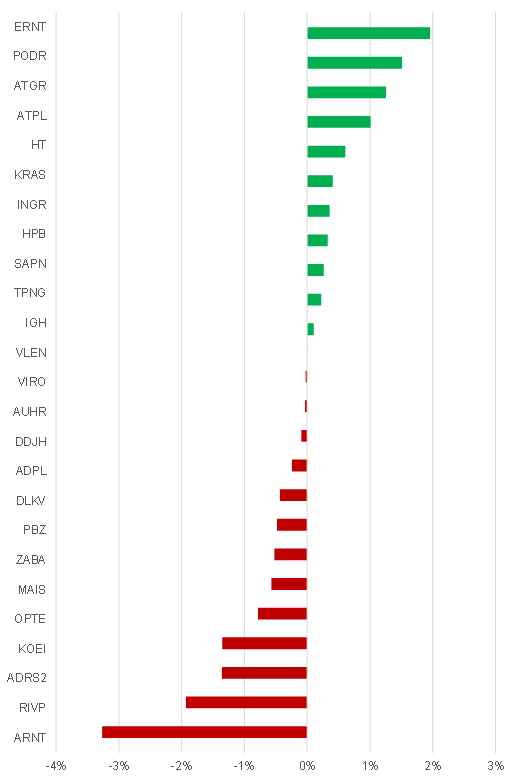

Although CROBEX is still below its value witnessed at the beginning of 2020 (-2.9%), some of its components have had a stellar performance both in terms of operating results and in terms of share price development during the same period. Therefore, we decided to see which components had the biggest impact on CROBEX’s movement since the beginning of 2020, or better yet since the outbreak of the COVID-19 pandemic.

The best performance among CROBEX components was evidenced by Ericsson NT whose share price surged 21% since the beginning of 2020. Their resilience to the pandemic was due to the sector they operate in, since the ICT sector was one of the least hurt by the pandemic. The company has a business model where work from home was introduced from the start of the pandemic, so ICT solutions produced by its human capital and their implementation was almost not affected by the pandemic. The company continued its contract with major telecom operator and extended its operations to all Croatian telecom operators. Its sales grew on all its markets and its margins increased as sales grew on higher margin businesses. On the same token, Hrvatski Telekom had a solid performance since the beginning of 2020 and its share price increased from the beginning of 2020 by 8%. HT’s business was influenced by decreased consumer spending due to lock-down and drop in inflow of tourists. But since 4Q 2020 this trend was reversed, and sales have picked-up. On the other hand, on the level of 2021 the decrease in sales is expected as the Group sold its investment in Optima Telekom which will not be consolidated anymore. Still, EBITDA margin is expected to be flat as savings in processes and other expenses were introduced. Due to higher depreciation and write-offs due to Optima on the level of 2021 19% lower net income is expected. But due to strong cash position and operations of HT Inc., dividend per share is expected at least on the same level as in this year, while company is stepping up its share buyback program to app. HRK 130m.

Consumer non-discretionary producers, Podravka and Atlantic Group, as expected did well since the beginning of 2020. From the start of the pandemic the results were boosted by the stockpiling effect while later consumers stuck with the purchase of their favorite brands which can now after the end of recession grow even further. Both companies also used the time of the pandemic to leverage on some savings and improved their business models, so their operating profitability was up. These both stocks put in a solid performance during pandemic, so Podravka’s share price surged from the beginning of 2020 by 21% and Atlantic Grupa’s by 16%.

Expectedly, hospitality companies Valamar and Arena, negatively influenced CROBEX, by 1.9% and 3.3% respectively. Their shares are down from the beginning of 2020 by 25% and 18%, respectively as their financials are still in the red. Third quarter is expected to show strong results for both companies, while 2022 is expected to bring further normalisation towards operations of pre-pandemic levels. So, we expect stocks that were the strongest prior to the pandemic to show leadership most likely after a full reopening.

Individual Impact of Shares on CROBEX Movement Since the Beginning of 2020

Source: Bloomberg, InterCapital Research

Note: Closing price as at 25 Aug 2021