For today, we decided to present you with an updated asset structure analysis of Croatian UCITS funds.

Since asset managers play a significant role in the Croatian capital market, it is particularly interesting to see how they have been affected by the ongoing Covid-19 situation. As the global financial markets, as well as the Croatian capital market, observed a partial rebound in April and the following months, it is worth seeing how Croatian UCITS funds performed during that period.

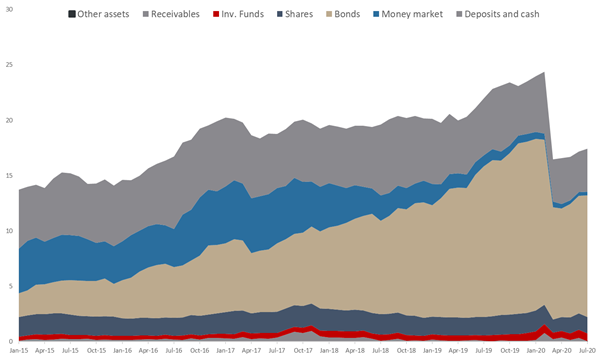

As visible from the graph below, NAV of all funds has witnessed a steady increase for each consecutive month since April, and as of end July stood at HRK 16.81bn (+1.6% MoM or HRK 260.4m). This still represents a decrease of 25.5% YTD. As a reminder, in late February until late March UCITS funds recorded the majority of the yearly decrease in their NAV. HANFA noted earlier this year that since 21 February until 24 March, 86.1% of the decrease could be attributed to withdrawals from the funds, while the rest 13.9% can be attributed to a change in value of assets in which the funds invest. As turmoil on financial market subsided withdrawals from funds were halted, but the value of most financial instruments has not yet returned to pre-crisis levels.

Asset Structure of UCITS funds (July 2020)

Looking at the asset composition of Croatian UCITS funds, it seems that asset managers have not changed significantly their composition, which can be seen in the graph above. Since the beginning of 2020, we witnessed a considerable decrease of bonds in the assets structure which went from 65% in January 2020 to as low as 59% (April), while as of July 2020 bonds take up for 62.9% of the total assets. Such a decrease could mainly be attributed to withdrawals from funds which (predominantly) invest in the mentioned asset class.

Shares have observed a gradual increase in total assets since February, and currently account for 8.5% of the total assets. Note that domestic shares account for 29.3% (or HRK 433.76m) of the total equity held by Croatian UCITS funds. To put things into a perspective, as of July 2020, Croatian Mandatory Pension funds managed a significantly higher amount in domestic shares (HRK 11.22bn), which accounts for 9.9% of their net assets. This indicates that mandatory pensions funds account for roughly 22% of the free float market cap of ZSE, whereas Croatian UCITS funds account for roughly 1%.

Total Assets of All Croatian UCITS Funds (2015 – July 2020) (HRK bn)

Source: Croatian Financial Services Supervisory Agency, InterCapital Research