NLB confirmed the 2nd dividend payment for 2022, in the amount of EUR 2.5 DPS. At the share price before the proposal, this would amount to a DY of 4.6%. The ex-date is set for 16 December 2022.

At its GSM meeting held yesterday, 13 December 2022, the shareholders approved the distribution of the 2021 profit. According to the announcement, out of the distributable profit of EUR 408.3m, EUR 50m, or EUR 2.5 DPS shall be paid out as dividends, implying a payout ratio of 12.25%. The remaining EUR 358.3m share be transferred into the retained earnings. The ex-date is set for 16 December 2022, while the payment date is set for 20 December 2022.

Combined with the previous dividend this year, NLB will pay out a total of EUR 100m, or EUR 5 DPS in 2022, implying a payout ratio of 24.5%. Combined, this would mean that in 2022, the DY of NLB amounted to 8.4%. Below, you can see the historical dividends and dividends per share of NLB.

NLB Dividend Per Share (EUR) and Dividend Yield (2019-2022, %)

Source: NLB, InterCapital Research

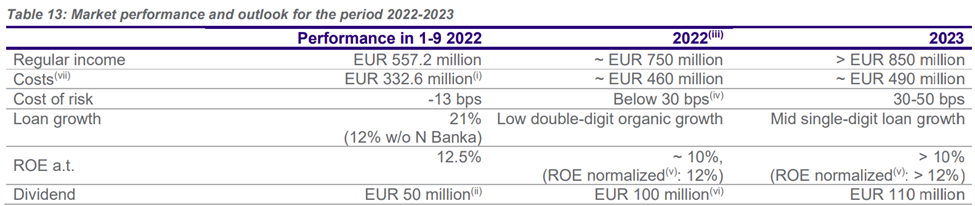

In their 9M 2022 results, NLB also commented on their outlook for the years to come, including the dividend payments.

Source: NLB

As seen in the Company’s outlook, they expect another dividend payment of EUR 100m in 2022 and EUR 110m in 2023. In fact, the Company commented that they are aiming to pay out a total of EUR 500m in dividends between 2022 and 2025.

NLB share price (2022, YTD, EUR)

Source: Bloomberg, InterCapital Research