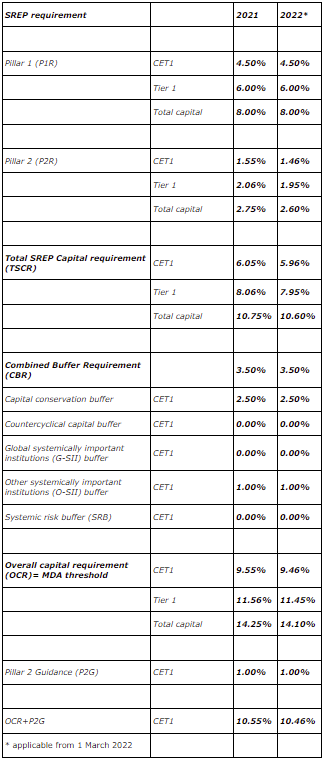

On 2 February 2022, the ECB issued a new SREP decision for NLB. Due to the new ECB SREP decision, NLB lowers Total Capital Ratio from 14.25% to 14.1% (indicating additional excess capital of EUR 19.2m).

On 2 February 2022, the ECB issued a new SREP decision for NLB under which it has reduced the Pillar 2 Requirement from 2.75% to 2.60% while Pillar 2 guidance remains at 1.00%. New SREP decision shall apply as of 1 March 2022. Following the new OCR the Group has excess capital of EUR 392.4m (9M 2021 results). NLB is as of this date required to maintain the OCR at the level of 14.10% on a consolidated basis, consisting of:

- 10.60% TSCR (8% Pillar 1 Requirement and 2.60% Pillar 2 Requirement (of which at least 56.25% must be held in CET1 capital and at least 75% must be held in Tier 1 capital)); and

- 3.5% Combined Buffer Requirement (2.5% Capital Conservation Buffer, 1% O-SII Buffer and 0% Countercyclical Buffer).