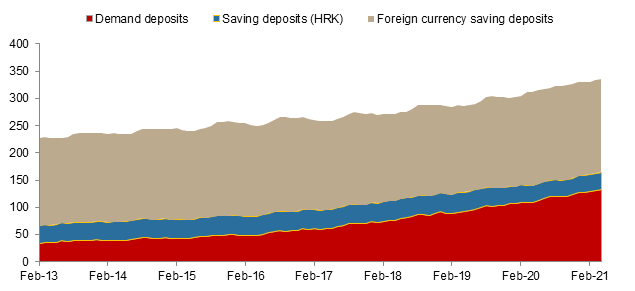

At the end of April 2021 total deposits in Croatia amounted HRK 335.2bn, up by HRK 2.1bn YTD.

According to the consolidated statement of financial position for monetary financial institutions which is monthly published by the Croatian National Bank (HNB), total deposits as of end February 2021 amounted to HRK 335.2bn, representing a solid increase of 7.7% YoY, while increasing 0.6% MoM. This amount represents once again an all-time high. The high level of savings indicates that Croatian citizens are unwilling to take on the risk of other asset classes.

This increase can be attributed to a high increase of 21.2% YoY in demand deposits, reaching HRK 132.4bn, which accounts for 39% of total deposits. As we are in a time of uncertainty the mentioned increase does not surprise. During the crisis, lower spending and higher savings are expected.

The increase was backed up by a slight rise in the total savings deposits, which amounted to HRK 202.8bn (+0.4% YoY) at the end of April. Also a small down trend in MoM change has been overturned resulting in a 0.5% MoM rise. For the first time in two years there has been an increase in local currency savings deposits. The 5.8% increase to HRK 32.2bn reflects lower belief in foreign currencies reflecting the COVID-19 pandemic influence on the surrounding countries. Foreign currency savings accounted for HRK 170.6bn, a 0.6% drop YoY. At the end of April 2021 the total saving deposits were 16% in the local currency and 84% in foreign currency, showing that Croatian institutions and citizens still do not prefer holding the their savings/assets in the Croatian Kuna.

When observing solely household deposits, they hold HRK 229.1bn, a share of 68% of total deposits. We note that foreign currency saving deposits account for 51% of total deposits.