12.7% YoY or HRK 14.4bn). Meanwhile, on a YTD basis, NAV is up by 7.1%, while on a MoM basis, NAV of Mandatory Pension funds is up by 0.9%. We also note that net contributions in July amounted to HRK 634.2m, reaching a total of HRK 4.2bn YTD.

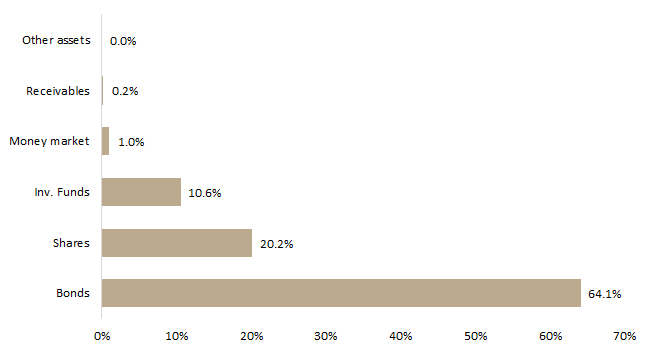

Looking at the asset composition of pension funds, one can notice that bonds account for the vast majority of total assets (64.1%) which as of end July amounted to HRK 82bn. We note that bond holdings observed a MoM increase of 2.5% (or HRK 1.97bn).

AUM Structure – Mandatory Pension Funds (July 2021)

Shares come next, with 20.2% or HRK 25.8bn, representing an increase of 1.8% MoM (or HRK 457.5m). The majority of the mentioned increase came from foreign equity (+3.1% MoM or HRK 347.7m). Meanwhile, domestic equity witnessed a slight increase of 0.8%. Note that domestic equity accounts for 55.6% of total equity holdings. On the other hand, in the bond market, the domestic bonds hold vast majority with 95.1%.

Total Assets of Croatian Mandatory Pension Funds (2018 – July 2021) (HRK bn)

In H1 Unior Group witnessed a rise in sales of 31.82%, an increase in EBITDA of 69.27% and a net profit of EUR 6.4m.

In H1 of 2021, Unior Group recorded EUR 122m in sales revenue, which amounts to an increase of 31.82% YoY (or EUR 29.5m). This growth is a result of an increase in net sales revenue in foreign markets of 37.85% YoY (or EUR 29.7m). All of three programs (Forge, Hand Tools and Special Machines) noted a boost in sale revenue. Most notably, the Forge program recorded an increase of 67.18% YoY (or EUR 24.8m).

Unior Sales ( H1 2019 H1 2020 H1 2021 ) (EUR m)

When observing the operating expenses, they amounted to EUR 111.2m, representing an increase of 22.5%. The mentioned increase could mostly be attributed to the rise in material and services costs by EUR 19.1m (+33.8% YoY) due to increas in material prices.

EBITDA of the Group rose by EUR 6.1m (or 69.27%) in comparison to H1 2020 and reached value of EUR 15m. Meanwhile, the Group’s EBITDA margin improved to 12.3% (+2.7 p.p. YoY).

Unior Performance ( H1 2019 H1 2020 H1 2021 )

Following last year’s H1 net loss of EUR 2.7m, Unior Group recorded a net profit of EUR 6.4m. Such a result indicated a profit margin of 5.2%.

It is noteworthy that in H1 2021, Unior Group made investments in new fixed assets of EUR 4.9m. The EUR 1.2m was invested in the modernization of production facilities and EUR 3.7m was invested in new equipment to increase and modernize production facilities.

In the first 7 months of 2021, GWPs recorded an increase of 2.9% YoY. Of that Non-life insurance witnessed an increase of 2.8% and Life insurance by 3.0%.

The Slovenian Insurance Association published their monthly update on the GWP progress in Slovenia. The first 7 months of 2021 performed well, as GWPs increased by 2.8% YoY to EUR 1.63bn. Both Non-life and Life insurance rose by 2.81% (to EUR 1.18bn) and 3.03% (to EUR 457m) respectively.

Non-Life insurance, which accounts for almost three fourths of the total GWPs, showed a good performance as a result of an increase in other damage to property segment (+17.85%), along with land motor vehicles segment (+4.52%). On the other hand, Motor vehicle liability insurance, observed a decrease of 5.49% YoY, thus being the worst performer (in absolute terms) in the non-life segment.

Health insurance, which is the largest segment of Non-Life insurance with a 25.1% share in total GWP, witnessed a slight increase of 0.53%. The market has also noted a pickup in credit insurance which is currently up by 9.8% YoY.

Looking at Life insurance, we can see an increase of 3.03%. Within the segment, Unit-linked life insurance rose by 17.76%, while Life assurance diminished by 5.52%.

When observing MoM change, total GWPs decreased by 5%, mostly as a consequence of Non-Life insurance drop (-6.2%), but also as a result of a slight decline from Life insurance (-2%).

Top and Bottom Performing Segment (change YoY) (EUR)