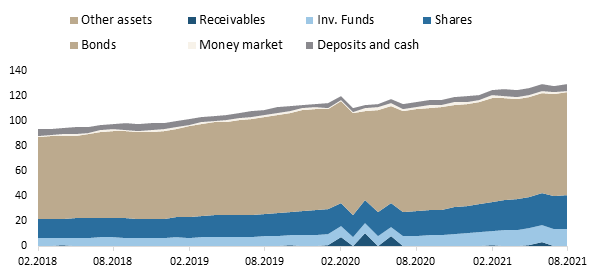

As of end August 2021, NAV of Croatian Mandatory Pension funds amounted to HRK 128.73bn.

As pension funds could be seen as the key player on the Croatian capital market, it is worth seeing how they have performed in the recent period.

NAV of pension funds has witnessed a steady increase for the 17th consecutive month, and as of end-August stood at HRK 128.73bn (+12.3% YoY or HRK 14.1bn). Meanwhile, on a YTD basis, NAV is up by 8.1%, while on a MoM basis, NAV of Mandatory Pension funds is up by 0.9%. We also note that net contributions in August amounted to HRK 628.6m, reaching a total of HRK 4.8bn YTD.

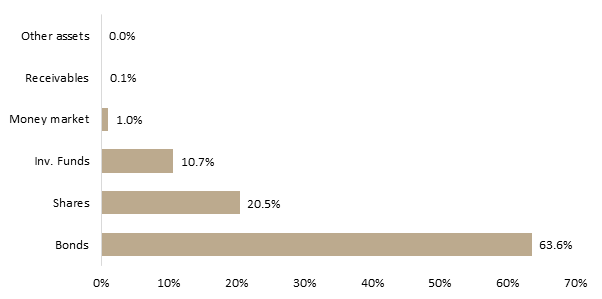

Looking at the asset composition of pension funds, one can notice that bonds account for the vast majority of total assets (63.6%) which as of end-August amounted to HRK 82bn. We note that bond holdings observed a MoM increase of 0.2% (or HRK 177.17m).

AUM Structure – Mandatory Pension Funds (August 2021)

Source: HANFA, InterCapital Research

Shares come next, with 20.5% or HRK 26.5bn, representing an increase of 2.7% MoM (or HRK 457.5m). The majority of the mentioned increase came from foreign equity (+3.1% MoM or HRK 689.2m). Meanwhile, domestic equity witnessed an increase of 3.2%. Note that domestic equity accounts for 55.9% of total equity holdings. On the other hand, in the bond market, the domestic bonds hold vast majority with 95.04%.

Total Assets of Croatian Mandatory Pension Funds (2018 – August 2021) (HRK bn)

Source: HANFA, InterCapital Research