For today, we decided to present you with an updated asset structure analysis of Croatian UCITS funds.

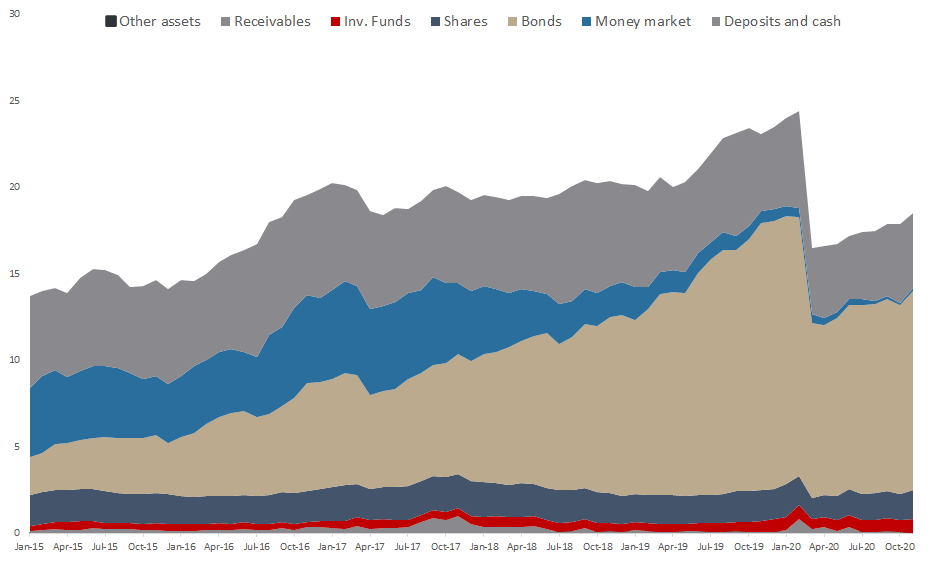

Since asset managers play a significant role in the Croatian capital market, it is particularly interesting to see how they have been performing in 2020. As visible from the graph below, NAV of all funds has witnessed a steady increase for each consecutive month since April, and as of end November stood at HRK 17.76bn (+2.8% MoM). This still represents a decrease of 21.3% YTD (or HRK 5.8bn).

As a reminder, in March, UCITS funds observed a sharp decrease in their NAV of 32.2% or HRK 7.42bn. We note that most of the mentioned decrease could be attributed to the withdrawals from the funds, while a smaller portion reflects the change in value of assets in which the funds invest in. As turmoil on financial market subsided withdrawals from funds were halted.

The biggest decrease of a YTD basis was observed in bond holdings, which decreased by 25.7% or HRK 3.97bn. Meanwhile shares observed a decrease of 6% or HRK 106.47m. November was a particularly positive month for equities as they were given additional tailwind by the positive vaccine development. As a result, total equity holdings increased by 9.8% MoM (or by HRK 149.74m).

On a MoM basis, bonds have observed the highest increase in nominal terms of HRK 614.3m or 5.6%. Looking at domestic equity holdings, they are up by 10.4%. To put things into a perspective, CROBEX was up by 8.1% in November.

Asset Structure of UCITS funds (November 2020)

Looking at the asset composition of Croatian UCITS funds, it seems that asset managers have not significantly changed their composition, which can be seen in the graph above. Since the beginning of 2020, we witnessed a considerable decrease of bonds in the assets structure which went from 65% in January 2020 to as low as 59% (April), while as of November 2020 bonds take up for 62.2% of the total assets. Such a decrease could mainly be attributed to the above-mentioned withdrawals from funds which (predominantly) invest in the mentioned asset class. Of the aforementioned bond holdings, domestic government bonds account for 40.5% of the total assets under management (or HRK 7.51bn) which is the single largest item of UCITS funds.

Shares have observed a gradual increase in total assets since February, and currently account for 9.1% of the total assets (or HRK 1.68bn). Note that domestic shares account for 29.2% (or HRK 489.5m) of the total equity held by Croatian UCITS funds. Domestic equity holdings are down by 18.3% YTD, representing a decrease of HRK 109.5m.

Total Assets of All Croatian UCITS Funds (2015 – November 2020) (HRK bn)

Source: Croatian Financial Services Supervisory Agency, InterCapital Research