As of November 2020, Slovenian mutual funds manage EUR 3.15bn, representing a sharp increase of 7.2% MoM and an increase of 4.3% YTD.

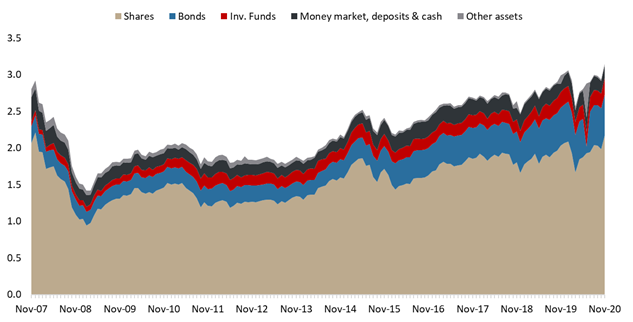

For today, we decided to present you with a short asset structure analysis of Slovenian mutual funds. When looking at the graph below, one can notice that the Slovenian mutual funds have not significantly changed their assets structure during COVID-19 crisis.

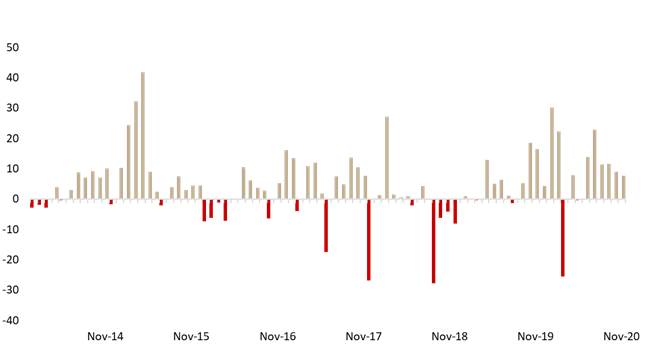

As of November 2020, Slovenian mutual funds manage EUR 3.15bn, recording a sharp increase of 7.2% MoM, which represents second highest monthly increase experienced since March, when mutual funds observed a sharp drop of 12.4%. Such a high monthly increase could almost exclusively be attributed to the positive sentiment observed on the financial markets in November, while net contributions to funds amounted to EUR 7.62m. It is also worth noting that mutual funds experienced a full recovery after a considerable loss in March 2020 due to crisis caused by the Covid-19 pandemic. As a reminder, in April the AUM partially recovered with a 7.8% increase. Meanwhile, on a YTD basis, AUM is up by 4.3% down, indicating that the investors were not withdrawing funds at a significant level during the Covid-19 outbreak, which was not the case in Croatia. To be specific, in March, net contribution to mutual funds amounted to EUR -25.5m. However, since than cumulative net contributions have significantly increased (by EUR 83.8m).

Net contribution in the Slovenian mutual funds (EUR m)

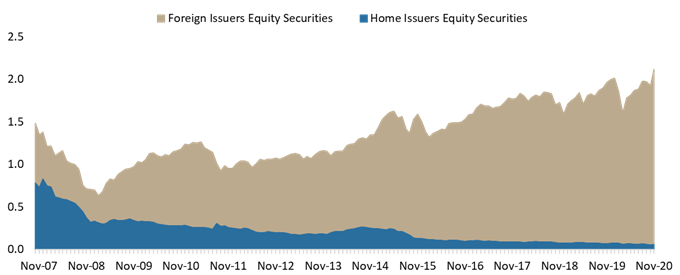

Turning our attention to the asset structure, as of November 2020, shares account for 68.9% of the total assets (or EUR 2.16bn). Shares observed an increase of 9.5% MoM and were the main driver of the overall increase. Note that the vast majority (97%) of equity holdings of Slovenian mutual funds come from the foreign market. Meanwhile, total equity holdings are up by 4.8% YTD. Domestic equity holdings, which amount to EUR 58.1m have witnessed an increase of 4.1% MoM. Such an increase indicates an underperformance relative to SBITOP which increased by as much as 12%, which notes its biggest increase in 2020. On a YTD basis Slovenian mutual funds have observed a decrease in domestic equity holdings by 18.3%, while the current EUR 58.1m represents the one of the lowest position in domestic equity since the inception of Regulator’s statistics.

Equity Holdings by Slovenian UCITS Funds (EUR bn)

Next come bonds, which make up for 17.9% of the total asset structure or EUR 563.8m. Of that, 94% come from the foreign market. Investment funds’ share in AUM amounts to 7% of total assets, while money market, deposits & cash account for 5.6%. In nominal terms, shares have observed the largest increase of EUR 99.6m since the beginning of the year, followed by bond holdings which are up by EUR 41.8m.

Total Assets of All Slovenian UCITS Funds (Nov 2007 – Nov 2020) (EUR bn)