For today, we decided to present you with an update asset structure analysis of Croatian UCITS funds.

Since the asset managers play a very significant role in the Croatian capital market, it is particularly interesting to see how they have been affected by the ongoing Covid-19 situation. Given that the global financial markets observed a partial recovery in April, it is worth seeing how Croatian UCITS funds performed during that period.

According to the report, NAV of all funds in April 2020 experienced a slight increase of 1.4% MoM (or HRK 225m), amounting to HRK 15.87bn. This also represents a decrease of 17.8% YoY and a decrease of 29.7% YTD.

As a reminder, in late February until late March UCITS funds recorded the majority of the yearly decrease in their NAV . HANFA noted earlier this year that since 21 February until 24 March, 86.1% of the decrease could be attributed to withdrawals from the funds, while the rest 13.9% can be attributed to a change in value of assets in which the funds invest. As turmoil on financial market subsided withdrawals from funds were halted, but the value of most financial instruments has not yet returned to pre-crisis levels.

Asset Structure of UCITS funds (April 2020)

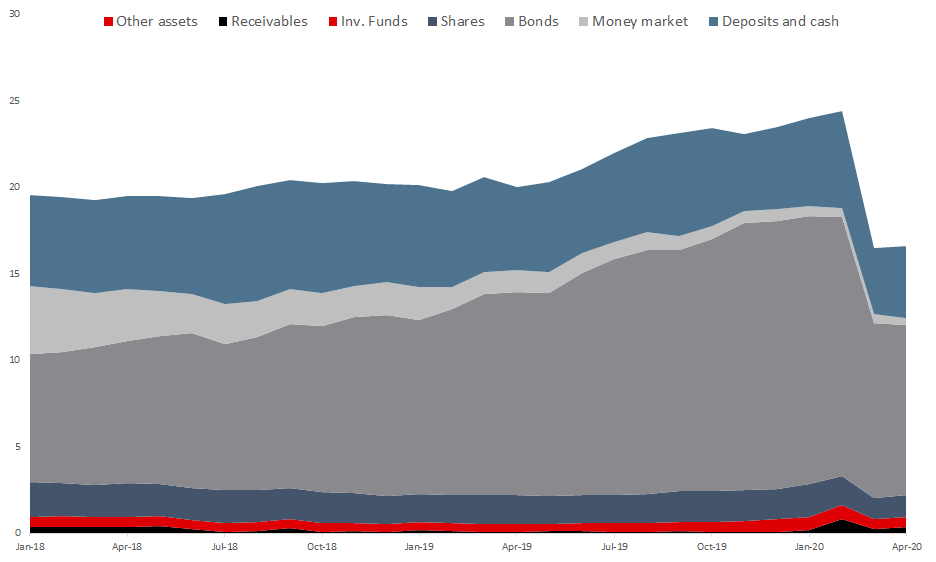

Looking at the asset composition of Croatian UCITS funds, it seems that asset managers have not changed significantly their composition, which can be seen in the graph above. Since the beginning of 2020, we witnessed a considerable decrease of bonds in the assets structure which went from 65% in January 2020 to 59% in the April of 2020. Such a decrease could be attributed to withdrawals from funds which (predominantly) invest in the mentioned asset class, but also to decrease in value of bonds compared to the end of 2019.

Money market funds and shares which currently account for 2.5% and 7.7% of the total asset structure of UCITS funds, remained relatively flat both on MoM and YoY basis.

Total Assets of All Croatian UCITS Funds (2018 – April 2020) (HRK bn)

Source: Croatian Financial Services Supervisory Agency, InterCapital Research