Today we take a look at the recent performance of the BDI Index which has continued its strong recovery after the outbreak of the COVID-19 pandemic.

The Baltic Dry Index or BDI index is a composite of various shipping rates used to transport dry bulk containers on merchant ships. Although the index is useful to determine the demand for dry bulkers, it can also be used as an important economic indicator. Namely, the use of this index as an indicator is a variation on the theme Charles Dow employed a century ago: transportation activity implies future commerce.

A change in the Baltic Dry Index can give investors insight into global supply and demand trends. Many consider a rising or contracting index to be a leading indicator of future economic growth. It’s based on raw materials because the demand for them portends the future. These materials are bought to construct and sustain buildings and infrastructure, not at times when buyers have either an excess of materials or are no longer constructing buildings or manufacturing products.

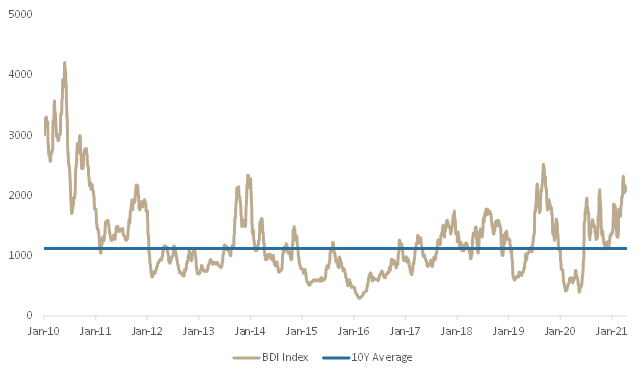

BDI Index Historic Performance

Source: Bloomberg, InterCapital Research

As witnessed from the chart, the BDI index almost hit its decade low in 2020 amid the outbreak of the COVID-19 pandemic as global trade was put on halt. However, as optimism spurred with the introduction of the vaccine, the index successful recovered. Not only that, but the index closed yesterday at 2,145 points which is significantly above the 10-year average of 1,119.97 indicating that demand and future growth is to be expected. One should also note that the BDI index is up 57% YTD, indicating a significant recovery of raw materials demand.

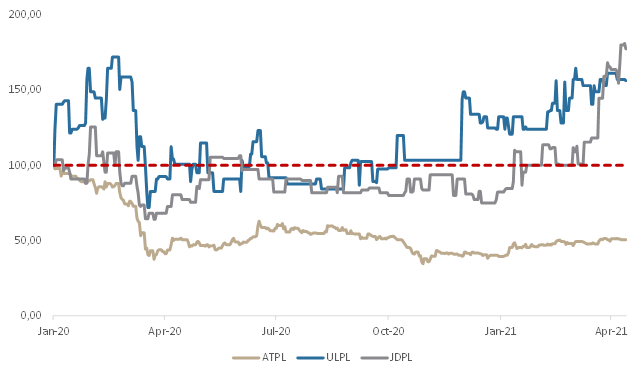

Share Price Performance of Croatian Dry-Bulk Companies

Source: Bloomberg, InterCapital Research

This is also apparent when looking at the share prices of Croatian Dry-Bulkers who showed a strong share price performance in 2021. Namely, the share price of Jadroplov is up 115% YTD, while Atlantska Plovidba soared 28% YTD. Finally, Alpha Adriatic increased 18% YTD. When comparing current share prices to pre COVID-19 levels, two out of three Croatian dry-bulkers have recorded significant prices increases. Namely, when compared to the beginning of 2020, Alpha Adriatic and Jadroplov recorded a share price increase of 77% and 56%, respectively. On the flip side, despite rising 28% in 2021, the share price of Atlantska Plovidba remains -49% below the level seen at the beginning of 2020.