As of end July, total financial institution’s loans amounted to HRK 279.8bn, which represents a 3.2% increase YoY.

According to the monthly statistical report published monthly by Croatian National Bank (HNB), as of end July, total financial institution’s loans amounted to HRK 279.8bn, which represents a rise of 3.2% YoY and a 0.5% increase MoM. Pick-up in July is evidenced compared to previous months as annual growth in July stood at 2.3% YoY, and in May and April at 0.7% YoY.

Its largest segments household loans recorded a significant growth of 4% YoY and 1% MoM. Meanwhile, corporate loans witnessed a decrease of 0.3% YoY. It’s also worth noting that corporate loans documented a negative trend for the fifth consecutive month, both on YoY and MoM (-0.3% YoY and -0.19% MoM). Focusing on a YTD basis, household loans rose by 3%, while corporate loans are down by 1.1%.

Corporate and Household Loans Growth Rates (YoY)

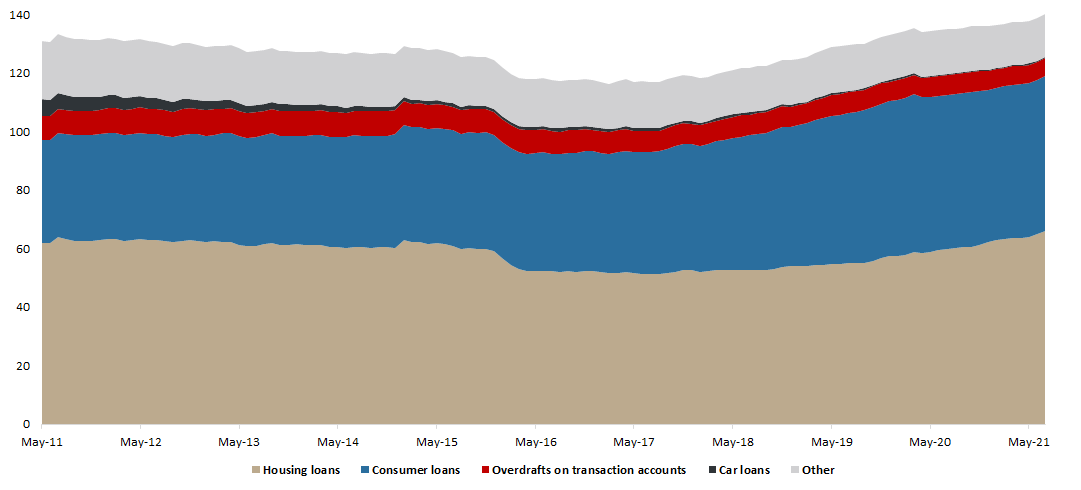

Total loans issued to households amounted to HRK 140.33bn, representing an increase of 4% YoY (or HRK 5.36bn). Such an increase was mainly a consequence of a rise in housing loans (+10.4% YoY or HRK 6.23bn). Furthermore, the government’s subsidizing program influenced the growth of housing loans which amounted to HRK 1.14bn MoM (or 1.8%). Consumer loans, which maintained the level of 37.7% (or HRK 52.89bn) of all household loans, witnessed a minor growth of 0.1% YoY (or HRK 71.6m).

Household loans growth was partially offset by a lower result of overdrafts on transaction accounts loans (-5.1% YoY or HRK -342.7m) and other loans (-3.6% YoY or HRK -341.1m). The mentioned segments account for 95.8% of total household loans. Turning our attention to specific purpose loans and car loans, a negative trend continues as both segments decreased by 1.8% MoM.

Loans to Households (HRK bn)