For today, we decided to bring you an updated overview of the indebtedness and capital structure of Croatian companies using H1 2020 results.

For today, we decided to present you with a comparison of Croatian companies. To be specific, we observed how indebted Croatian companies are by comparing net debt to EBITDA (trailing 12 months) and % of debt financing. We also added how much additional debt these companies could take in order to reach 3xEBITDA.

Note that Adris Grupa and ZABA were excluded from the overview as Adris operates as a holding, while ZABA is a bank.

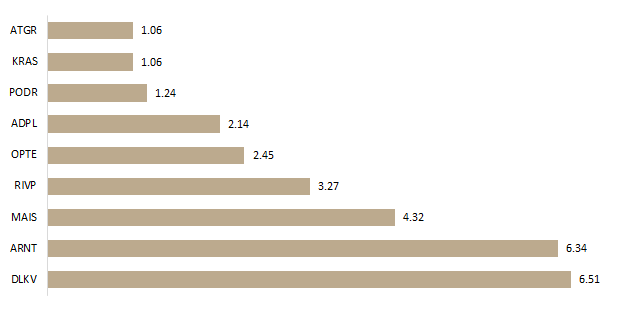

Net Debt/ EBITDA (trailing 12m)

Among observed companies Končar, HT and Ericsson Nikola Tesla operate at a negative net debt, meaning their cash position (short term financial assets + cash and cash equivalents) exceed their financial debt. Dalekovod has the highest indebtedness (of the observed companies) of 6.51x EBITDA. Next comes Arena Hospitality Group follows with a net debt/EBITDA of 6.34, compared to 2.09x EBITDA (FY 2019). Such an increase mostly came as a result of a negative EBITDA of HRK -37.1m recorded in H1 2020 (compared to HRK 29m in H1 2019). Two other tourist companies follow, Maistra and Valamar Riviera, with 4.32 and 3.27, respectively.

On the flip side, Atlantic Grupa is currently operating with historically low indebtedness which translates to 1.06x EBITDA.

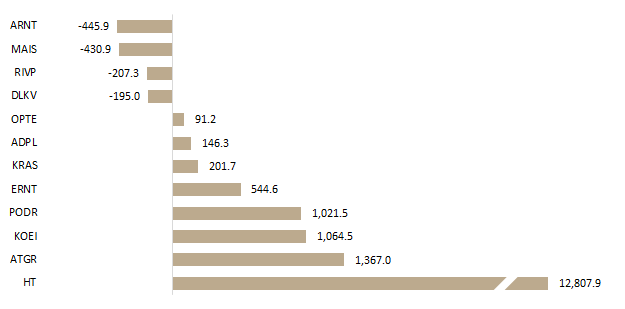

We also observed how much additional debt companies could take to reach 3xEBITDA which is in the region considered as a breaking point and red flag in terms of indebtedness.

This analysis provides information on the companies’ potentials for takeovers, but also the potential for an internal growth through additional borrowing. It’s important to point out that companies with net debt above 3xEBITDA are not necessarily too indebted as not all them are equal and their industries differ (and the other way around – certain industries are not prone to hold any leverage).

Potential Additional Debt (HRK m) to Reach 3x EBITDA

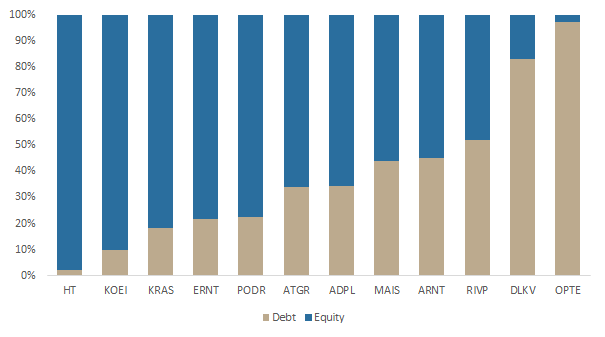

Turning our attention to the capital structure, of the observed companies, 9 of 12 are mostly equity funded. Of those, HT leads the list with 98% equity, followed with Končar 90%. On the flip side, Optima Telekom and Đuro Đaković are almost entirely debt funded with a capital structure of 97% and 83%, respectively.

Capital Structure of Croatian Companies