According to the latest GDP estimate released by the Slovenian Statistical Office, the country’s GDP grew by 1.6% YoY in 2023, and 2.2% YoY in Q4 2023. This is above the previous estimate by the Statistical Office (+1.3% YoY in 2023), and European Commission (+1.3% YoY). In this overview, we’ll detail what drove this growth.

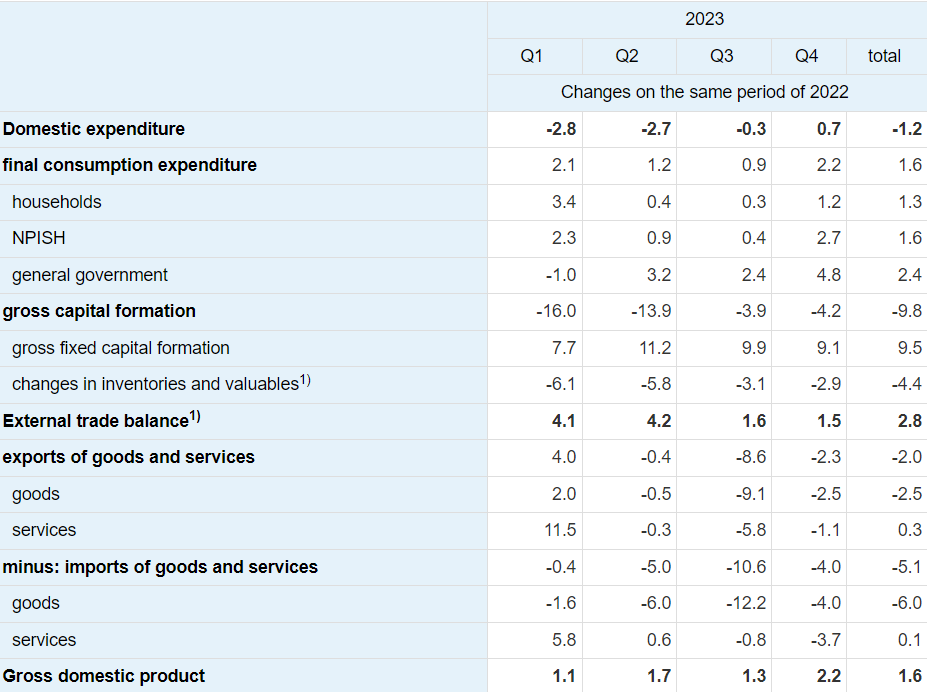

Starting off with the Q4 data, domestic expenditure grew by 0.7% YoY, final consumption expenditure by 2.2%, while at the same time, capital formation declined by 4.2%, mostly due to a decrease in inventories. On the other hand, Gross fixed capital formation grew by 9.1%, mostly due to an increase in investment in buildings and structures. Household consumption also grew, by 1.2%. In terms of exports and imports, imports decreased by 4% YoY, while exports also decreased, albeit at a slower pace (-2.3% YoY). This resulted in a 2.2% YoY growth in Q4 2023.

Moving on to the yearly data, according to the first GDP estimate, GDP grew by 1.6% YoY in 2023. Of the GDP components, Gross fixed capital formation and household expenditure had a positive impact on the GDP growth, with Gross fixed capital formation increasing by 9.5%, while household expenditure grew by 1.3%. On the other hand, changes in inventories had a negative impact on GDP growth of 4.4 p.p. Furthermore, exports decreased by 2%, while imports decreased by 5.1%. Due to the larger decrease in imports, a higher external trade balance was recorded, contributing 2.8 p.p. to GDP growth.

Slovenian GDP YoY growth rates (quarterly, real GDP growth rates, Q1 2015 – Q4 2023, %)

Source: SURS, InterCapital Research

The increase in the gross fixed capital formation was expected, as both companies and the government continued investing during the year, albeit the focus was more and more on the Government spending later in the year, due to both the scope of infrastructure projects started by the Government, but also due to the slowdown in investment from companies in the latter part of the year, as higher interest rates on loans started ramping up. Furthermore, inflation, which on a decreasing trend, especially since the 2nd half of the year, also weighed in on investments. Costs, especially energy costs due to elevated prices of energy commodities due to the war in Ukraine, as well as employee costs due to said inflation, also slowed down investment sentiment from companies.

Household expenditure, one of the prime drivers of growth in developed economies was also weighted down by inflation, as real wage growth, despite increases was slowed. Furthermore, while unemployment is at record lows in Slovenia, wage growth was not significant in the current situation, while replacements could only be found from foreign workers, and the majority of companies aimed at keeping their workers, which all culminated in a slower real wage growth. In the situation of macroeconomic uncertainty, this also led to household expenditure being suppressed.

The Slovenian economy has been export-orientated for the last decade, i.e. after the GFC, with exports growing faster than imports. This led to a high external trade balance. While the same was true in 2023, it happened for the opposite reasons. This is because during the year both exports and imports dropped, but imports dropped faster than exports, leading to a continued higher external trade balance, which positively contributed to GDP growth. There are many reasons for why this happened, but the few main ones could be noted. Firstly, subdued household and company spending, which meant that demand for imported goods was lower. Furthermore, elevated prices of energy commodities also meant that there was less demand for them, also leading to lower imports. Combined with this, talks of recession in Slovenia’s main trading partners in the EU (most notably Germany), also meant that there was a drop in industrial production (again, most notably Germany) leading to reduced supply. This led to higher prices of various imported goods, as the costs of production also increased significantly under the influence of inflationary pressures. These pressures were especially noted in energy commodity prices, but also in wage growth in the countries where those goods are produced.

On the other hand, exports also slowed down, albeit at a slower pace, as the Slovenian economy was not hit as hard. At the same time, demand for Slovenian exports was subdued in the EU countries, as the same factors influenced a reduction in demand in them, as they did in Slovenia (apply the imports argument in Slovenia to imports in EU countries (exports from Slovenia), and you can see the picture more clearly).

Slovenian GDP by expenditures, constant prices, growth rates (%)

Source: SURS, InterCapital Research