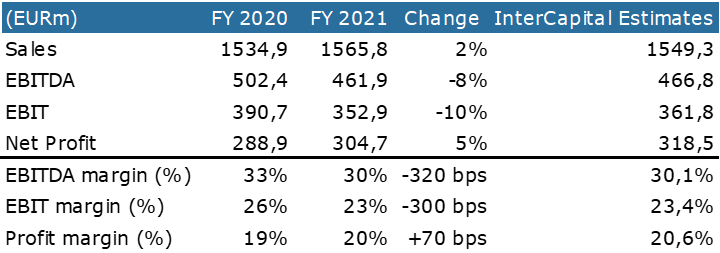

Krka published their preliminary FY 2021 results yesterday, showing a 2% YoY increase in sales, a 5% YoY increase in net profit (EUR 304.7m), with an 8% YOY decrease in EBITDA, which is all in line with our estimates.

In 2021, Krka recorded sales in the amount of EUR 1,565m, an increase of 2% YoY, which is also the Company’s best-recorded sale result ever. This growth was fueled by both the value as well as volume sales, which both grew by 2% YoY.

Krka Key Financials

Source: Krka, InterCapital Research

When looking at the revenue by markets, Region East Europe remains the largest market, accounting for 35% of the Company’s total sales. Sales revenue in East Europe amounted to EUR 548m, which represents a 6% increase YoY. Russia, the largest individual market in the region, generated sales revenue of EUR 333m, representing an increase of 2% YoY. At the same time, sales growth denominated in the Russian ruble amounted to 9%.

The Region Central Europe, which is composed of Visegrad Group and the Baltic states, had a sales revenue of EUR 352m, which makes 23% of total Krka Group sales. This represents a 3% increase YoY. Poland, which is the leading market in this region, generated EUR 167m in product sales, growing by 2% YoY. Sales growth denominated in the local currency (zloty) was up 5%. Region West Europe noted EUR 305m in sales revenue, accounting for 19.6% of total sales. This region recorded a decrease of 11% in sales YoY, primarily due to price pressures, fewer product launches, and the end of the public tender system in Spain. Germany generated the strongest sales, followed by the Scandinavian countries, France, Italy, and Portugal, while the highest growth rates were recorded in Ireland, the United Kingdom, and Austria. Region South-East Europe recorded sales revenue of EUR 209m, contributing to 13.4% of the Company’s total sales, and growing by 5% YoY. In Slovenia, sales amounted to EUR 93m, accounting for 6% of total sales, and increasing by 9% YoY. Lastly, we have Overseas markets, which experienced the largest relative increase of 18%, growing to EUR 54m.

EBITDA amounted to EUR 461.9m, representing a decrease of -8% YoY. This decline can be attributed to lower costs of goods sold due to raw material price pressure that started from the mid of last year and higher marketing expenses. Meanwhile, the EBITDA margin declined to 29.5% from 32.7% which is still strongly above the strategic target of 25%. However, the Management stated that the current margin is not sustainable in the long run and that a graduate return to the strategic level can be expected in the future.

At the same time, net profit amounted to EUR 304.7m, which is an increase of 5% YoY. This also marks the highest net profit margin in the Company’s history.

Looking over at investments, CAPEX in 2021 amounted to EUR 66m. The primary focus of these investments was on development, quality management as well as increasing and technologically upgrading overall production capabilities.

New Marketing Authorizations

In 2021, Krka was granted marketing authorizations for 16 new products, out of which 14 were prescription pharmaceuticals, and two were animal health products. These products include two products launched in China and one product launched in the Russian Federation. At the same time, several other products are going through the registration process as well, and are planned to receive their market authorization in 2022 and 2023.

Plan for 2022

According to the Management’s outlook, the Company estimates a sale revenue of EUR 1,610m and a net profit of app. EUR 300m in 2022. It should be noted that the expected net profit exceeds our initial projections made in our analysis. The Company also plans to allocate EUR 130m for CAPEX in 2022.