The financial closing of the transaction is estimated in Q2 2022, subject to regulatory approval.

OTP Bank announced yesterday it has entered into an agreement to acquire 100% of Slovenia’s NOVA KBM and its subsidiaries, which are 80% owned by funds managed by affiliates of Apollo Global Management and 20% by EBRD. The financial closing of the transaction is estimated in Q2 2022, subject to regulatory approval.

With a market share of 20.5% by total assets as of December 2020, Nova KBM d.d. is the 2nd largest bank in the Slovenian banking market and as a universal bank it has been active in the

retail and corporate segments as well.

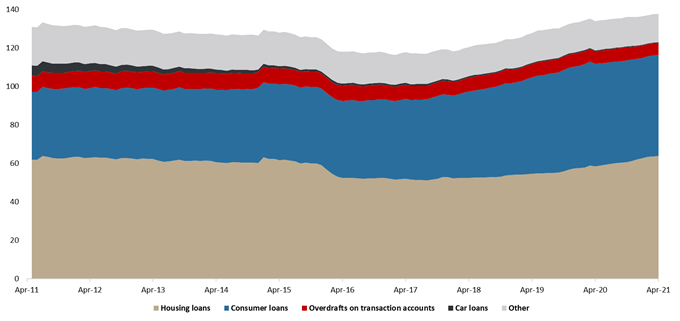

As of end April, total financial institution’s loans amounted to HRK 274.3bn, which represents a 0.7% increase YoY.

Croatian National Bank (HNB) published their monthly statistical report yesterday on loans placement of other monetary financial institutions. According to the monthly statistical report as of end April, total financial institution’s loans amounted to HRK 274.3bn, which represents a 0.7% increase YoY and a decrease of -0.7% MoM. Such figures do indicate that credit activity, especially certain segments, showed very solid resilience during the pandemic.

Its biggest categories household loans and corporate loans evidenced growth of 2.7% YoY and -0.2% YoY, respectively. On a monthly basis Corporate loans have for the 2nd consecutive month noted a decrease (-0.68% MoM) and ended April at HRK 86.3bn. When looking on a YTD basis, corporate loans remained flat, while household loans are up by 1%.

To be specific, total loans issued to households amounted to HRK 137.5bn, representing an increase of 1% YTD (or HRK 1.35bn). Such an increase was almost entirely driven by a rise in housing loans (+2.6% YoY or HRK 1.6bn), which continue to show solid increases for the 12th consecutive month. Housing loans growth was partially offset by a lower result of mostly credit card loans (-6% YTD or HRK 219m) and consumer loans (-2.3% or HRK 210m). The mentioned segments account for more than 86% of total household loans.

We also note that car loans continue to observe a negative trend (MoM decrease for each consecutive month in 2021) and are down by 7.8% YTD.

Loans to Households (HRK bn)

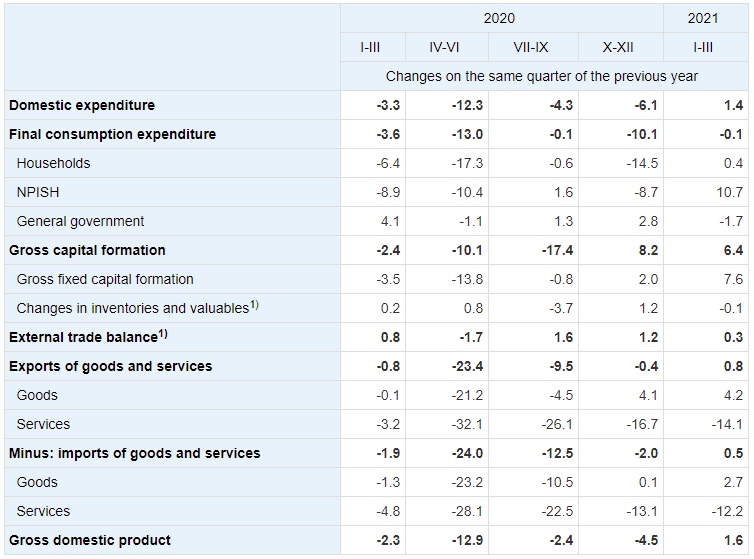

According to the Statistical Office of Slovenia, seasonally adjusted GDP increased by 2.3% compared to the Q1 of 2020 and by 1.4% compared to the fourth quarter of 2020.

In the first quarter of 2021, Slovenian economy expanded by 2.3%, as domestic consumption came to the positive territory despite restrictions that were still on due to pandemic. Domestic expenditure increased by 1.4% YoY due to surge in investments. Namely, gross capital formation was up 6.4% YoY, which is in line with our estimates, and it was due to the increase in gross fixed capital formation in machinery and equipment (by 20.0%). Gross fixed capital formation in transport equipment increased by 31.7% and gross fixed capital formation in other machinery and equipment by 16.8%. Construction investment declined in the first quarter of 2021 by 3.9%. The continuation of investment growth should result from acceleration in world trade, while New Generation EU program should allow Slovenia to withdraw funds to invest in sectors where it is already expanding like green energy and digital industries.

Final consumption expenditure declined slightly by 0.1% as consumers started to spend more and household spending was up 0.4% YoY while expenditure of government was down 1.7% YoY. Expenditure for services on the domestic market was quite lower than in the 1Q of 2020, as lock-down was in place and many services were not available. In other groups of household expenditure increase was observed, the largest in the group of durable goods, where car purchases represent a large share.

In Q1 2021, external trade balance gave positive contribution on GDP by 0.3 p.p. due to imports increasing (0.5%) slower than to exports (0.8%). Exports and imports of goods in the same period increased: exports of goods by 4.2% and imports of goods by 2.7%. Services, at both exports and imports, decreased by 14.1% and 12.2%, respectively. While the largest decrease was observed in travelling. In 2021 we expect Slovenian trading partners to recover so exports of goods and services are expected to grow about 10%, which could be overshadowed by stronger growth of imports due to pent-up consumer spending. So external trade balance could in 2021 negatively impact GDP growth. Q1 movements in economy showed positive development, while in the following quarters we expect economic recovery to speed up.

Source: Statistical Office of Slovenia