Producer prices of industrial products on the domestic market increased by 28.4% YoY in April 2022. The energy sector still remains the main driver of this increase, and if we were to exclude it, the increase would amount to 7.8% YoY.

Croatian Bureau of Statistics has published its monthly report on the movements and trends in the industry sector. In it, we can see that the industrial producer price index on the domestic market increased by 28.4% YoY. If we were to exclude the energy sector, the total industrial PPI increase would amount to only 7.8% YoY in April 2022.

The increase can also be witnessed across various industrial sectors. On a MoM basis, PPI in Non-durable consumer goods grew by 1.5%, in Intermediate goods it grew by 1.2%, in Durable consumer goods it grew by 0.1%, and in Capital goods, it increased by 1.1%. Of course, the largest increase can be attributed to the growth the PPI experienced in the Energy sector, which grew even further by 5.6%, MoM, after an already big surge.

On a YoY basis, the story is similar. Industrial PPI increased by 86.7% in the energy sector, in Intermediate goods by 10.5%, in Durable consumer goods by 6.1%, in Non-durable consumer goods by 6.9%, while in Capital goods it grew by 4.5%. This means that the growth of the PPI is experienced across all segments of the industry, but the increase in the Energy sector is by far the largest. If we were to break down the PPI increases in the energy sector, the largest increase by far came in the Minning and quarrying segment, which grew by 271.9% being by far the biggest driver. PPI in Electricity, gas, steam, and air conditioning supply increased by 32.1%, and in Manufacturing it grew by 15.1%.

Producer prices of industrial products (June 2016 – April 2022, each month, YoY, %)

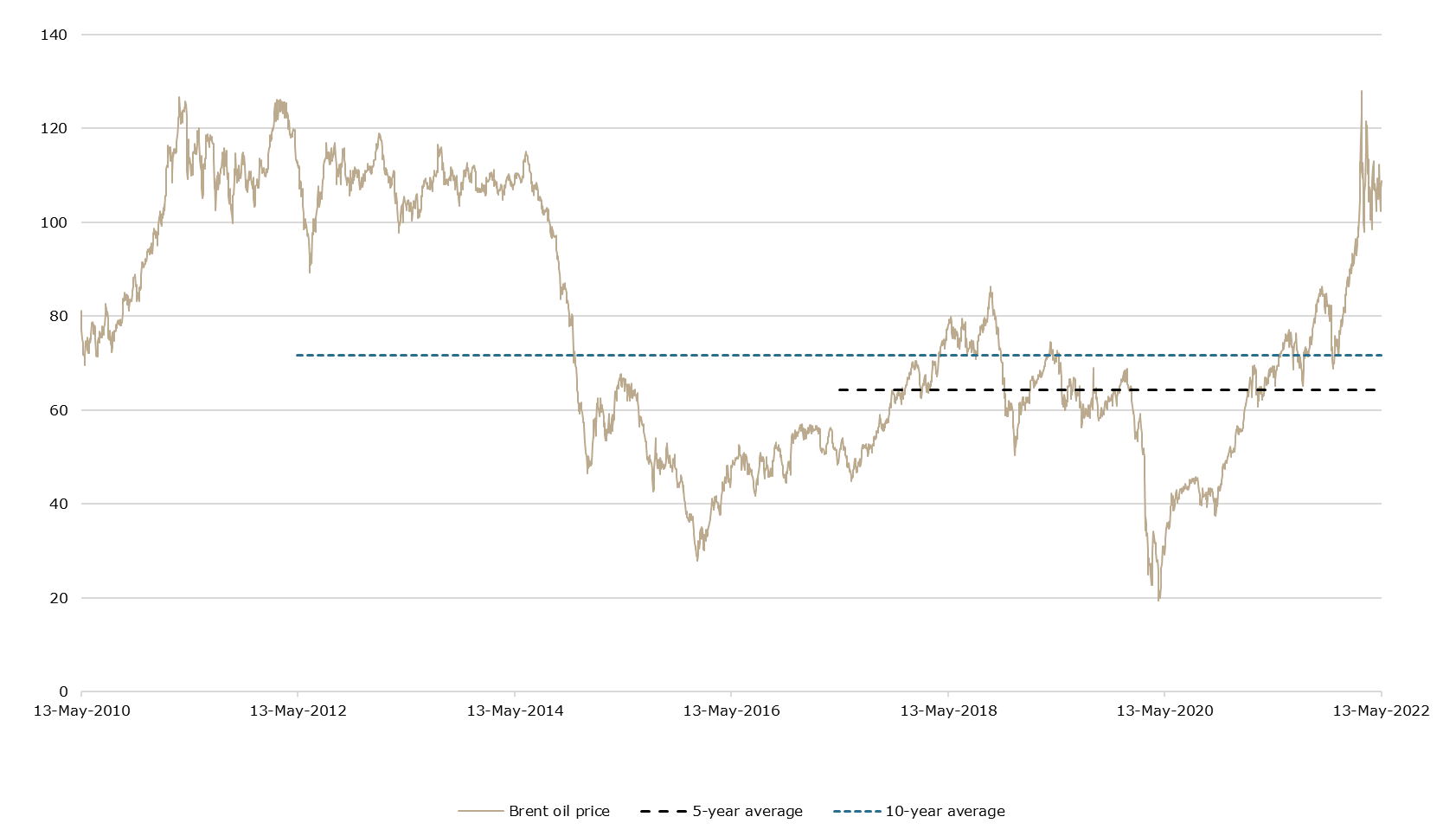

The current geopolitical tensions, caused by the Russia-Ukraine conflict, are bound to continue in the next period, therefore pressures on the producer prices in the energy sector are here to stay. When looking at the forecast for Brent price in 2022, it stands at 101 USD per barrel which is close to the current spot of USD 108.86, so we cannot expect to see an easing of price pressures soon. The 2023 forecast stands around USD 90 per barrel so high oil price conditions are here to remain for some time. As producers require many more commodities like oil and gas, pressure on producer prices is even more exacerbated by these strong price increases. Brent crude currently stands at 69% above its five-year average. It is also 52% above its 10-year average. In 2021 thus far, its price was up 40% YTD.

Brent oil prices (January 2010 – today, USD/bbl)

Source: Bloomberg

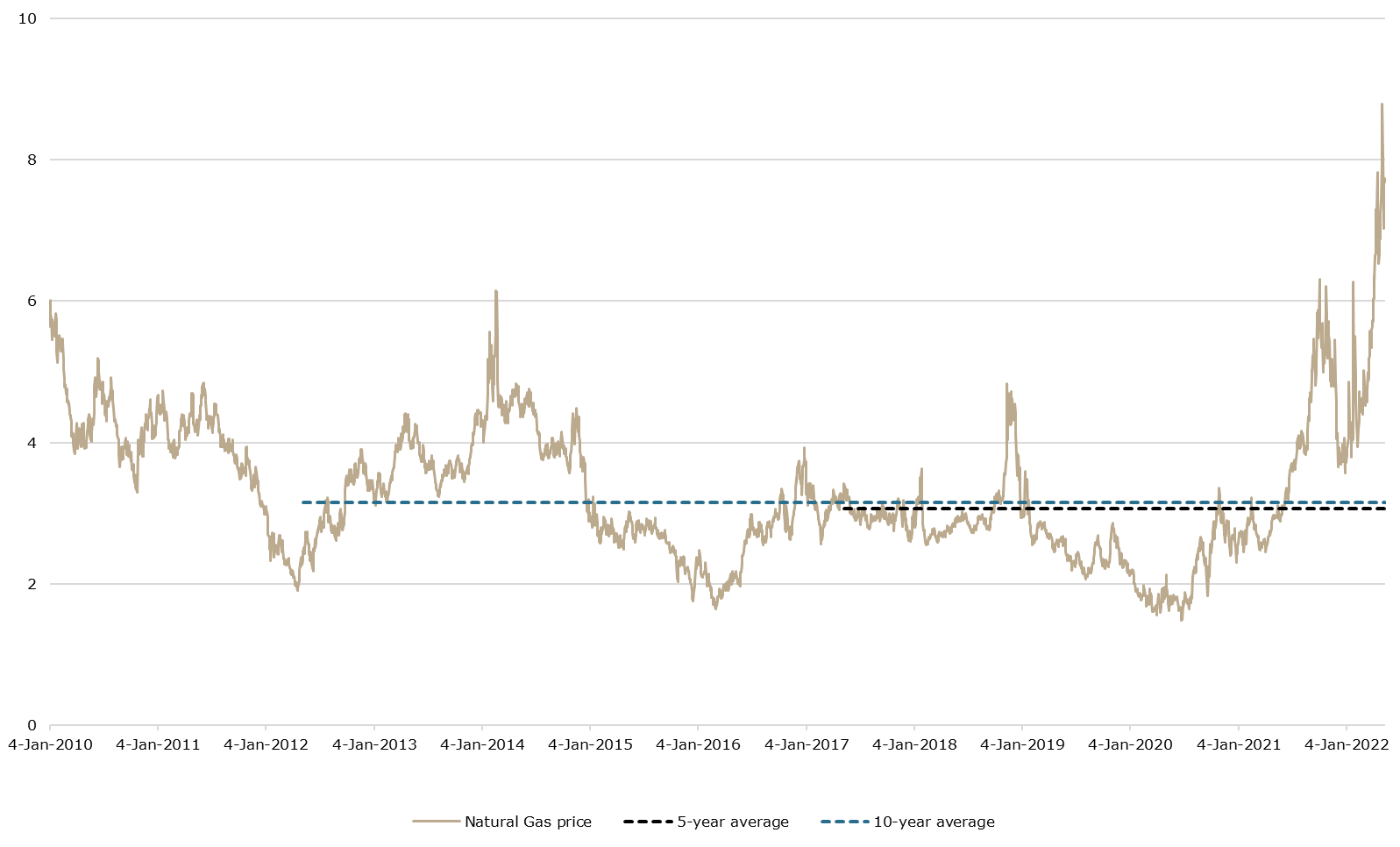

Next, we took a look at the natural gas prices. Due to the importance of Russian natural gas to the European economies, as well as the escalation of tensions in the past several weeks (Russia stopping gas exports to Poland and through Poland to some entities in Germany, Russia stopping natural gas exports to Bulgaria, a key transportation point in Ukraine getting closed due to the conflict, etc.) has also had a significant impact on the natural gas prices, and by extension, producers who use it. Currently, natural gas prices (NG1 Commodity Future from Bloomberg) stand at 7.68 USD/MMBtu, which is an increase of 106% YTD, above its 5-year average by 151%, and above its 10-year average by 143%. As the European countries scramble to find alternatives, which requires time, these high prices are expected to continue rising, especially if the current situation escalates further.

Natural gas prices (NG1 commodity futures, January 2010 – today, USD/MMBtu)

Source: Bloomberg