Orderbooks for the first Croatian retail bond have opened yesterday at 8.00 CET and by 15.00 CET about 4.600 private individuals have placed orders in total size of 155mm EUR. Not bad for a maiden voyage. So what’s going to be left to institutional clients in March and what do we make of this initial piece of data? Well, You’ll have to open up the article and read it.

But first as an appetizer, some macro information nuggets in order to understand what the yield curves are telling us about market expectations. Minutes of the Federal Open Market Committee (FOMC) session that ended on February 01st reveals essentially nothing new. FOMC members are still hawkish and recent hard data such as US PMIs might have firmed their stance even further. It’s not just that US core inflation remains stubbornly elevated despite energy prices coming off their recent highs, but it’s the fact that the US labour market remains resilient and tailwinds to US consumer spending such as slowing headline inflation, last year’s pay rises, cost of living adjustments for retirees and state taxes might have set up the perfect framework for a soft landing to take place (i.e. inflation back under control without a recession). Torsten Slok (ex-Deutsche Bank macro wunderkind, currently working as a portfolio manager in Apollo) correctly pointed out what has been brewing under the hood of recent +517k growth in US non-farm payrolls. My mid-year 2022 US recorded net immigration in size of 1 million people and this flow could be directed into blue-collar job openings, putting a lid on wage-induced inflation from gaining even more momentum. Slok thinks the same forces could be at play in Europe and he doesn’t mention it directly, but it’s primarily because of the influx of skilled immigrants from Ukraine. Time will tell, although while sitting in Zagreb it’s difficult not to argue that such an influx caused rents and housing prices to skyrocket, pushing inflation higher in the process.

One thing almost everybody agrees on is that thanks to lagging the first half of 2022 and now having to catch up for the missed time, ECB has been reborn as the most hawkish central bank in the developed world. If you work with cash bonds/IRSs/FX swaps, then this is no Aha! moment for you – you have figured it out on your own by now. BBG WIRP function demonstrates how €STR expectations rose all the way to 3.65% in September 2023, implying about +125bps of hikes to unfold in the Euroland. In our view, it’s quite likely ECB will get there by the end of July, setting the place for more monetary policy coordination at the Jackson Hole meeting in August, which would also be attended by BoJs Ueda Kazuo. Goldman Sachs, Berenberg and Barclays all expect that the ECB would walk the walk and get to 3.50% by September, while Deutsche Bank sets the bar even higher at 3.75%.

We’re missing the big question here and that’s how come that in times as this ECB looks like the most hawkish of the three DM central banks? Part of the answer lies in the fact that the ECB took off (too) late with rate hikes, but a substantial part of the answer could be found in the unionization of the workforce in Europe. At a time when US immigration flows into blue-collar jobs and poster child white-collar companies such as Microsoft, Amazon, and even McKinsey are forecasting layoffs, European trade unions such as Verdi (Germany) are demanding a 10% wage rise this year for 2.5mm people working in public services. Exactly one month ago, Robert Holzmann (ÖNB – Österreichische Nationalbank) explained that faster hikes are actually an antidote to trade union demands, but in order to curb these demands the central bank has to convince households and corporations that they will bring consumer inflation under control within one year. This is possible – but the unions aren’t buying it.

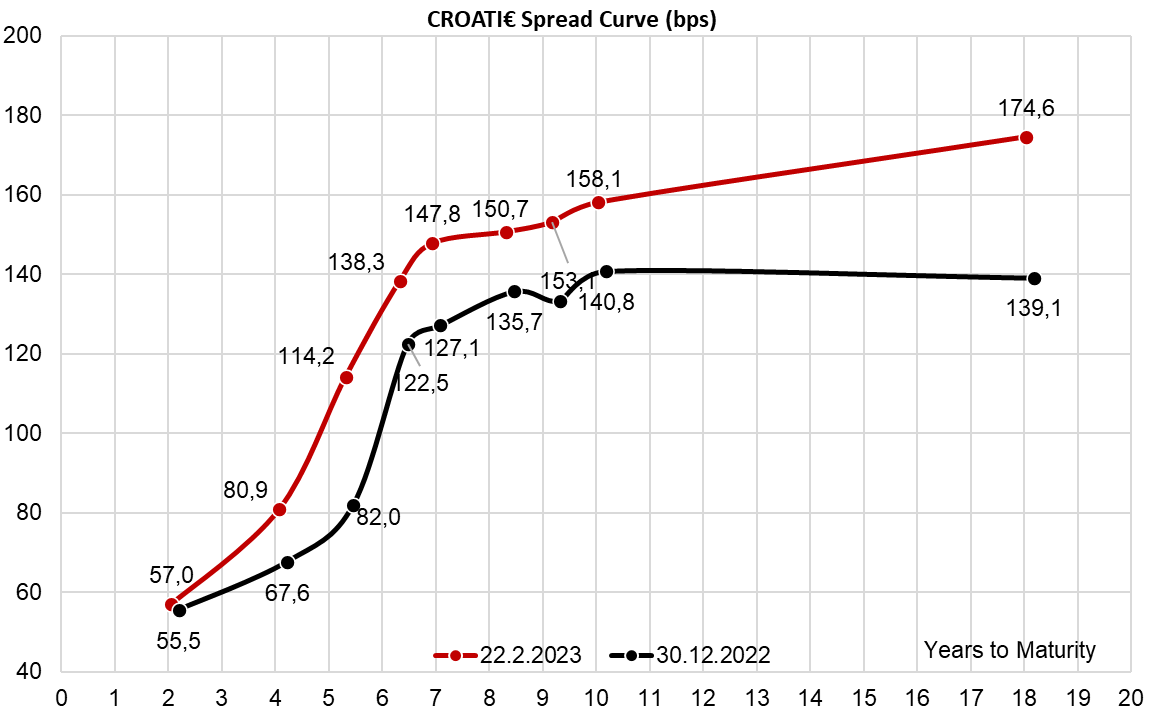

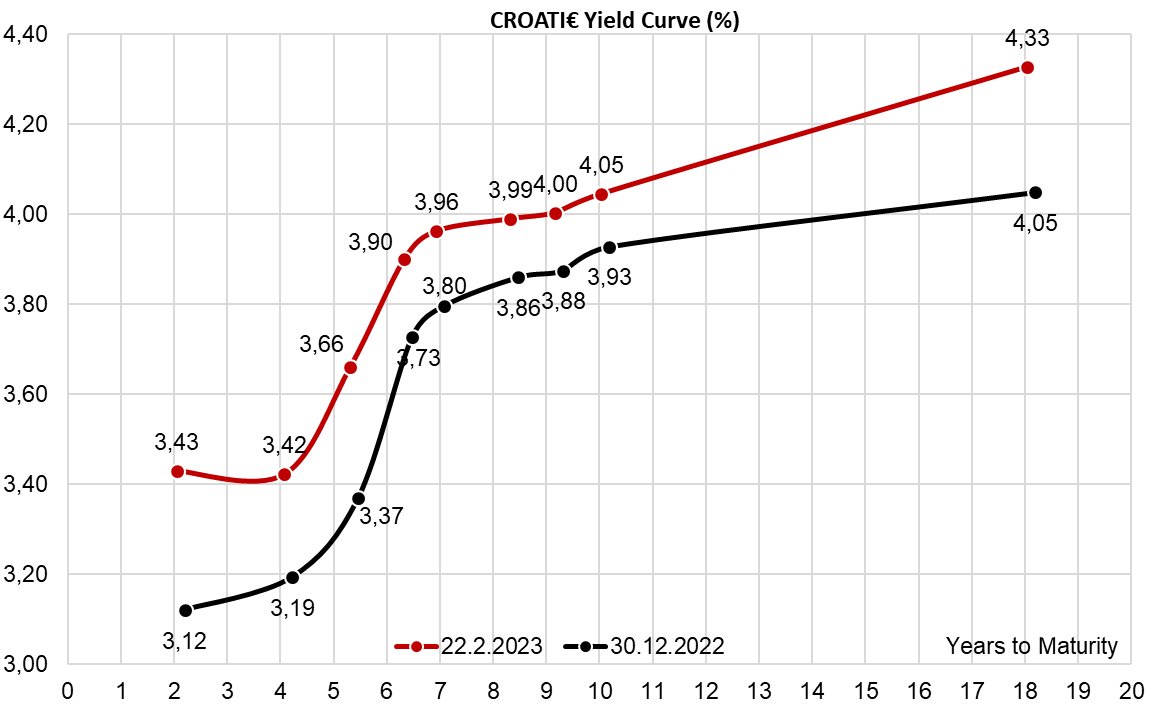

How is the Croatian bond market holding up? Yields have stabilized, albeit buyers are reluctant to add on more positions, excluding the front part of the curve. Last week we have seen trading in CROATE 5.75 07/10/2024€ at 3.20% YTM in modest sizes of 2mm EUR. The Croatian Ministry of Finance kicked off the first retail bond placement, starting the process yesterday morning. By 15.00 CET about 4.600 people gave orders in aggregate size of 155mm EUR to get a minimum yield of 3.25% on 2Y maturity. Although the average lot is 33.7k EUR, we argue that the medium order is closer to 100k EUR, at least according to our estimates. The prospects of institutional investors being able to take on their balance sheet the residual size up to 1bn EUR has dented demand on CROATI 3 03/11/2025€ (international bond with exactly the same maturity), which is currently traded at high 3.30% yields, but in sizes that are modest, albeit not scraps. And this is probably the highest value to our readers – if you are a cash bond portfolio manager, then you can easily see that the new bond is exactly on the yield curve and even if the retail leaves merely scraps for institutional investors, there are other instruments with similar characteristics being offered.