In 2019 Ericsson recorded an increase in sales of 8% and a net profit of SEK 1.8bn (compared to SEK -6.3bn in 2018).

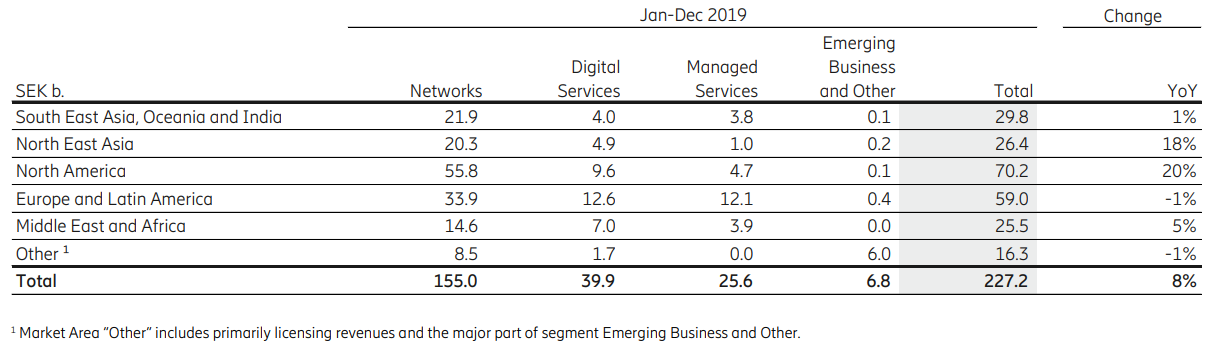

As Swedish Ericsson published their FY 2019 report, we are brining you key takes from it. According to it, net sales amounted to SEK 227.2bn, recording an increase of 8%. However, when adjusted for comparable units and currency it increased by 4%, with Networks growing by 6%. The sales increase in Networks was driven mainly by higher demand for radio access network (RAN) equipment. In the geographical dimension, sales were driven by growth in North America and North East Asia.

Source: Ericsson

Operating expenses decreased by 3.9% YoY to SEK 64.2bn, with SG&A expenses of SEK 26.1bn (-5.1% YoY). R&D expenses amounted to SEK -38.8bn, remaining flattish. For 2020 Ericsson expects somewhat higher operating expenses, which should not jeopardize their financial targets.

As a result of the above mentioned, operating income improved to SEK 10.6bn compared to 1.2bn in 2018. Such an increase was driven by higher gross margin and higher sales. The improvement was partly offset by SEK -10.7bn in costs related to the resolution of the US SEC and DOJ investigations. Operating margin improved by 4 p.p. standing at 4.6%.

Going further down the P&L, in 2019 the company recorded a net profit of SEK 1.8bn, compared to a net loss of SEK -6.3bn in 2018. The company notes that the The Board of Directors will propose a dividend for 2019 of SEK 1.50 per share, which is an increase of SEK 0.50 per share compared to 2018.