Yesterday, the European Commission published its Autumn 2023 European Economic Forecast. In this brief overview, we’re bringing you the main highlights, with a special focus on Croatia.

The European Commission (EC) notes that the European economy has lost momentum, due to the high cost of living, weak external demand, and monetary tightening. As a result, they have revised the EU GDP growth downward as compared to the summer projections. On the other hand, after a challenging year, economic activity is expected to modestly recover going forward, as consumption picks up on the back of a still robust labour market, sustained wage growth, and continued easing of inflation. Despite a tighter monetary policy, investment is projected to continue growing, supported by overall solid corporate balance sheets and the Recovery and Resilience Facility (RRF).

Inflation is estimated to have dropped to a two-year low in the euro area in October and is set to continue declining over the forecast horizon. While the slowdown in inflationary pressures has been mainly driven by a decline in energy prices, due to the sheer duration that inflation remained elevated, it has now increasingly spilled over to other consumption categories, beyond energy. The EC expects that inflation is set to continue declining, as monetary tightening keeps working its way through the economy, though at a more moderate pace.

Amid heightened geopolitical uncertainty, the future evolution of energy prices remains a concern. The energy price shock has dented cost competitiveness in the EU, in particular for the more energy-intensive Member States and industries. As the energy prices decreased in 2032, the large inflation differentials across the Member States have only partly subsided. Combined with price differentials, this could lead to competitiveness gaps in some Member States. Furthermore, with the energy prices and thus input costs continuing to be higher than those of trading partners, closing the gap in productivity growth compared to peers remains crucial to preserve global competitiveness.

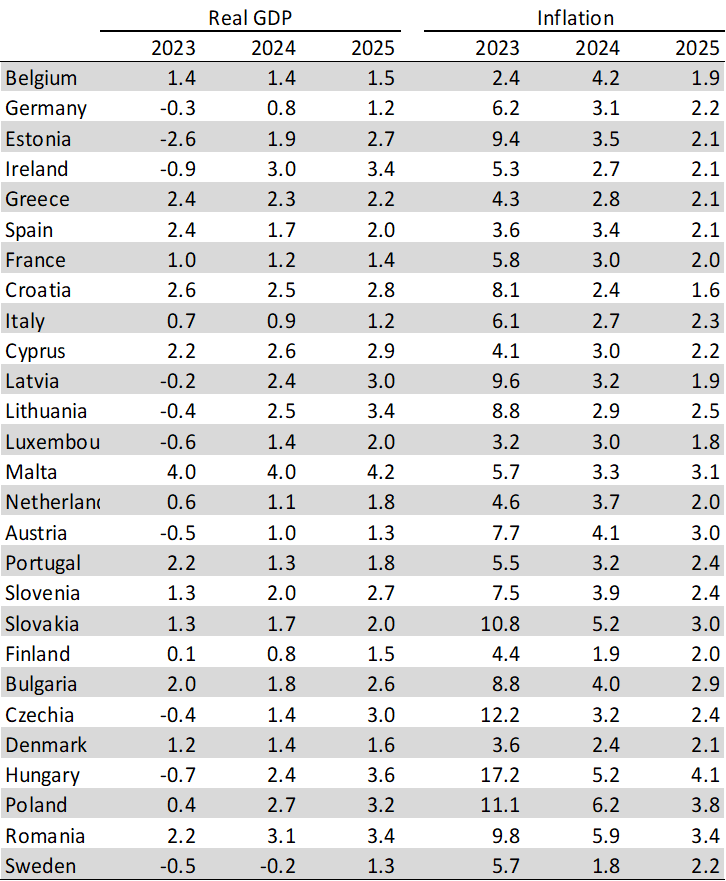

Autumn 2023 Forecast (real GDP growth rate, inflation, %, 2023 – 2025)

Source: European Commission, InterCapital Research

As we can see in the forecast, Croatia is 2nd to only Malta in terms of growth in the 2023 – 2025 period Also, as the EC noted, Croatia’s GDP is expected to grow at a sustained pace, supported by increasing private consumption amid rising real wages, and by investment boosted by EU funds. The labour market is expected to tighten further, with employment recording solid growth and the unemployment rate reaching record-low levels. The expected moderation of headline inflation is driven by lower energy and unprocessed food prices, while services inflation is projected to remain more persistent. The general government balance is set to be negatively impacted by large increases in public sector wages and social benefits, putting pressure on expenditure.

As a result of these developments, real GDP growth is expected to remain solid in 2023 at 2.6% YoY, as Croatia takes advantage of its accession to the euro and Schengen areas. This is also due to the high carry-over from 2022 and despite a weaker momentum in the external environment. Consumer demand is set to remain high amid employment and real wage growth. Furthermore, both government consumption and investment are projected to contribute positively to growth, with investment supported by increased absorption of EU funds. On the other hand, a deceleration in inventory’ build-up is expected to firmly weigh on domestic demand. Net exports are projected to positively contribute to GDP growth as a decrease in goods imports more than offsets lower goods exports, amid overall strong tourism demand.

In 2024, real GDP is estimated to grow by 2.5%, mainly driven by domestic demand as headline inflation falls towards 2%. The contribution from net exports is set to decrease substantially but remain positive, supported by increasing demand in the main trading partners’ economies. Growth in 2025 is forecast to reach 2.8% YoY and remain broad-based, also supported by the increased absorption of RRF grants and loans. The main risk to the economic outlook is a slower-than-expected decline in inflation, which has been more persistent in Croatia than in most EU countries. Should wage increases intensify, after having already resulted in comparatively higher unit labour costs growth, they could lead to possible wage-inflation spirals. This risk may be exacerbated if cost pressures are not absorbed by firm profits, which grew in 2022 and early 2023. Under such a scenario, the trade balance could deteriorate amid strong domestic demand growth, while exports and cost competitiveness could be endangered.

The entire report, including detailed forecasts for other EU countries, is available here.