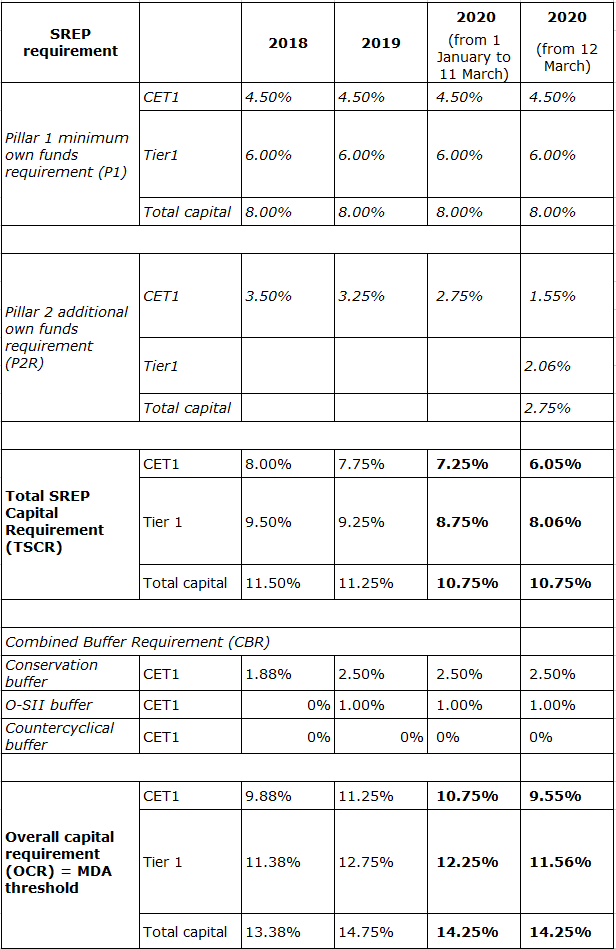

NLB has received new decision amending the composition of the Pillar 2 additional own funds requirement of the currently applicable decision establishing prudential requirements.

NLB published an announcement on the Ljubljana Stock Exchange stating that the ECB has formally notified the bank of its decision to amend the applicable decision establishing prudential requirement (Original Decision) in relation to P2R composition:

the Pillar 2 additional own funds requirement to be held in the form of Common Equity Tier 1 (CET1) capital, shall, instead, be held in the form of 56.25% of CET1 capital and 75% of Tier 1 capital, as a minimum. Decision shall apply retroactively from 12 March 2020.

Source: NLB Group

NLB also announced that they received the decision of the Bank of Slovenia relating to MREL requirement (minimum requirement for own funds and eligible liabilities), which amounts to 15.56% of Total Liabilities and Own Funds (TLOF) on sub-consolidated level of the NLB Resolution Group (consisting of NLB d.d. and non-core part of the NLB Group). MREL requirement shall be reached by 31 December 2021 and from that date shall be met at all times. This new BS decision supersedes previous BS decision on MREL requirement dated 15 May 2019.