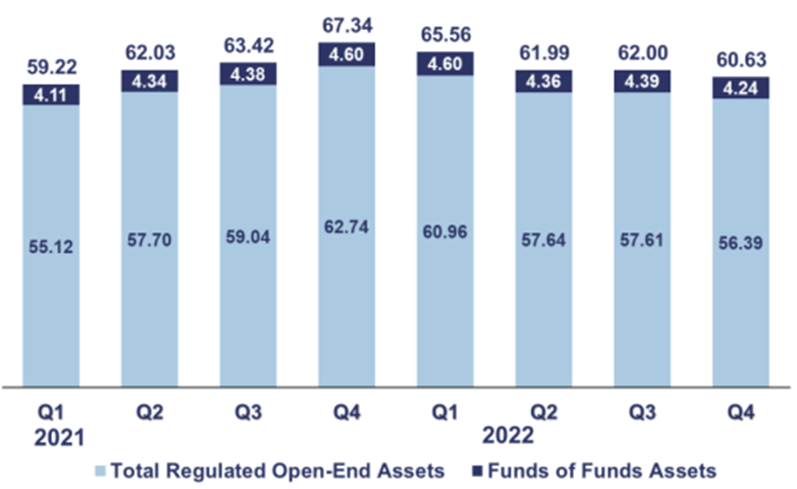

Worldwide regulated open-end fund assets decreased by 2.2% to EUR 60.6 trillion in Q4 2022 compared to Q3. In USD terms, assets increased by 7% due to the significant depreciation of the USD. Measured in local currency, the net assets in the two largest fund markets – US and Europe, increased by 5.6% and 0.9%, respectively. Further, net sales registered a net inflow of EUR 128bn, mostly on the back of money market inflow. Overall, financial markets slightly recovered during Q4 2022, but investors remained cautious – resulting in continued net outflows from long-term funds.

Looking at worldwide regulated open-end funds assets, a 2.2% decrease during Q4 2022 in euro terms can be noted. Further, the net assets in the two largest funds markets, US and Europe, measured in local currency, increased by 5.6% and 0.9% respectively. On a euro-denominated basis, worldwide equity fund assets experienced a slight decline of 0.6% QoQ and ended the year at EUR 25.7 trillion (down 14.9% on a yearly level).

Worldwide Assets of Regulated Open-End Funds [EUR trillion, end of quarter]

Source: EFAMA International Statistical Release, InterCapital Research

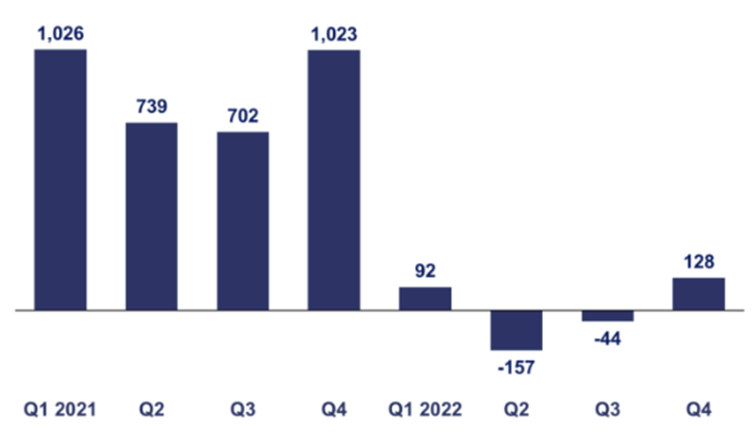

Further, worldwide investment funds registered a net inflow of EUR 128bn during Q4, compared to the net outflow of EUR 44bn during the previous quarter. However, even taking into account positive net inflow during the last quarter of 2022, overall worldwide assets of open-end funds decreased by as much as 10% on a yearly basis in Q4. This can be further observed by looking at quarterly net inflows/outflows since 2021. The picture below can give us an insight into a “shakey” sentiment and demand for open-end funds.

Worldwide Net Sales of Regulated Open-End Funds [EUR bn]

Source: EFAMA International Statistical Release, InterCapital Research

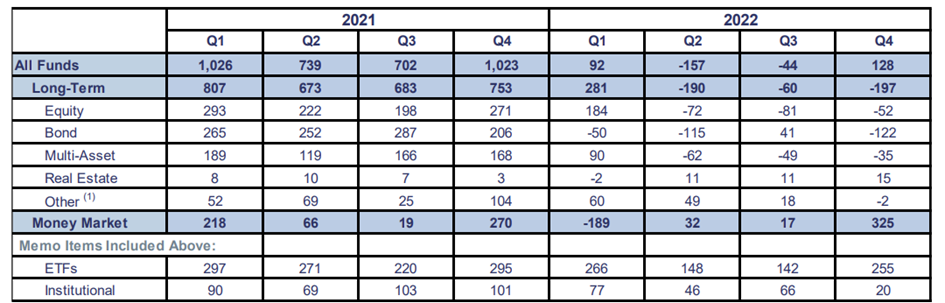

Nevertheless, it is worth looking at the mentioned net inflow of EUR 128bn during Q4 (net outflow of EUR 44bn in Q3) in more detail.

Net Sales of Worldwide Regulated Open-End Funds [EUR bn]

Source: EFAMA International Statistical Release, InterCapital Research

One can notice that the positive Net Sales during Q4 can be mainly attributed to the EUR 325bn inflow in the Money market, which was partially offset by an outflow from Long-Term funds, amounting to EUR 197bn (mainly Bonds followed by Equity). Overall, we can notice investors remained cautious during the quarter, which resulted in the continued net outflow from long-term funds and strong sales of MMFs – even as financial markets somewhat recovered during the quarter.

Finally, it is worth looking at Net Assets by type of Fund of Worldwide Open-End Funds

* ”Other” include guaranteed/protected funds

Source: EFAMA International Statistical Release, InterCapital Research