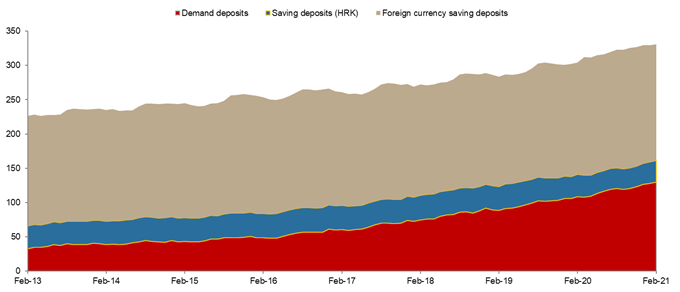

Total deposits in Croatia at the end of February 2021 amounted to HRK 330.8bn, up by HRK 1.4bn YTD.

According to consolidated statement of financial position for monetary financial institutions monthly published by Croatian National Bank (HNB), total deposits as of end February 2021 amounted to HRK 330.8bn, representing a very solid increase of 8.8% YoY, while increasing +0.4% MoM. We note that this level of savings represents once again an all-time high, which indicates unwillingness of Croatian citizens to invest in riskier asset classes.

Such an increase could be attributed to a high growth of demand deposit money which increased by 19.6% YoY to HRK 129.8bn and which accounts for 39% of total deposits. The aforementioned increase does not come as a surprise as in the times of uncertainty demand deposits usually grow the most. In other words, the majority of 2020 was marked by lower spending and higher savings, which is an expected behavior during a crisis.

The increase was further backed by a rise in savings deposits, which at the end of February 2021 amount to HRK 201bn (+2.8% YoY). However, we note that savings deposits have been observing slight decreases for the 4th consecutive month. Local currency savings deposits have observed a decrease of -5.3% YoY and currently account for only 15.4% of total savings deposits. To be specific, local currency savings deposits amount to 31bn, while roughly 70% of them are pertaining to households. Foreign currency savings, on the other hand account for 84.6% of all savings deposits and 51.4% of total deposits. Foreign currency saving reached HRK 170bn, increasing by 4.5% YoY, while showing a MoM decrease of 0.2%.

When observing solely households, they hold HRK 228.6bn in deposits, noting an increase of HRK 15.2bn. We note that foreign currency deposits account for the vast majority of deposits (61%).

The binding offer and the conclusion of the transaction are conditional upon approval of the Extraordinary General Meeting of Shareholders of the Group.

Romgaz published an announcement on the Bucharest Stock Exchange stating that the binding offer to acquire all shares issued by ExxonMobil Exploration and Production Romania Limited as endorsed by the Group’s Board of Directors, was submitted to ExxonMobil Upstream Business Development on 30 March 2021. The binding offer and the conclusion of the transaction to acquire all shares issued by ExxonMobil Exploration and Production Romania Limited are conditional upon approval of the Extraordinary General Meeting of Shareholders of the Group.

The aforementioned binding offer relates to all shares (100% of the share capital) issued by ExxonMobil Exploration and Production Romania Limited, company that holds 50% of the rights and obligations under the Concession Agreement for petroleum exploration, development and production in XIX Neptun Deep Block.

OMV Petrom holds the other 50% participating interest, representing rights and obligations under the Concession Agreement for petroleum exploration, development and production in XIX Neptun Deep Block.