In September, according to Croatian National Bank, deposits at banks increased 6% YoY reaching record value at HRK 323bn. Total loans issued by credit institutions amounted to HRK 271.6bn, representing an increase of 7.1% YoY.

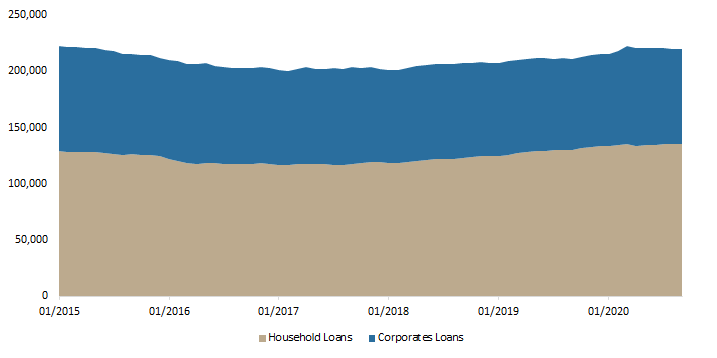

According to consolidated statement of financial position for monetary financial institutions monthly published by Croatian National Bank (HNB) at the end of October, total deposits in September amounted to HRK 322.8bn, representing a solid increase of 6% YoY, while they were flat MoM. Such an increase could be attributed to a high growth of demand deposit money which increased by 17% YoY to HRK 119.4bn and which accounts for 37% of total deposits. Such an increase was partially offset by a solid decrease in savings deposits (-12%), which amount to HRK 203.4bn. Meanwhile, it is important to note that local currency savings deposits have observed a decrease of 12% YoY, as a point in time for taking over Euro as a local currency is getting closer. Local currency savings deposits amount to 29.9bn, while 73% of them are pertaining to households and 18% to corporates. Kuna savings deposits account for 9% of total deposits and 15% of savings deposits, while Foreign currency savings deposits account for 85% of all savings deposits. Foreign currency saving has increased 3% YoY, while MoM increase is at low 0.6%. In the times of uncertainty demand deposits usually grow the most, while savings deposits, both local and foreign currency, stand at HRK 203m and have grown 0.8% YoY. Savings at record levels shows unwillingness of Croatian citizens to invest in riskier asset classes despite their increase in financial literacy.

Deposits in Credit Institutions (HRK m)

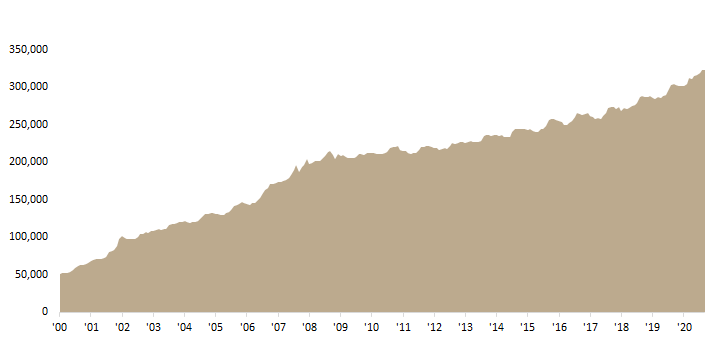

Total loans issued by credit institutions amounted to HRK 271.6bn, representing an increase of 7.1% YoY. Of that, 81% of it is pertaining to loans to corporates and households. Loans to households amounted to HRK 135.6bn (+4.2% YoY). If we were to observe the loan development to households MoM, one can observe only 0.3% increase as effects of pandemic have started to kick in. Corporate loans increased 5% YoY, which can be explained by prolonged pandemic times that is making corporates to turn more to credits. Loans to central state also increased 24% YoY which is due to issuance of HRK 6bn local currency loan to State for pandemic purpose.

When looking at loans’ currency structure we can see that local currency loans are growing at 15% YoY rate while FX loans grew only 1.2% YoY. The state loan for pandemic purposes taken in April is partially to blame for skewed increase in local currency. Still foreign currency loans make 53% of total loans, while foreign currency deposits have 54% share in total deposits. As loans (+7.1% YoY) have increased a little bit faster than deposits (6.2% YoY), loan deposit ratio at the end of Sep 2020, stands at the same level where it was a year ago, at 84%.

Total loans issued by credit institutions (HRK m)