In the last couple of weeks, we have witnessed significant rise of yields across the globe due to hawkish stance of main central banks and scare of inflation being less temporary than previously thought. On top of that, energy crises in Europe and Asia are heating which drives inflation expectations further. In this brief article we are looking at the main drivers of the latest jump of nominal yields and what could we expect in the following months.

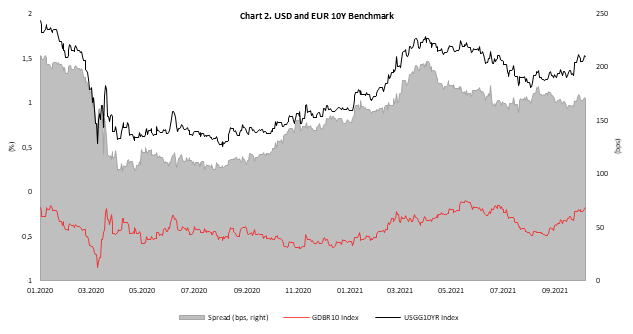

Our latest blogs written by my colleague Ivan and me, were describing the latest moves by major central banks. Namely, on its last monetary policy meeting, Fed decided to taper their purchases before the end of 2021 while mentioning that their asset purchase program could end completely by mid-2022. Furthermore, there were 9 out of 18 officials seeing rates rising already in 2022 which caught investors by surprise. Yields were unchanged after the meeting but started to rise rapidly on the day after, i.e., on that September 22nd US 10y stood at 1.30% while only a week later it reached 1.55% which was the largest move up since March 2020 when all asset prices’ correlation went to 1. Going on, ECB also decided to taper their purchases although it called it only recalibration as Ms Lagarde did not want to sound too hawkish. As we wrote in our pieces, this marked the peak in loose monetary policy and most likely will only go tighter.

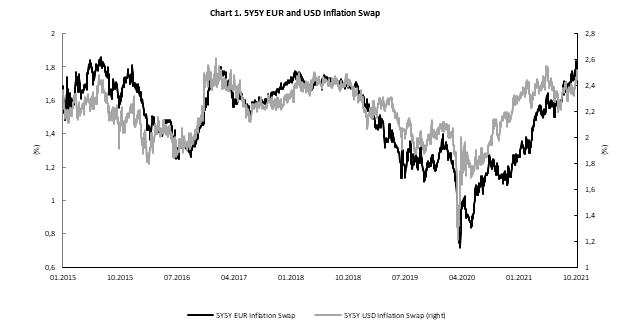

Talking about monetary policy, one does not omit recent surge in energy prices with natural gas and power prices going through the roof. Main reasons for the surge of natural gas in Europe are continuing decline in gas production in Europe, lower pipeline imports from Russia, lower LNG imports due to Asian demand and due to financial speculation on the energy sector. Meanwhile, 5 EU nations issued statement suggesting common EU approach in dealing with current energy crisis, meaning that European public is becoming nervous just before the winter season. As many commodity prices are rising to their multiyear or even multi decade highs, consumers are increasing their inflation expectations which could be detrimental to transitory story. EUR 5y5y inflation swap breached 1.80% level and currently stands at the highest level since 2015. One of the consequences of the increased inflation expectations and higher inflation at the moment are possible wage increases as workers want their piece of inflation cake. Despite unemployment levels in EU or USA are still above pre-covid levels, there are doubts that workers will quickly come back to the labor force even when corona packages are out of the picture. All in all, there are more and more evidence that inflation could show to be more stubborn than investors and central bankers thought in the first place.

However, there are two arguments that could stop yields from surging further. The first one is growth deceleration among major economies, as it could stop central banks in their hawkish intentions. Most of the high frequency data shows that GDP growth decelerated in the end of third quarter and there are no clear signs of growth reacceleration even if you bear in mind that corona cases in the world started to fall once again. Another thing that could drive yields lower would be higher yields. Namely, in scenario where yields rise too fast, that should hurt most of the equity indices, resulting in investors hiding into safe assets such as bund and USTs. Nevertheless, in the last couple of days we saw correlation going from slightly negative to positive, meaning that investors no more see 10Y year papers with fixed coupon as safe assets, especially when commodity prices go on a wild ride like these days.

In any case, bonds are once again under attack and this time it did not catch so many investors with surprise as it did in February 2021. Looking ahead, even in case energy prices normalize soon, we do not expect yields to go down abruptly as they did before this summer as inflation story is now becoming more serious due to increased inflation expectations that could be sticky while central banks already decided to change their stance and slowly start to tighten their policies. On the other hand, we do not expect global growth to slow dramatically and in case it decelerates further, inflation could stay above the central banks’ targets as many issues are on the supply side which could take a while before they are solved in full.

Source: Bloomberg, InterCapital

Source: Bloomberg, InterCapital