For today, we decided to present you with an updated asset structure analysis of Croatian Mandatory Pension funds.

Pension funds could be seen as the key player on the Croatian capital market, as their current domestic equity holdings account for more than 40% of the free float market cap of ZSE. Therefore, it is particularly interesting to see how they have been affected by the ongoing Covid-19 situation. As the global financial markets, as well as the Croatian capital market, observed a partial rebound in April and the following months, it is worth seeing how Croatian mandatory pension funds performed during that period. As visible from the bottom graph, the NAV of the mentioned funds has increased on a YTD basis.

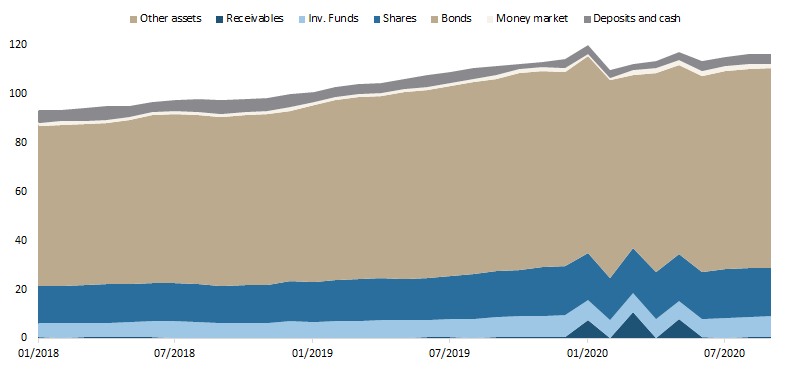

NAV of pension funds has witnessed a steady increase for each consecutive month since April, and as of end October stood at HRK 115.83bn (+0.1% MoM or HRK 69.86m). This also represents an increase of 2.9% YTD. As a reminder, in March (the worst performing month for almost all asset classes) the pension funds recorded a decrease of 3.3% MoM or HRK 3.76bn.

It is also worth adding that in October net contribution payments amounted to HRK 587.9m, which is by HRK 53.6m lower compared to the previous month.

Asset Structure of Croatian Mandatory Pension Funds (October 2020)

Source: Croatian Financial Services Supervisory Agency, InterCapital Research

Looking at the asset composition of pension funds, asset managers have not changed significantly their composition, which can be seen in the graph above. Bonds account for the vast majority of total assets (70.1%) which as of October amounted to HRK 81.68bn (increase of HRK 134.4m MoM or 0.2%). Shares come next, with 17% or HRK 19.8bn, representing a decrease of 1.3% MoM. Such a decrease mostly came on the back of a decrease in foreign shares by 1.9% or HRK 156.5m.

Unlike Croatian UCITS funds whose majority of equity holdings are foreign, mandatory pension funds have 58.6% (or HRK 11.60bn) of their equity holdings allocated in domestic shares. We note that shares have once again turned red on a YTD basis with a slight decrease of 0.3%. Of that, domestic shares are down 6% YTD, while foreign shares are up by 9.2% YTD.

Total Assets of Croatian Mandatory Pension Funds (2018 – October 2020) (HRK bn)