Sava Re expects a decrease in operating revenue between 5% – 7%, and a drop in net profit between 15% and 20%.

Sava Re published an assessment of Covid-19 on their operations. The assessment is based on the latest forecasts of economic trends issued by the Office of the Republic of Slovenia for Macroeconomic Analyses and Development, predicting a fall in Slovenian GDP of between 6% and 8%.

Sava Re prepared our assessment of the impacts on the profit for 2020 and the Company’s solvency position at the end of 2020 based on the following assumptions:

- In terms of impact on operations, two periods were observed. The first period stretching until the end of May, in which the Group expects a direct impact on insurance underwriting and contacts with customers but with a lighter claims burden, and the second period, from early June to the end of the year, in which we expect an indirect impact on operations due to lower GDP than originally forecast.

- Sava Re estimates that the largest loss of premiums compared to plan will be in non-life business, in motor business, primarily related to the decline in sales of new vehicles, lapsed registrations of vehicles, especially goods vehicles and purchase of narrower covers. Premiums are also expected to decline in travel insurance and assistance business.

- In life insurance, we expect that new business volume will decline as the result of restricted contact with customers. Reinsurance business is expected to shrink in the proportional business segment. Operating revenues of pension companies and the investment fund management company will decline because of a drop in assets under management as the result of falling financial markets.

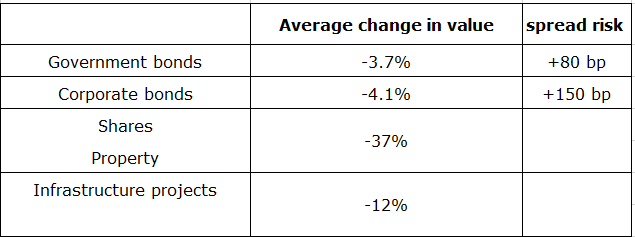

- Impacts on financial investments were calculated based on circumstances in financial markets as at 20 March 2020. The basis for calculating impacts was the revised estimated portfolio of financial investments compared to the planned 2020 figures, assuming that spread risk for debt instruments remains at the Q4 2019 level. The assessed impacts of COVID-19 show the following changes in the value of financial investments and the related spread risk for debt instruments:

Source: Sava Re

The estimated business results made considering the COVID-19 circumstances are strongest impacted by the assumptions relating to the movement in the value of the investment portfolio. If the year yields a positive development in financial markets (especially shares) compared to 20 March 2020, the impact will be smaller than the one assessed in this document.

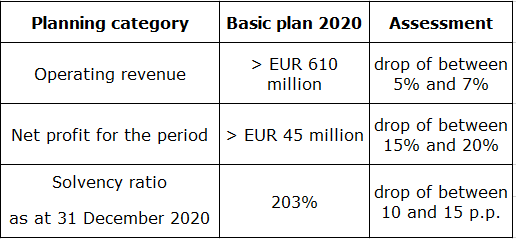

Based on the assumptions set out above, the Company assesses that the potential impact on the major planning categories of the Sava Insurance Group are:

Source: Sava Re