Yesterday, NLB revealed the terms regarding its newest bond issuance. EUR 500m will be issued in the form of green senior preferred notes. The interest rate amounts to 7.125% per annum. The notes’ issuance is set for 27 June 2023.

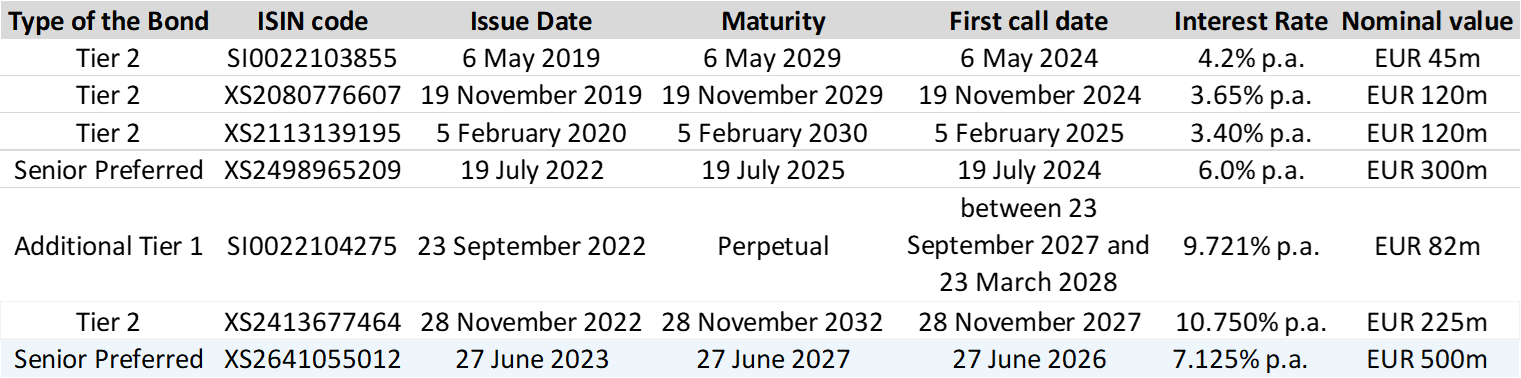

In the last couple of years, NLB has issued bonds in many different forms, including Tier 2 notes, Additional Tier 1, and Senior Preferred notes. The infographic detailing the outstanding bonds, as well as the newly announced bond, is available below:

NLB Group’s outstanding bonds and newly announced bond

Source: NLB Group

The newest bond issuance will be in the form of green senior preferred notes, in the nominal amount of EUR 500m. NLB has communicated many times over the previous year their intention to issue this bond, however, the issuance was expected in the EUR 300m to EUR 500m range. The reason for the issuance is the fulfillment of the MREL requirements, but it should be noted that EUR 300m would be enough for this. The higher amount issued then came as a result of strong demand for NLB’s bond, and according to the Company, they received a 4x oversubscription on the book.

The interest rate for the bond amounts to 7.125% per annum, and the issue price will be equal to 100% of the nominal amount. Furthermore, the Company noted that due to the strong demand for the note, they managed to tighten the spread by 75 bps, moving their yield from 7.875% to 7.125%. As a point of comparison, the Greek Bank managed to tighten the yield by 25 bps to 7% on the EUR 500m 6NC5 (6-year non-callable, 5 years callable) Senior Preferred notes.

NLB’s bond issuance is on 27 June 2023, the maturity date will be 27 June 2027, with the option for early redemption on 27 June 2026, meaning that this is a 4-year non-callable, 3-year callable bond. The ISIN code of the notes will be XS2641055012.