The Government of Republic of Croatia introduced a set of new measures that should help preserve jobs in the private sector. These measures apply to 80,000 people and are worth HRK 2.1bn.

Starting last Saturday, Croatia entered what can be considered as a “soft lockdown”, as the Croatian Government imposed further restrictions to tackle the spread of the virus. The current measures, which include the closure of all restaurants, bars, sport centres etc. are by far the strictest measures taken since the March lockdown. The aforementioned restrictions will be in place at least until 21 December.

Since then, it did not take a long time for the Croatian Government to respond with a new set of measures which should help preserve jobs in the private sector. To be specific, The Prime Minister of Croatia, Andrej Plenković, presented new set of measures yesterday, which should aid in preserving jobs. As a reminder, previous measures, for which HRK 7.4 bn had been paid, had saved 630,000 jobs, and the measures had also helped 107,000 companies.

The Government noted that the presented measures apply to more than 80,000 people. The measure for the preservation of jobs will continue, in the amount of HRK 4,000 per worker during the suspension of work with the exemption from paying contributions, for which approximately HRK 320m will be provided, or HRK 470m including contributions.

Next, a part or all of the fixed costs will be covered during the suspension of work for sectors now affected by the new measures. Such measures apply for a revenue decline of more than 60% in December. According to the Governments estimates, this measure should amount to around HRK 250m.

Furthermore, in cooperation with the agency HAMAG BICRO, a new package of so-called Covid-loans is prepared in the amount of HRK 1.3 billion.

With a share of over 20% in total revenues, coffee is the largest individual business category for the Group, while the new partnership should ensure a stronger presence of the espresso coffee segment in the HoReCa channel.

Atlantic Grupa published an announcement stating that they have entered into a strategic partnership with the company Procaffe, one of the leading players in the Croatian espresso coffee market. Procaffe is currently present in more than 800 HoReCa entities in Croatia.

Atlantic Grupa is already the leading coffee producer in the region. The Group is a market leader in Serbia with brand Grand kafa, leader in Slovenia with the brand Barcaffe and a strong competitor for the leading position in the Croatian market. With the aforementioned partnership, the Group notes that they will ensure a stronger presence of the espresso coffee segment in the HoReCa channel.

With a share of over 20% in total revenues, coffee is the largest individual business category for the Group and certainly one of strategically most important ones for business development. As a reminder, in 9M of 2020, the Group recorded HRK 801.9m in this segment, noting a decrease of 1.9% YoY. Such a decrease came primarily in the markets of Serbia and Bosnia and Herzegovina which was partly compensated for by the increase in the markets of Croatia, Slovenia, North Macedonia, Germany and Austria. However in Q3, coffee recorded an increase in sales as a consequence of easing the local authorities measures to prevent the spread of Covid-19.

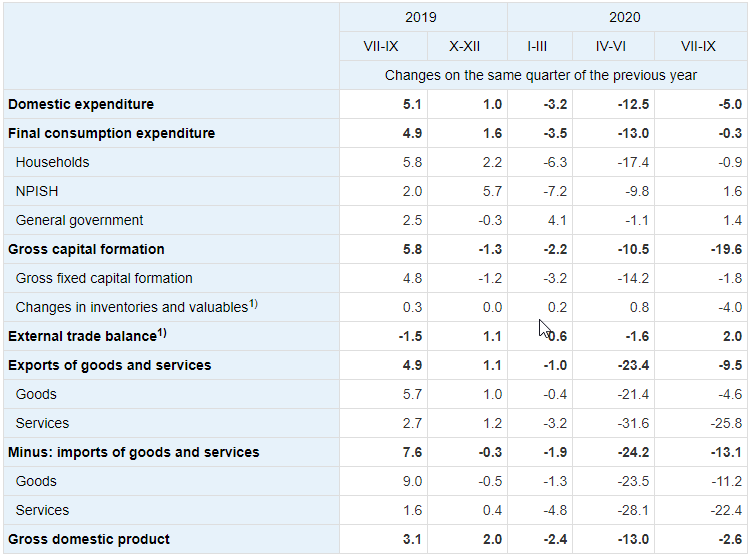

According to the Statistical Office of Slovenia, GDP in Q3 of 2020 decreased by 2.6% compared to the Q3 of 2019 and in 9M of 2020 it decreased by 6.0% over the same period of 2019.

Due to opening of economies in the 3Q of 2020, domestic consumption improved compared to the lock-down period when it fell by 12.5% YoY. Domestic expenditure declined by 5.0% YoY due to both final consumption expenditure and gross capital formation. Namely, final consumption expenditure improved significantly by declining only 0.3% YoY while gross capital formation accelerated its decreased and dropped by 19.6% YoY. The high decrease in gross capital formation is a consequence of the decrease in inventories. Gross fixed capital formation decreased by 1.8%. A decline was observed in machinery and equipment, while construction investment increased (by 2.7%).

Household final consumption, as the most significant component of the final domestic expenditure, decreased by 0.9% YoY and this decrease was less prominent than in the first two quarters of 2020. (-17.4% YoY in Q2 and -6.3 in Q1). Household final expenditure on the domestic market decreased by 6.0%. The highest decrease among household expenditure was observed in consumption of fuels and services. General government expenditure in Q3 increased by 1.4% YoY as government continued with measures to dampen the fall in economic activity.

In Q3 exports decreased by 9.5% YoY, export of goods decreased by 4.6% and due to strong decline in international travelling caused by pandemic measures, export of serviced dropped by 25.8%. Among services, the largest decrease was observed in travelling. Somewhat higher decrease was evidenced with imports which were down by 13.2%. Due to higher drop in imports, the external trade balance had a positive contribution to GDP volume growth (2.0 p.p.).

The aforementioned decrease was one of the lowest in the region, beating the expectations of macro analysts. To put things into a perspective, the GDP drop in Q3 was lower than in some EU countries such as Austria (-5.3%), Belgium (-5.2%), Hungary (-4.7%), Italy (-4.7%), France (-4.3%) and Germany (-4.2%) .

Source: Statistical Office of Slovenia