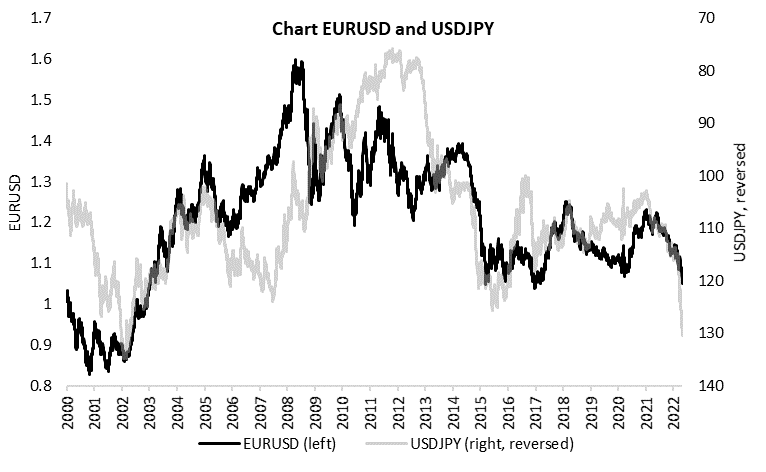

In the last few weeks, we have witnessed stubborn growth of the US Dollar versus many world currencies. DXY breached 103 level and reached the highest level since 2002 so the question is whether it could continue further. On the other side Yen is falling dramatically due to still loose monetary policy. In this article, we are looking into the details of these moves.

At the end of 2020, EURUSD reached 1.22 as Fed slashed its interest rates to zero while ECB did not have so much room to react. Sixteen months later, EURUSD stands at 1.05, level last time seen in February 2017 and there are plenty of reasons for the move, both for the strength of the USD and the weakness of the euro. The main drivers are obviously expectations that Fed will aggressively lift rates above 2.50% this year and close to 3.50% next year while ECB is still not showing signs of such a hawkish U-turn. Currently, Eurodollar futures for December 2022 stand below 97.0, reflecting expectations that a 3-month deposit that starts in December will bear a 3.0% rate while the same Euribor futures is at 99.45 (0.55%). This means that the spread between the two rates is expected to be around 2.50% versus 1.0% now. Furthermore, economic forecasts by the analysts are lower with each new edition which could benefit USD as a safe haven asset. Although there were some questions about the USD being the world’s leading reserve currency since start of the west’s embargo on Russia, decreasing its importance could take years. On the other hand, EUR’s weakness is coming from Ukraine-Russian conflict and ECB’s dilemma regarding its monetary policy. War in Ukraine will obviously have the largest impact on Ukraine, Russia, and Europe respectively, and bearing in mind European dependency on imported commodities one could not be surprised by its weakness. Talking about ECB, it is still not quite clear whether they are prepared to fight inflation without bearing in mind the health of the economy. ECB is slowly moving from QE and lifting rates is on the table, but they do not want to go full speed ahead with it but waiting for the monthly and quarterly data. As there is a real risk coming from a total embargo on commodities that would push Europe into recession this seems reasonable, but uncertainties could last for years while inflation in Europe is above 7.0% right now. In case ECB decides that it will start lifting rates in July and shows firm intentions to fight inflation despite the economic downturn we expect EURUSD to rise above the current levels but if Russian tensions intensify and ECB is still on ‘wait and see’ mode, EURUSD could go to parity quite soon.

On the other part of the globe, Japan’s currency is also witnessing a sharp weakening versus the US dollar. Namely, USDJPY reached 130, while being below 115 at the end of February, reflecting a depreciation of more than 10% in just 2 months. As stated above, Fed decided to hawk-up its game while BoJ decided that it will maintain its loose policy and will continue with yield curve control. This means that it will continue buying unlimited JGBs close to 0.25% which was once again confirmed this week. Inflation in Japan is still not showing any signs of uncontrollable growth as we see in all other parts of the world but is rising slowly. In March 2022, Japan’s CPI stood at 1.2% which was the highest level since 2018. Local investors most likely decided to sell as many JGBs as possible and transfer their funds into foreign assets bearing much larger interests, even when you look at FX-hedged basis. However, yesterday we saw Japan’s Ministry of Finance officials saying that recent FX moves warrant extreme concern meaning that one of the most dovish central banks in the world could have second thoughts soon. And then we would see what the real importance of Japan’s local investors for the global fixed income is.

EUR/USD exchange rate and USD/JPY reversed exchange rate

Source: Bloomberg, InterCapital