S&P projects that Croatia’s economy will contract by 9% in 2020 as a result of the strict measures to contain the spread of COVID-19 implemented at home and abroad.

S&P Global Ratings affirmed its ‘BBB-/A-3’ long and short-term sovereign credit ratings on Croatia, and the stable outlook, which did to some extent come as a surprise given that the revision was not announced by the standard calendar.

Downside scenario

Negative rating pressures could build if travel restrictions and the economic downturn result in more pronounced pressures on Croatia’s balance-of-payments performance, with external liquidity deteriorating significantly beyond their expectations, or if they lead to a more durable weakening of public finances, setting public debt on a firm upward trajectory.

Upside scenario

S&P could raise the ratings over the next two to three years if Croatia’s growth performance significantly outperforms their current expectations, boosting the country’s income levels.

S&P projects that Croatia’s economy will contract by 9% in 2020 as a result of the strict measures to contain the spread of COVID-19 implemented at home and abroad. These are hitting the country’s large tourism and hospitality sectors. However, the rating agency continues to believe that the reduction in macroeconomic imbalances over the last several years has helped put Croatia in a more favorable position to weather a temporary shock to its economy without permanent damage to the country’s credit metrics.

S&P adds that Croatia is one of the most tourism-dependent sovereigns in Europe, given that tourism contributes about 20% of GDP and one-third of current account receipts. The travel restrictions introduced over the past few months will severely hit the sector. Their base-case projection is that tourism revenue will contract by around 70% YoY in 2020. Additionally, uncertainty over the pace of the full removal of travel constraints in both Croatia and other EU states, as well as the potential changes to travel patterns, will likely lead to only gradual recovery of the tourism sector. This is one reason why S&P anticipates only a partial rebound in Croatia’s GDP growth in 2021, with real GDP returning to 2019 levels not earlier than 2023. S&P estimates that the economy is expected to somewhat recover by growing 5.3% in 2021 and 2.5% in 2022.

Severe fallout from the pandemic will continue putting the country’s balance of payments performance under pressure amid Croatia’s current account receipts shrinking by at least one-third in 2020. That said, absent longer cross-border movement restrictions, S&P believes Croatia should be able to avoid a permanent damage to its credit fundamentals.

On Friday, the Croatian Bureau of Statistics published its first estimate on GDP for Q1 2020 showing that in real terms it increased by 0.3% YoY (seasonally adjusted data).

The slowdown in GDP growth in the first quarter of 2020 is a result of decelerated growth of household consumption expenditure and of a decrease in exports of goods and services.

Final consumption continues to be the main contributor to GDP which observed a slowdown in growth (+1.8%). The largest part of final consumption, household expenditure increased 0.7% YoY, while general government’s expenditure amounting to roughly 1/5 of final consumption accelerated and increased by 4.8% YoY. Non-profit institutions serving households recorded a 3.9% increase. The slowdown in growth in the final consumption is solely attributed to the Covid-19 outbreak, which resulted in a lockdown in late Q1 (mid-March). The mentioned lockdown had a significant impact on reduced household consumption in the last two weeks of Q1, which was partially offset by higher general government spending.

Gross fixed capital formation rose by 3.1% YoY, reflecting slight slowdown compared to the previous quarters, however quite a significant slowdown compared to Q1 2019 when gross fixed capital formation observed a sharp increase of 11.5% but that could be due to several one-off events back then.

In Q1, the trend of exports and imports did not continue from the last quarters where exports growth accelerated, and imports growth decreased. What occurred in Q1 was a decrease both in imports and exports of goods and services by 5.8% and 3%, respectively. Such figures do not come as a surprise, given that international trade was basically put on hold in the last 2 weeks of March (due to the Covid-19 outbreak).

To be specific, the decrease in exports was solely driven by lower exports of services of -9.4% (which account for 28.4%) of total exports. Such a result was partially offset by a slight increase of exports of goods (+0.3%). The decrease in imports was mainly driven by a sharp decrease in imports of services, which recorded a drop of 25.1% YoY.

Croatian GDP, Real Growth Rates (%, YoY)*

*Quarterly Gross Domestic Product, seasonally adjusted real growth rates

According to the Statistical Office of Slovenia, seasonally adjusted GDP decreased by 3.4% compared to the Q1 of 2019 and by 4.5% compared to the fourth quarter of 2019.

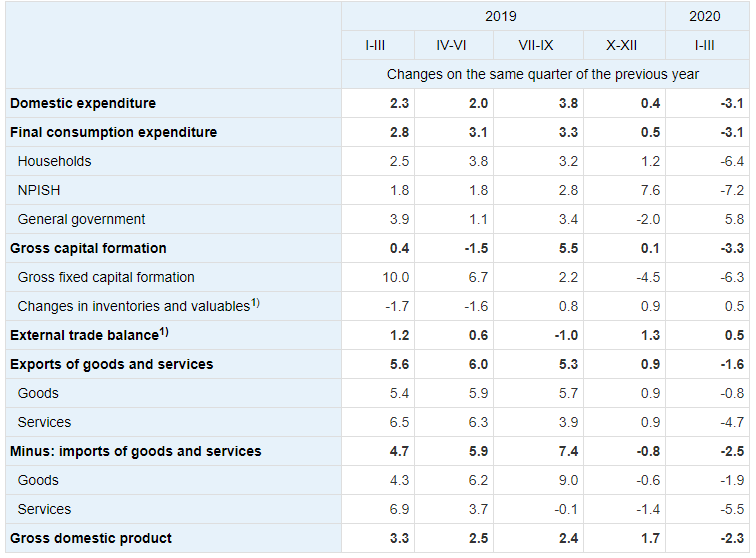

In the first quarter of 2020, decrease could mostly be attributed to domestic consumption as restrictions implemented in March took big toll. Domestic expenditure declined by 3.1% YoY due to both final consumption expenditure and gross capital formation. Namely, final consumption expenditure declined by 3.1% YoY while gross capital formation by dropped 3.3% YoY. As expected, expenditure of government increased (by +5.8%YoY) as government had to step in to protect jobs.

Household final consumption, as the most significant component of the final domestic expenditure, decreased by 6.4% YoY and gross fixed capital formation by 6.3% YoY. The majority of gross fixed capital formation decreased, except construction investment and investment in intellectual property products. Construction investment increased by 3.8% and investment in intellectual property products increased by 1.7% compared to the Q1of 2019. The above-mentioned results do come to some extent as a surprise, in spite the 2-week lockdown in March which occurred do to the Covid-19 outbreak.

In Q1, drop of external demand was recorded for the first time in ten years, except for second quarter of 2012 when it decreased by 0.1%YoY. Both Imports and Exports decreased by 2.5% and 1.6%, respectively. As a result of exports declining less than imports, the external trade balance had a positive contribution to GDP growth (+0.5 p.p.).

Source: Statistical Office of Slovenia