January kicked off turbulently for the oil market, defying the bearish consensus that prevailed heading into 2026. Many forecasters had predicted a massive supply glut and even projected crude prices to sink below $50 per barrel by the end of the year. Institutional investors were correspondingly positioned for weakness; a Goldman Sachs survey showed the most bearish oil sentiment in a decade. In other words, the pain trade was up. With so many traders either short or under-exposed, it didn’t take much upside movement to catch them off guard and spark a panicked scramble to cover positions. Indeed, 2026 was supposed to be the year of surplus and soft prices, yet the first weeks have seen oil futures surge toward $70 instead.

Several fundamental shocks quickly justified the bull case. A major supply outage hit Central Asia: Kazakhstan’s giant Tengiz oil field suffered a mid-January fire and power outage, slashing output by hundreds of thousands of barrels per day. JPMorgan estimated Kazakhstan’s crude production in January averaged only about 1.0–1.1 million bpd, roughly 700,000 bpd below normal levels. At the same time, an extreme Arctic blast swept across the United States. This winter storm knocked out up to 2 million bpd of U.S. oil production over the weekend as wells and infrastructure froze.

Reuters headline

Source: Reuters, InterCapital

The cold snap mainly spiked natural gas prices, but it also boosted short-term demand for oil-based heating fuels while temporarily cutting off some oil output. What began as a short-covering rally quickly gathered steam as traders realized the anticipated glut was slow to materialize in early January.

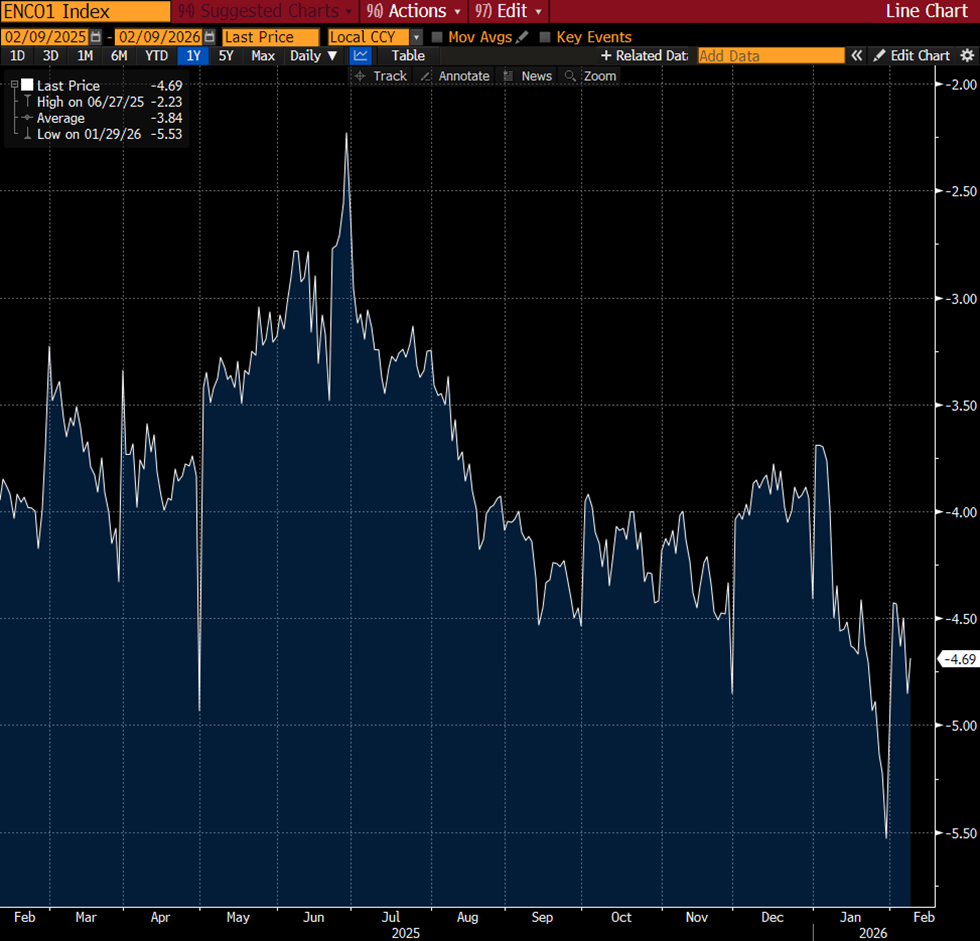

Notably, the price response was more pronounced in Brent crude than in its American counterpart, WTI. Brent, the global benchmark, has been quicker to reflect international risks, whereas WTI has been tempered by local factors. The Brent-WTI spread, essentially Brent’s premium over WTI, has widened significantly since December. By mid-January, WTI traded nearly $4.75 per barrel cheaper than Brent, the largest discount in about eight months. This was a sharp change from late 2025, when the spread was narrower.

Brent-WTI futures spread

Source: Bloomberg, InterCapital

The widening makes sense: escalating Middle East tensions have injected a risk premium into Brent prices, while an influx of crude into the U.S. (e.g. redirected Venezuelan barrels after regime change in Caracas) weighed slightly on WTI. In other words, Brent is pricing in more of the geopolitical safety premium. The result is a Brent-WTI spread at multi-month highs, as the global market tightens relative to the U.S. domestic market.

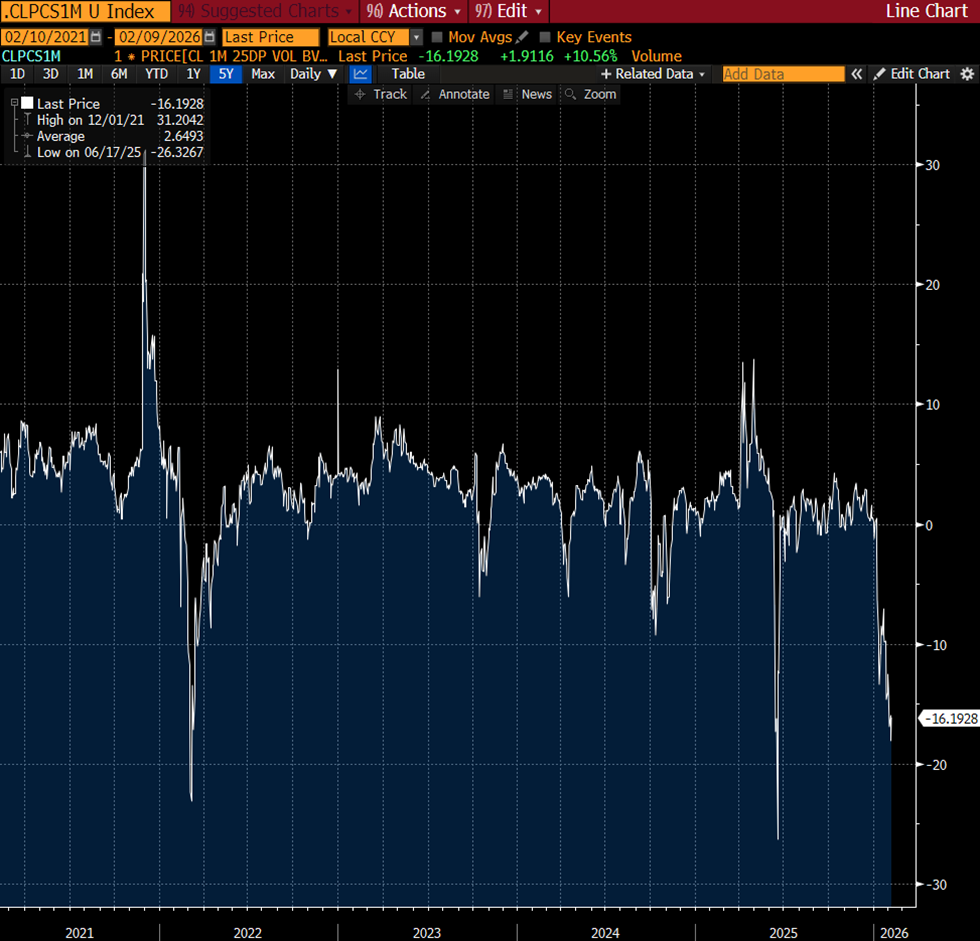

For companies and investors looking to hedge, insurance has gotten expensive. The oil options market is flashing heightened fear. One gauge, the 25-delta risk reversal (which measures the skew between out-of-the-money puts and calls), has spiked to levels last seen in early June 2025, right before the U.S. launched Operation Midnight Hammer strikes on Iran. In practical terms, this means bullish call options (upside protection) now carry a hefty premium. Traders are paying up for calls in case of another price spike, driving the implied-volatility skew to extremes.

WTI 25 Delta Risk Reversal (Put – Call IV)

Source: Bloomberg, InterCapital

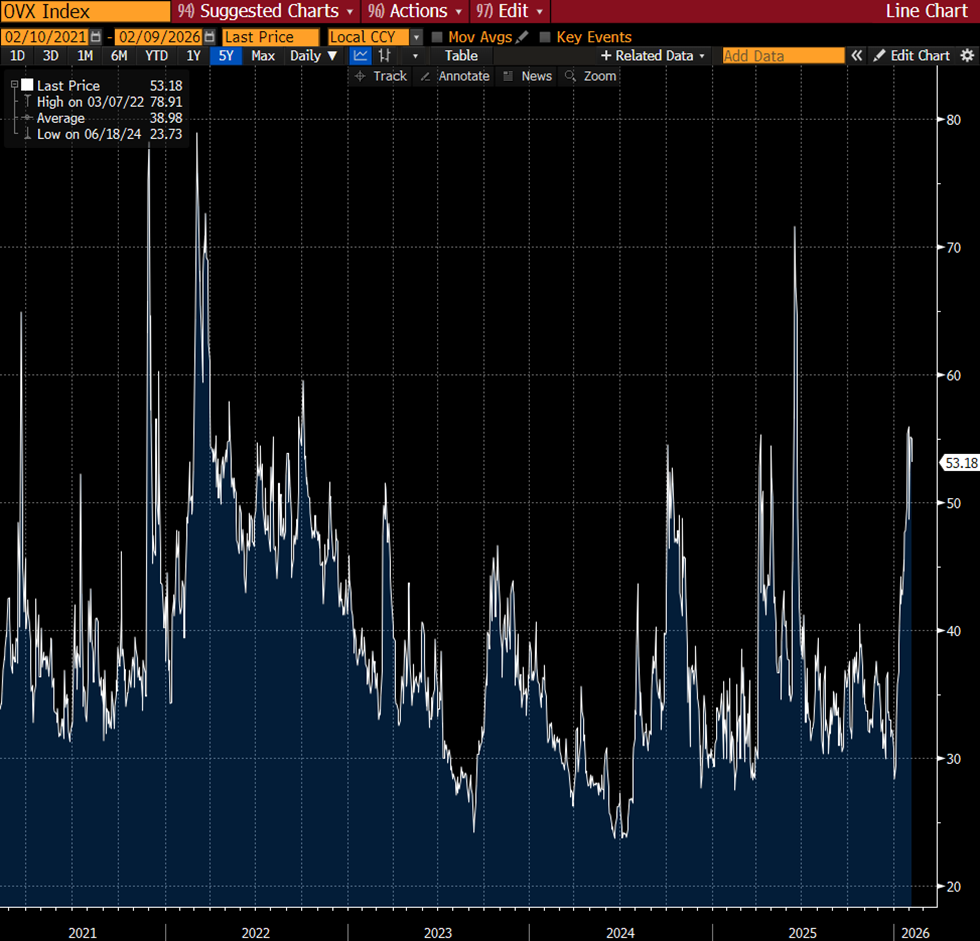

Unsurprisingly, overall volatility has surged. The CBOE Oil Volatility Index (OVX), which started the year around the low-30s, jumped by roughly 20 points to the low-50s. It’s now near its highest level since the brief Israel-Iran conflict last June. This across-the-board leap in implied volatility has lifted the entire options IV curve, making it costlier to carry hedges.

OVX Index

Source: Bloomberg, InterCapital

Seasoned oil traders know that such geopolitical risk premiums in options are often short-lived; in the past, selling that volatility has been profitable once the panic subsides. However, caution is warranted this time. We are coming from a period of relatively low baseline prices and low implied vols, so the starting point was nominally subdued. A genuine supply shock, say an actual prolonged military conflict that materially disrupts oil flows, could push both prices and volatility far beyond recent ranges. In June 2025, for example, oil volatility spiked to multi-year highs during the fighting, but prices themselves only briefly jumped before mean-reverting. Brent peaked around $79 and then quickly fell back. The geopolitical premium evaporated within days. Yet, the key difference now is that the market is starting off more complacent (lower base prices and vol), and the timeline for potential conflict is open-ended. Betting that history will repeat, that every spike will swiftly retrace, could be dangerous if a new crisis escalates in an uncontained way.

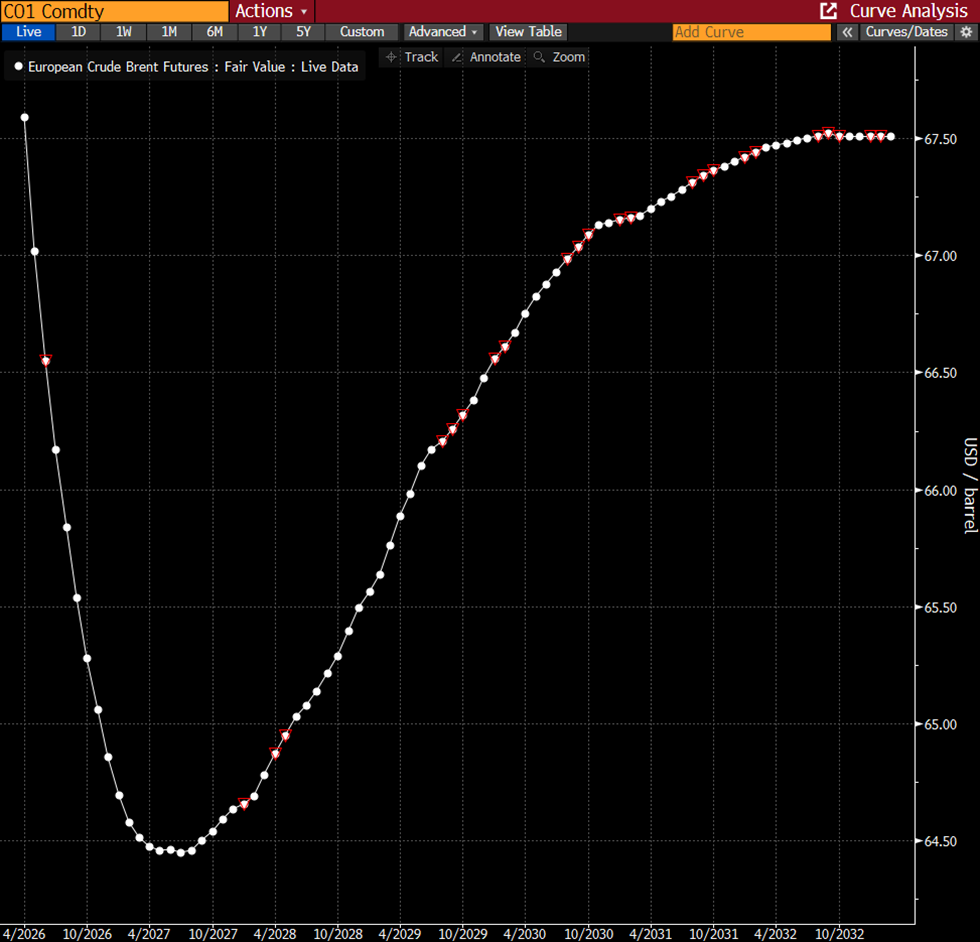

The term structure of oil prices reflects this uneasy balance between near-term risk and longer-term glut expectations. Remarkably, the rally and uncertainty have flipped the futures curve into a sharp backwardation extending out about a year. The front-month oil contracts are now priced higher than each subsequent month well into 2026. Typically, backwardation is confined to the very front of the curve during brief supply tightness, with later deliveries cheaper due to expected oversupply. Now we see the first 12 monthly contracts in backwardation. This is a significant shift from just a month ago, when the curve was signalling surplus. Traders are effectively bracing for a period of short-term tightness and risk, then a reversion to plenty down the line.

Brent oil futures curve

Source: Bloomberg, InterCapital

The open question is how long this inversion will last. Oil traders cannot simply mark a date on the calendar for resolution, so the risk premium is persisting.

One window into market expectations is the prediction market Polymarket. As of now, odds imply roughly a 50/50 chance that the U.S. will carry out a military strike on Iran by June 30.

US Strike Iran by…?

Source: Polymarket, InterCapital

That captures the essence of the oil market’s troubles: we could just as easily see a peaceful spring allowing fundamentals (like that looming oversupply) to reassert, as we could see a conflict that sends another shock through prices. With such binary outcomes in play, it’s no wonder that traders are hedging fervently and pricing in risk across the board. Until there is a clearer direction on the geopolitical front, oil is likely to remain on a knife-edge, torn between the bearish weight of abundant supply and the bullish prospects of potential conflict.