NLB acquired the 83.23% stake in Komercijalna Banka for EUR 387m, which puts the transaction multiple at P/B 0.77. Find out more about the acquisition in this brief article.

NLB published a document on the Ljubljana Stock Exchange announcing that they have acquired the entered into a share purchase agreement with the Republic of Serbia for the acquisition of an 83.23% ordinary shareholding in Komercijalna Banka.

NLB acquired the 83.23% shareholding for the amount of EUR387m, which will be payable in cash on completion. Such a price puts the transaction multiple at P/B 0.77 and P/E 6, while it implies a valuation of EUR 465m for the 100% stake in Komercijalna Banka. Note that in accordance with Serbian bank privatisation regulations, NLB is not required to launch a mandatory tender offer for minorities’ shareholdings in Komercijalna Banka.

The closing of the transaction is expected in Q4 2020 and is subject to mandatory regulatory approvals from, amongst others, the European Central Bank, Bank of Slovenia and the National Bank of Serbia.

Following the completion of the acquisition, Serbia would become NLB’s second largest market accounting for roughly 24% of the Group’s asses (compared to current 4%). Meanwhile, the Group’s assets in core foreign markets would increase from 34% to roughly 49%.

The Purchase Price will be subject to a 2% annual interest rate between 1 January 2020 and closing.

It is important to note that subject to National Bank of Serbia approval, declared but unpaid dividends and employee benefits for prior financial years will be paid before closing. Komercijalna Banka’s existing shareholders will also receive a dividend equating to 50% of 2019 net income up to a maximum of EUR 38m before closing.

Capital Adequacy & 2019 Dividend

NLB notes that they will at all times exceed the Overall Capital Requirement and Pillar 2 Guidance of 14.25%. To deliver on this objective we will use capital instruments already issued and not yet accounted for (EUR240m of Tier 2 instruments) and anticipated capital accretion stemming from retained earnings and/or ongoing RWA optimization measures, potential AT1 issuance and non-controlling interest inclusion.

NLB is striving to maintain a material dividend payment for 2019, however timing will be synchronised with the regulatory approval process and the implementation of capital optimisation measures. NLB is upholding its dividend policy which, subject to meeting its target capital ratio, envisages a dividend payout ratio of approximately 70%. If the company were to carry out such a payout ratio, this would imply a dividend of EUR 6.77 per share (DY roughly 11% at the current share price).

About Komercijalna Banka

Komercijalna Banka is the 4th largest bank in Serbia by total assets, which is the the largest market in the SEE region in terms of bankable population. Komercijalna Banka will add more than 770,000 active retail clients and the largest branch network in the country with 203 branches to NLB’s existing operations in Serbia.

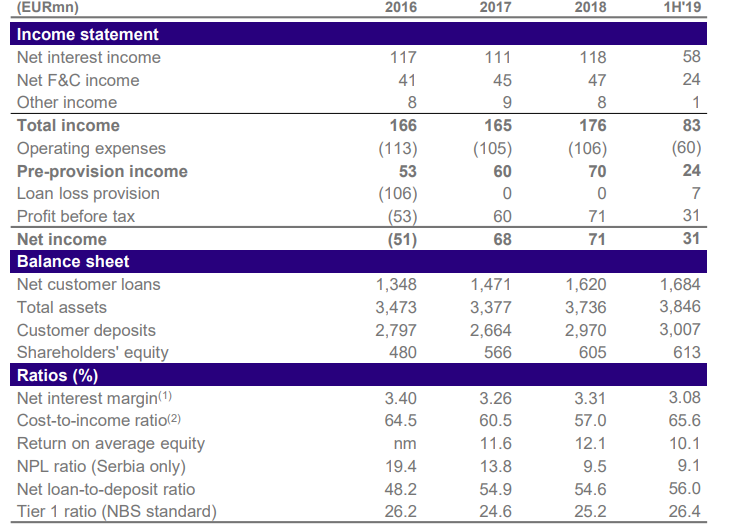

Komercijalna Banka Key Financials

Source: NLB Group

To read more about Komercijalna Banka click here.

To read our brief overview of the Serbian Banking sector click here.

Synergies

NLB notes that there are significant opportunities for value creation as a result of the mentioned acquisition. The company notes that they could achieve roughly EUR 16m in realization of materials cost and funding run-rate pre-tax synergies achieved in 2023.

Sources of value creation, according to NLB would be:

- Optimization – Head office functions in Belgrade, as well as operations in BiH and Montenegro; Harmonisation of information technology platforms

- Funding synergies – Leveraging Komercijalna Banka’s local currency deposit funding base; Integration of deposits and current accounts

- Revenue synergies – Increase share of active clients; Increase penetration and cross-sell cards, cash loans and mortgages

- Restructuring charges- Total restructuring charge of EUR 21m in the first two years of the transaction; 75% of charges phased in 2021 and the remaining in 2022